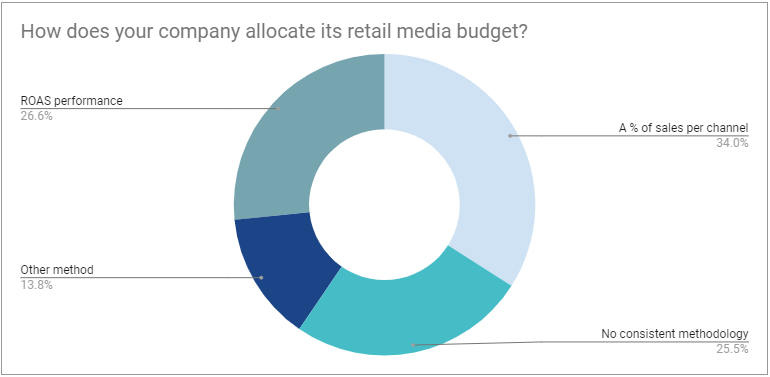

But any brand, large or small, does not have a bottomless budget. And we learned through our research into Retail Media Allocation that their methods of allocating budgets are also not scalable.

The prevailing models: ROAS and Trade

Most brands assign a budget to retail media as a percentage of channel sales. For example, if Walmart represents 15% of your sales, it will get 15% of your total ad budget). But this approach has a major downside: it only counts existing retail channels (not new, emerging channels). It also makes a company slow to react to very fast-growing channels, as this model is backward-looking in nature.

This model is often called a “trade-based” model because the budget comes from the trade marketing budget. Larger, traditional brands are likely to have this model since their organizational structure and P&L are often built around retailers.

Many brands, 27% in our poll, allocate based on ROAS (return on advertising spend). ROAS indicates profitability in advertising. For brands that have any kind of growth objective like growing market share, ROAS is not helpful, and in fact, may place an upper limit on growth. But because it is easy to calculate and compare across channels, many brands become fixated on this metric.

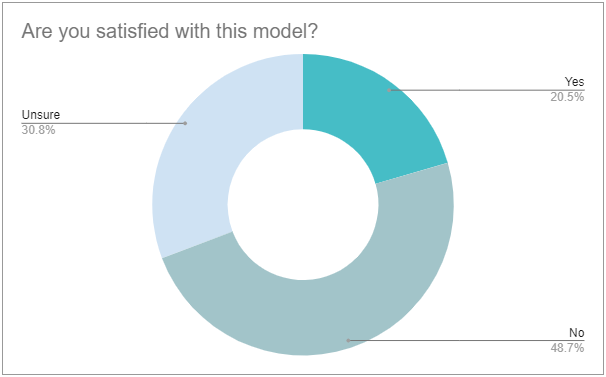

Brands are dissatisfied with these models

These models are not working for brands. A poll run during a webinar presenting our research (you can watch the replay here) found much dissatisfaction with these models, echoing the research we did with clients and industry peers.

A new model

Our proposed framework to solve this issue is to instead allocate media spend based on the marketing funnel. Each retail media platform comes with its own universe of ad types and audience targeting options, each of which is suitable for a different stage of the shopping journey. In his model, the budget flows to where there are campaign types that suit the brands’ business objectives.

This is part of a broader thesis that we have at our parent company, Acadia: Our goal is to take the first dollar and chase the best return.

.png?width=1408&name=Screen%20Shot%202022-05-05%20at%203.39.49%20PM%20(1).png)

Early results are promising. During our research project, my co-author Matteo Bizon re-modeled his clients’ advertising structure using this approach. A sports nutrition brand that was focused on growing brand recognition, their main performance metric was to increase their branded search term volume. Using this model, the client saw a 33% increase in branded search volume over a 4-month period, and 10% YoY. And another of Matteo’s clients, a cult skincare brand, saw a 17% increase in branded search term volume over the same period.

Want to learn more about this new framework and how to implement it? Download our white paper: Retail Media Allocation

A challenge we often hear is that objectives may differ at the sub-brand or even product level. For example, a new product’s objective may be growing market share, thus its focus would be on top-of-funnel, awareness-based campaigns. The rest of the brand’s portfolio may be its cash cows, with a specific contribution margin target. Focusing on high-ROAS, bottom-of-funnel campaigns would be suitable for that product set.

While early results are promising, it is still a manual process. As a marketplace performance agency, we are power-users of our ad-tech platform of choice, Pacvue. Within Pacvue there is an ability to structure and tag campaigns using this model and report performance accordingly. But the actual work of getting clear on the objective at the sub-brand and product level, and then agreeing to pursue the best use of each ad dollar - that’s foundational, potentially tough change management that a lot of brands need to work through (PS - our full report has many tips and tactics from real brands on how to do this).

In what may be a year of uncertainty for the retail industry, one thing is clear: brands need to consider a new approach to where and how they allocate their media budgets, which are more precious than ever before.

Tagged: PPC Advertising, Amazon Account Management, Amazon Display Advertising, Walmart, Instacart, Bobsled Marketing, Target Marketplace, Target Advertising

.png)