💡 This article was published in 2016. Since then, we shared new information. Here's a recent post:

Read about trends on Amazon’s international growth, and how brands can ride the wave of Amazon’s aggressive international expansion.

Note: this is the first in a series of articles and white papers about how brands can leverage Amazon’s international growth to build a multinational presence and sell to customers all around the world.

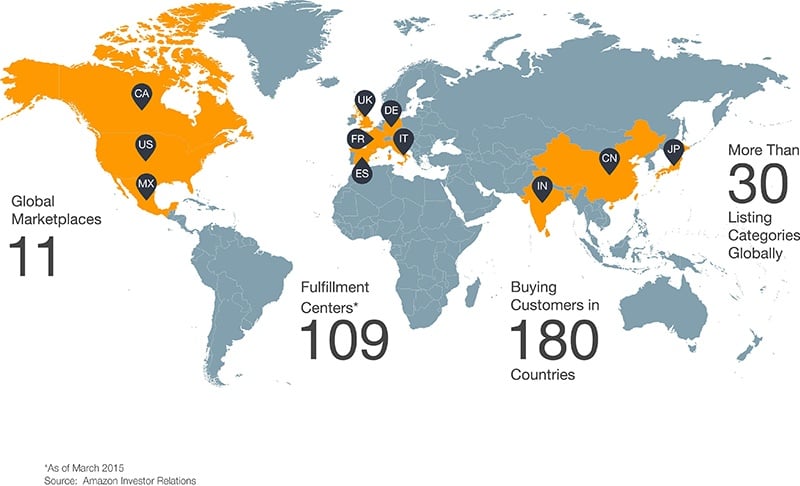

Amazon seeks to become the largest ecommerce retailer in the World. And in order to do that, it has to play in more markets than just North America. Amazon’s growth outside of the US & Canada (read here about selling FBA in Canada) has evolved to adapt in the types of markets it launches in, offering sellers the opportunity to ride along and rip the benefits of its aggressive and revenue-driven international expansion.

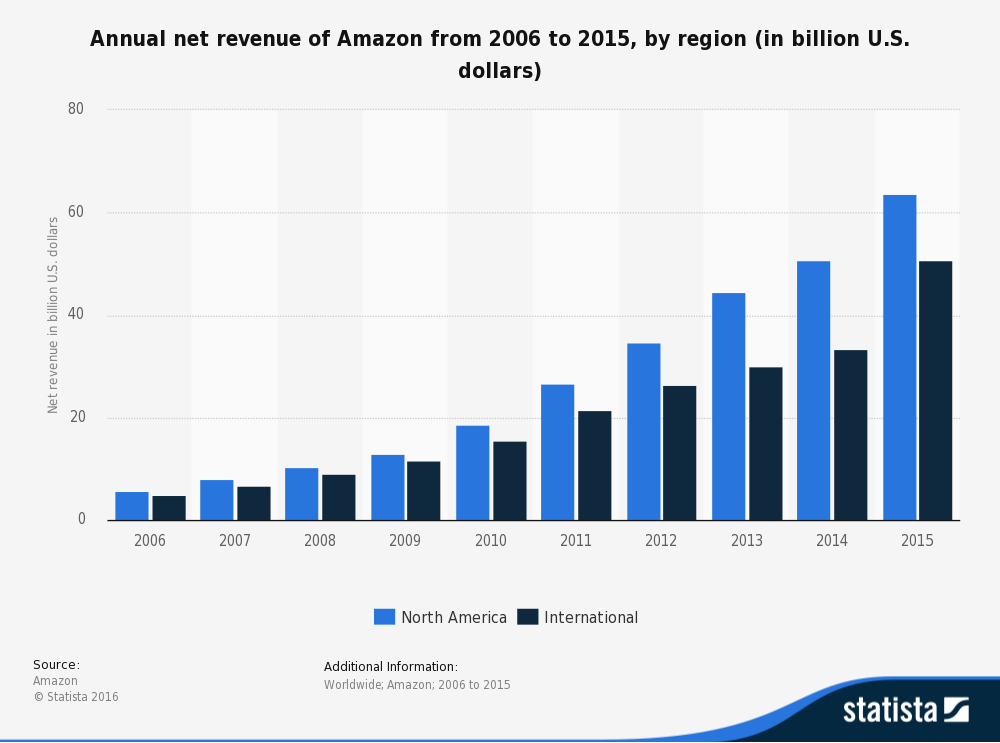

It is a strategy that works and their numbers prove it. Within the last 9 years, Amazon’s international expansion strategy sky-rocketed their annual net revenue, revenue from other countries than its homeland (North America) hitting close to the 25% mark in terms of growth rate in the first quarter of 2016.

