Amazon makes frequent changes to their FBA (Fulfillment By Amazon) program, moderating fees charged on to Sellers in apparent alignment with their own costs. The latest raft of fee updates from Amazon announced today, December 16, 2016 is not only designed to reflect changes to Amazon’s own operating costs, but creates new carrots and sticks to incentivize Seller behavior.

Key changes

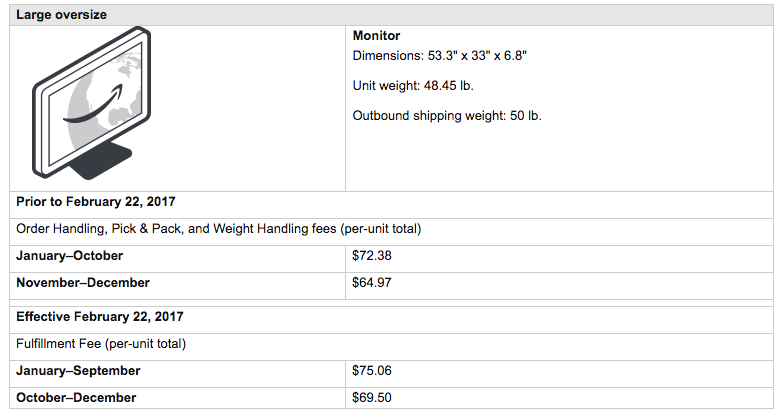

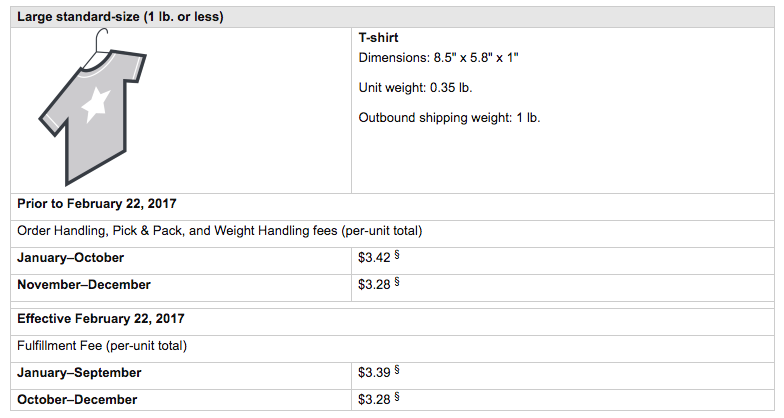

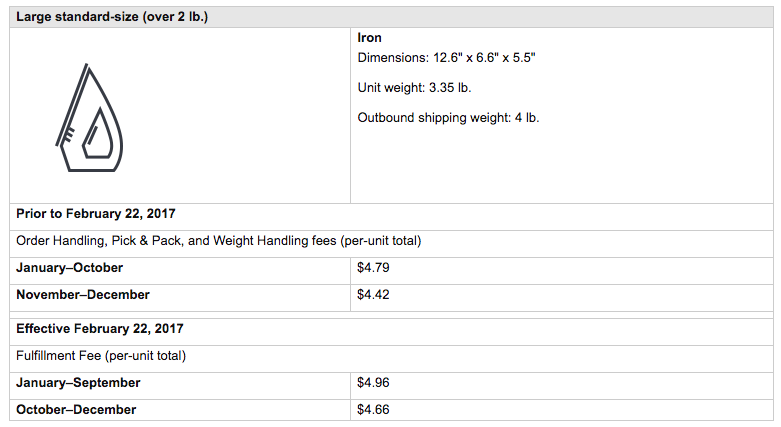

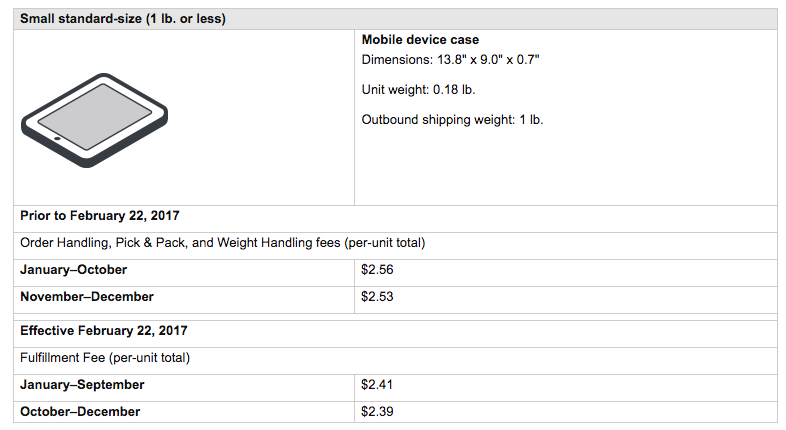

- Fulfillment fees decrease modestly for standard-sized items, and increase modestly for oversized and heavier items

