As one investment pro Robert Luna said earlier this year, “Amazon.com is the best long-term story in the market right now… laying competitors to waste”. For Amazon, 2017 might just become their best year yet and sellers are bound to reap the benefits. In Q3/2016 sales were up 29% to $32.7 Billion, a considerable difference compared with last year’s Q3 results, of $25.4 Billion. Just consider this: Consumer Intelligence Research Partners estimates that Amazon counts 63 million Prime members among its shoppers—an increase of 19 million from last June.

.png) Net revenue of Amazon from 1st quarter 2007 to 3rd quarter 2016 (in billion U.S. dollars)

Net revenue of Amazon from 1st quarter 2007 to 3rd quarter 2016 (in billion U.S. dollars)

With that being said, it looks like there’s simply no matching Amazon’s reach, ease-of-use, and revenue potential. But when it comes to selling on Amazon, brands have a difficult time staying on top of their game, due to Amazon constant policy updates. It’s something that oftentimes brands dread, since a new update could mean a whole new marketing strategy.

With only a few weeks before 2016 becomes 2017, brand owners and Channel Managers need to start planning their strategy for the next year. Our CEO, Kiri Masters shares her 2017 Amazon predictions to help brands and sellers get an idea of what the new year may bring.

1. Higher FBA fees

3P sellers will continue to pay higher prices for fulfillment as demand for warehouse space outstrips supply.

Amazon has been adding new warehouses at an astonishing rate. But it’s not enough to keep up with demand from merchants for their FBA service.

In 2016, Amazon enacted the following changes to stem an overwhelming tide of inbound inventory:

- Increased inventory storage fees dramatically over the busy November & December months

- Built, 25 fulfillment centers in 2016, up from 12 in 2015.

- Hired 120,000 temporary employees over the holiday season.

- In a drastic move, prevented new Sellers from sending in any inventory from October - December.

- Offered to return or dispose of inventory for free (usually this carries a per-unit fee).

- Introduced a native inventory liquidation program for sellers with excess inventory.

All these measures point to the fact that Amazon’s fulfillment network is bursting at the seams with inventory.

Amazon continues to invest heavily in logistics technology - with the Prime airplane fleet, extensive experiments with drone delivery technology in the UK, and more - all with the intent of supplementing its current reliance on UPS and FedEx.

But this won’t stop Amazon increasing FBA costs for sellers in the immediate term while its fulfillment capabilities catch up with surging demand from merchants and customers alike.

What this means for brands:

Carefully track the effects of any fee changes on the profit margins of your assortment, and be prepared to increase your prices if necessary. Consider the Seller Fulfilled Prime program and determine if this is a good match for your existing fulfillment capabilities.

2. Deeper expansion into international markets

Amazon invested heavily in fulfillment capabilities in the UK and Europe in 2016. As of November 2016, Amazon has 31 fulfillment centers throughout Europe (UK, Germany, France, Italy, Spain, Czech Republic and Poland)

New programs like Amazon For Business and Seller Fulfilled Prime are being made available in these markets, offering brands even more ways to attract customers.

Amazon has spent $2BN on its Indian marketplace - suggested to be the biggest investment in any single country by Amazon in such a short period.

In 2017, Amazon will continue to invest in Mexico, India, and continental Europe; and might also begin expansions in earnest in the Middle East and South East Asian regions.

What this means for brands:

Research which markets are most likely to be profitable for your existing range, and consider launching in a handful of strategic marketplaces. You will generally find that Amazon’s marketplaces are far less competitive than in the USA.

3. Soliciting reviews in emails to Amazon customers

will be tightly controlled or banned

In September 2016, Amazon made a swift, but not entirely unexpected, move to disallow “incentivised reviews”. Reviews provided by users who received a product for free or at a discount were first banned, then retroactively removed from Amazon.com.

Many brands who relied on product-review exchange services to kickstart their sales had to re-think their product launch strategy. Many currently see post-purchase emails, sent through Amazon’s own messaging system, as the final workaround for encouraging product reviews from tight-lipped customers.

Using this technique, brands can initiate a series of emails to encourage customers to leave a review. This is in addition to any emails that Amazon themselves might send to customers. The danger now is that many sellers will now be sending streams of desperate emails to customers, pleading for product reviews in order to boost credibility to other customers. For frequent Amazon shoppers, receiving 2, 3 or even more emails from each brand will become tiresome to say the least.

Since the initial policy change was made in response to growing customer dissatisfaction around the overall trustworthiness of incentivized reviews, I can only see Amazon closing this last loophole - either preventing Sellers from sending any proactive emails to customers at all, or requiring an ‘unsubscribe’ option for such emails.

What this means for brands:

Consider how to build traffic and interest outside of Amazon, sending qualified traffic to your product pages. Influencer marketing, social media marketing & PPC can be effective when done correctly.

4. PPC (Pay Per Click advertising) will become critical

for brands on Amazon

Because of the changes in the product review ecosystem, new brands launching on Amazon as well as incumbent sellers will need new ways to get their products and offers in front of customers.