Amazon in Europe and Japan

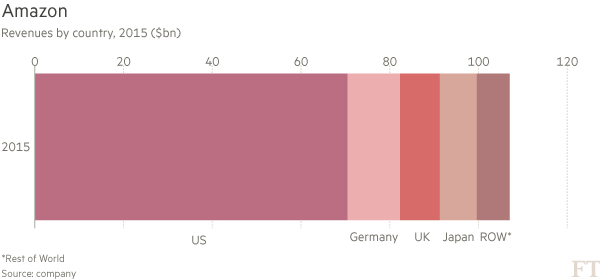

Amazon’s international sales might not be following just yet the soaring trend of its North American market, where in the past three years, sales doubled. But Germany, the UK, and Japan have long proven to be well-established markets for this e-commerce market. In fact, at this moment, these are the three largest markets outside of the US and Amazon’s international market expansion strategy is to replicate here the successful strategies it has deployed at home, starting with the Prime Now service.

Sellers active on Amazon Germany, UK, Italy and Japan have all been reaping the benefits of the retailer’s decision to roll out a series of its most desirable services. From its Prime Now express delivery service, which guarantees delivery of products in 2 hours, to video streaming in Japan and Amazon Fresh in UK, this was a decision that had both sellers and buyers jump for joy.

In the UK, for example, grocery shopping is moving away from the traditional supermarket and into the digital world. Amazon took notice of this opportunity and rolled out its online grocery delivery service Amazon Fresh. The UK market is expected to reach £9.8 billion in online grocery sales this year, up 13% from 2015 and Amazon is aiming to take a big chunk of that. Take into account that Amazon Fresh is currently available only in select cities in the US, but with 48% of Brits currently shopping their groceries online, UK is having one of the highest penetration rates for online grocery in the world. It’s no wonder Amazon is striving to keep this market engaged on its platform. Read here about selling on Amazon UK and Europe with FBA.

Related: planning to expand your business to international markets using Amazon? We have just the right thing for you. Click here to receive access to our dedicated country guides that will teach you how to start selling on Amazon Canada, Germany, UK and Mexico.

The Pan-European fulfillment option also makes it easier for Sellers to start selling in all the EU markets with greater ease than ever before. You can now reach tens of millions of European customers just by sending your products to an Amazon fulfillment center and entrust them with the allocation of your inventory throughout the continent to ensure fast dispatch on customer demand.

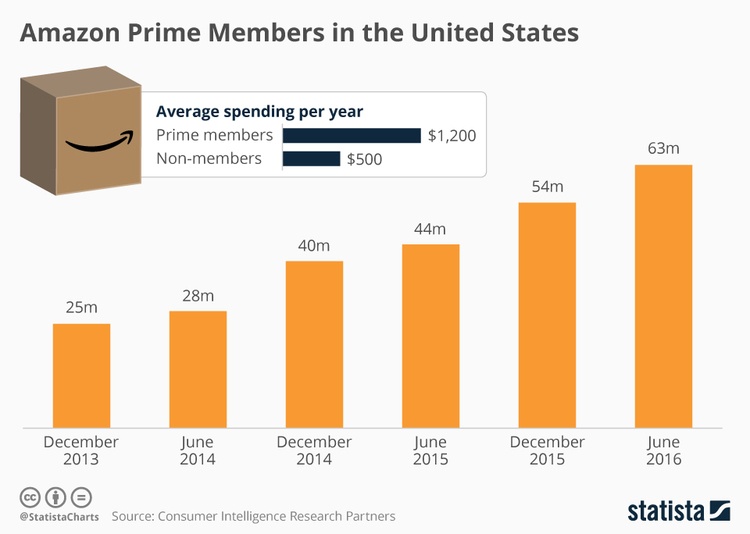

However, the strategy that worked best so far, revolves around the brilliant “Prime” model, as Amazon is looking to replicate what’s been successful in their early markets. Amazon Prime (renamed ‘Amazon Premium’ in some markets) is currently available in North America, the UK, Spain, Japan, Italy, Germany, France, Canada and Austria. Although Amazon does not disclose demographics on its Amazon Prime members, there’s a good hint even in international markets, this service is a big draw. Just look at the whooping sales recorded during Prime Day.

Prime Day

Prime Day started in 2015, part of Amazon’s 20th anniversary celebration, and it was the biggest days for international sales at Amazon. In international markets, the retailer made the sales event available for 24-hours and thought of a way to make sure non-Prime members all over the world could taste the benefit of Prime. Consumers from US, Canada, UK, Spain, Japan, Italy, Germany, France and Austria had the opportunity to enjoy Prime Day by signing up for the service right then and get a 30-day free trial.