- Fulfillment fees decrease in October, in line with November and December

- Inventory storage fees increase across the board, but particularly in October

- Heavier splitting of inbound shipping plans to multiple Fulfillment Centers (FCs)

While an increase in fees is usually interpreted as bad news, here's a positive take on Amazon's fee updates as well as a couple of downstream effects that the changes may have.

Good news - Many brands using Fulfillment Centers appropriately will potentially see a modest reduction in fees

Essentially, Amazon has decreased order-related fulfillment fees (pick & pack, order handling, and weight handling fees), and increased monthly inventory storage fees. They will also increase how often inbound shipments are required to go to different fulfillment centers - resulting in an added cost to send inventory to Amazon.

This should discourage Sellers from sending in excessive amounts of inventory and using Amazon as a primary warehouse for their goods. Note that Amazon never refers to the existence of Amazon ‘warehouses’; they are “Fulfillment Centers”. Amazon has had to invest enormous amounts of capital into building new facilities to handle storage and demand. Their facilities employ such a high level of high-tech automation which is enhanced for fulfillment, that simply using them as holding pens for thousands of units of slow-moving inventory is a huge waste of potential.

Products most likely to benefit from the changes are standard sized products. Oversized items will have higher fulfillment costs in general.

More good news - The fee updates may reduce competition

at the lower end

In recent years, and especially the past 12-24 months, we’ve seen the number of Sellers on Amazon increase dramatically. There are two reasons for this - firstly, a cottage industry of Private Label selling has emerged on Amazon. Often these are individuals researching products which already sell well, sourcing a supplier in China, and engaging in a supply/demand arbitrage opportunity. Sometimes design improvements are made to the products, but often there are not, resulting in a sea of me-too products on Amazon in high-selling categories.

The second reason for this phenomenon is that the Chinese manufacturers of these products have seen the opportunity to sell these goods directly, and have started building their own presence on Amazon, sometimes cutting out the Private Label middlemen.

In these two scenarios, both parties use Amazon as their primary or or sole sales channel, and often rely on cost savings from shipping large quantities of inventory by sea directly to Amazon.

Amazon’s new fee structure penalizes Sellers holding too much inventory, and rewards more of a “Just In Time” inventory model, which more established brands with alternative inventory distribution capabilities (i.e. having their own warehouses or using a 3PL).

Image gallery above shows the current and updated fee structure for different types of products sold using Amazon FBA.

Implication 1: Seller Fulfilled Prime is becoming more attractive

Amazon has been pushing the Seller Fulfilled Prime (SFP) program to established Sellers over the past couple of months, and these fee changes will make the program even more attractive.

Brands with oversized products, slower-moving products, fragile or meltable products already benefit from using SFP because they can cut out the cost of shipping inventory to Amazon’s Fulfillment Centers in order to make it Prime-eligible. Now, with increased fulfillment costs for large and heavy items, the need to split inbound shipments to multiple FCs, and ann incentive to ship less inventory more often, will make SFP even more attractive to these brands.

Implication 2: The Vendor program will become more attractive

Just like Seller Fulfilled Prime, Amazon has been pushing the relatively new “Vendor Express” sales platform to new & established brands. The program reflects a wholesale model, where Amazon places purchase orders for inventory. The wholesale price, order frequency, and order volume is driven by algorithms - a frustrating model for some sellers. The platform itself is also fairly bare-bones from an operations standpoint - there is little in the way of reporting, support, or other features that brands are accustomed to on Seller Central.

But, the fee changes may make the wholesale model of selling to Amazon more attractive to brands who prefer a guaranteed payment from a purchase order, rather than paying to ship inventory to Amazon & potentially maintaining separate pools of inventory, waiting for inventory to sell at Amazon, having fees deducted from the sale, and being paid on the proceeds 2 weeks later.

.png)