The playing field is now level, and brands will need to pay for Amazon Sponsored Product Ads (Seller Central) or Amazon Marketing Services (Vendors) to get traffic and sales for their products.

Amazon has been investing in their PPC platform for the last couple of years, slowly adding more features and functionality to bring it into line with comparable PPC platforms like Adwords.

What this means for brands:

Carve out budget for paid advertising on Amazon, and invest in a specialist agency like Bobsled Marketing which offers a dedicated PPC management service.

5. Amazon will recruit more brands to its Vendor platform

Amazon offers 2 primary modes of selling:

- 3rd party Merchant (3P), using Amazon as a platform to reach customers

- 1st party Vendor (1P), selling inventory to Amazon on a wholesale basis

Amazon says they do not favor one model over the other, but I predict that Amazon will begin to more aggressively recruit existing 3P sellers to become 1P sellers. Here is why:

- Amazon can control the price of products when they are selling inventory directly. Offering value for money has always been a core part of Amazon’s USP

- Amazon can better control the quality of inventory if they are selling inventory directly. Consumers in 2016 have been disappointed with the prevalence of counterfeit products on the platform, eroding Amazon’s brand.

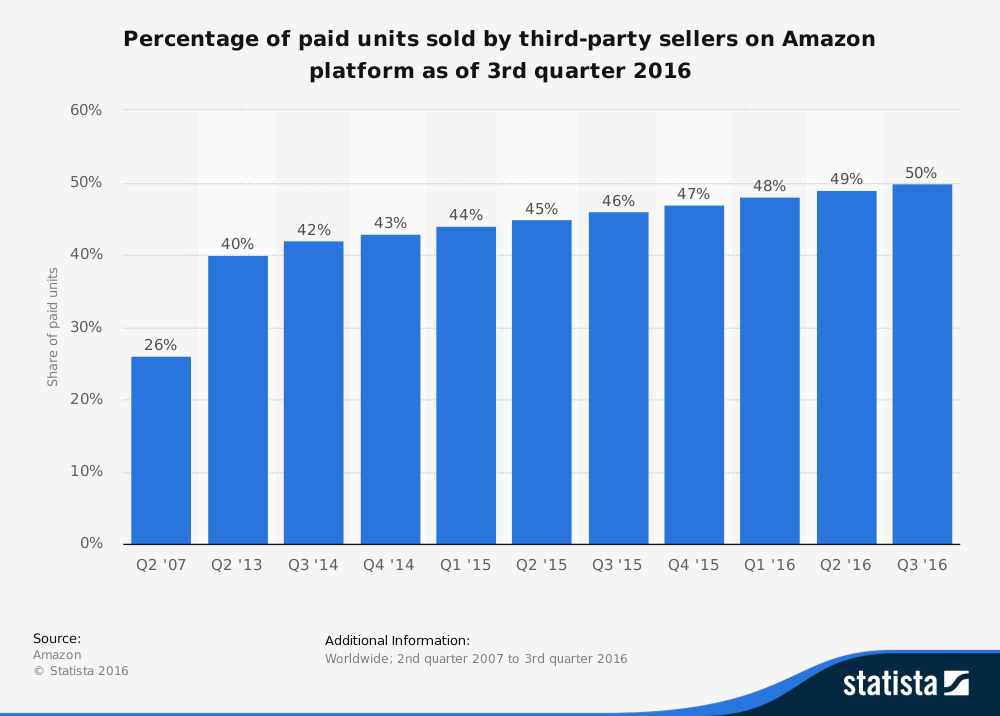

- Products sold by 3rd Party merchants, as a % of the total range of products sold, has been climbing rapidly, and it makes sense for Amazon to re-balance this ratio.

What this means for brands:

Keep an open mind about becoming a Vendor. Vendors get access to more visually appealing product pages, including videos, access to the Vine Reviews program, and more comprehensive PPC advertising options. Consider a ‘hybrid’ model of having both a Vendor and Seller account.

Percentage of 3rd Party sales on Amazon (versus 1st Party) Marketplace Pulse, an ecommerce analytics provider, found that 51% of all sales in Q2 2016 were from marketplace sellers (3P), and expect this to rise to 50% by the end of 2016.

Percentage of 3rd Party sales on Amazon (versus 1st Party) Marketplace Pulse, an ecommerce analytics provider, found that 51% of all sales in Q2 2016 were from marketplace sellers (3P), and expect this to rise to 50% by the end of 2016.

Bottom Line

2017 is bound to bring a lot of changes in the marketplace, but mature sellers in the marketplace know that reacting quickly to Amazon’s updates helps them stay on top of their game, rather than sending them spinning. Whether you’re an old hat with Amazon, or simply considering it as the future place for your business, having a good marketing strategy set in place ahead of time will help you adapt faster to Amazon’s updates and identify the right opportunities for your business.

At Bobsled Marketing, we dedicate a considerable amount of time into researching and finding solutions for Amazon’s updates so that our clients can make the most of their time in the marketplace. We help brands to boost their revenue and reach on the Amazon marketplace, helping them skip the learning curve and start seeing results faster.

.png)