The first Prime Day was a global success, as Amazon reported it was “bigger than Black Friday and will be held again”. According to Amazon, customers ordered 34.4 million items, with a record-breaking 398 items ordered per second. For Amazon Sellers, this translated in up to 300 percent growth in unit sales. For Amazon Prime, this meant hundreds of thousands of new subscribers in just one day.

As promised, Prime Day was held again, on July 12, 2016 and it has already been dubbed as ”the biggest day in the history of Amazon”. The retailer says it has shipped 60% more products worldwide, compared to its 2015 sales event. Although the retailer didn’t roll out exact numbers, they have been referring to Prime Day 2016 as a record breaking day in sales.

Best-sellers varied with each country. For Italians it was Caffe Vergnano coffee capsules, the Germans skyrocketed toy sales, the Brits bought more than 600 Trunki suitcases before breakfast, while the French and Belgians invested their Prime benefits in game consoles.

Amazon in New Markets

Amazon is also taking aim at emerging markets in an international expansion strategy that is obviously bound to take on competitors as Alibaba and Jet.com. Yet, each of these markets presents specific hurdles that require specific strategies. In India for instance, regulatory requirements make it hard to play the same strategies that brought on success in North America and Europe. But that hasn’t stopped Amazon to dip its toe in the water and see what works for each market. In total, Amazon has 13-country specific websites, but not all of them sell the full range of categories. For example. Australia only sells kindles and media products.

Amazon in India

Based on pure size, India is Amazon’s biggest emerging opportunity. But India has complex regulatory requirements that make it difficult to replicate the exact same distribution playbook as in established markets. This means, the brainiacs at Amazon have to come up with a localized strategy that makes it easy for new sellers to rip the benefits of its platform without worrying about the regulatory hurdles. Amazon’s made $2bn in investment in the country so far, and analysts who follow the retailer believe they will keep investing in the marketplace to edge out other competitors like Flipcart.

Amazon’s localized strategy for India has to successfully address the following regulatory issues:

- Amazon can’t sell its own inventory (so no Vendor program), because no one seller can account for more than 40% of sales.

- Amazon can’t influence the pricing of prices on marketplaces. Previously, marketplaces offered incentives like fee discounts to ply sellers into discounting products. This government will start cracking down on this.

- There’s no Prime in India, because Amazon has no fulfillment centers there.

Amazon in Mexico and Latin America

In 2015, Amazon made its first considerable attempt to conquer Mexico, as it launched a Spanish website and established a distribution center outside of Mexico City. Amazon has been selling its Kindle e-books in Mexico since 2013, but it in two years, it built only one distribution center.

Compared to its expansion in India, where Amazon built seven distribution centers in two years, it looks like the retailer is not going to move just as quick to expand in Mexico. However, Amazon is expected to overtake the market, given than Mexico has over 110 million inhabitants and a considerably small e-commerce industry.

The Mexico website official launch was dubbed by Amazon itself, as its biggest international launch ever, offering more categories than any of its other international websites had ever featured at launch, at around 30 categories. Yet, compared to the current product assortment in the US, there’s still room for improvement.

What’s unique about consumer behavior in new markets?

Amazon figured out consumer behavior in emerging markets is different than that of consumers in well developed countries, with strong a e-commerce industry. First of all, consumers in emerging markets prefer foreign brands that are well-recognized. Private Label products (including Amazon’s own `Amazon Basics` line) don’t do as well as recognized brand names which have cachet in the local market.

Bottom Line

Amazon is working to make cross-border commerce as easy as it can be for Sellers and consumers as well. From opening new distribution centers to rolling out new website categories, the retailer’s international expansion strategy brings in benefits for all those involved. The most recent benefit for Sellers, come from the retailer’s recently introduced Pan-European FBA, which allows inventory to be distributed amongst UK and EU marketplaces without the Seller having to pay for freight to move inventory around.

Manual workarounds will continue for countries without a dedicated Amazon presence. For example, Australians don’t have the full Amazon website, so they often buy from the US and UK Amazon websites, sometimes using third party intermediary freight forwarders when sellers don’t offer international fulfillment options. Read here about selling on Amazon from Australia with FBA.

Selling to international customers via Amazon is the simplest way for brands to expand internationally. In most markets (except India) Amazon manages order fulfillment and warehousing for you. This dramatically reduces traditional costs and complexities of international growth.

.png)