Brands simply can’t afford to sell on Amazon if fees eat up too much of their profit margins. A lot has changed across the retail landscape since Covid-19 hit, and in order to survive, brands need to intimately understand the profitability of each sales channel.

With Q4 just around the corner, we thought it would be a good time to revisit Seller Central fees, and how Amazon fees have been impacted by Covid-19. Read on to learn more!

First Steps

Before listing your products on Amazon, Sellers should be aware of all the costs that come with selling on the channel, and how they will impact profit margins. Be sure to:

- Calculate all the fees based on actual weights and sizes of your products (rather than simply using estimates)

- Include the manufacturing and shipping to Amazon costs into your calculations.

- Research how the advertising and promotions will impact your profit margins.

- After all the costs have been taken into account, look at adjusting the sale price in order to preserve your margins.

We have outlined all the different types of Seller Central fees below.

Monthly Subscription Fee

The vast majority of brands selling physical products on Amazon will find no use for an Individual Selling Plan - they will need a Professional Selling Plan which costs $39.99 per month.

Referral Fees

Sellers on Amazon are charged a referral fee per item sold. Referral Fees are essentially Amazon’s ‘commission’ for facilitating the sale of your product with an Amazon customer.

This fee is calculated on the total sales price (taxes not included). Sales price is the amount paid by the buyer (includes item price and any additional charges, such as delivery or gift-wrapping).

Most categories have a minimum referral fee (per-item) set at $0.30 (sellers pay this amount only if it’s greater than the calculated referral fee). Referral fee percentage varies depending on category, from a minimum of 8% up to 96% for Extended Warranties, Protection Plans, and Service Contracts. But for most categories referral fees are either 8% or 15%.

From February 18 2020, there was a decrease in referral fees across certain categories:

- Shoes, Handbags & Sunglasses - referral fee percentage went from 18% to 15% (sale price above $75).

- Outdoor Furniture - referral fee percentage went from 15% to 10% (sale price above $200).

- Personal care appliances - referral fee percentage went from 15% to 8% (sale price below $10). However, it remains 15% for items in this category with a sale price above $10.

- Activewear - referral fee percentage of 17% (same as the Clothing & Accessories category)

- Ring accessories - referral fee percentage of 45%.

- Amazon Business - tiered fee structure will be discontinued and the same referral fee rate will be applied to all categories, regardless of price.

FBA Fees

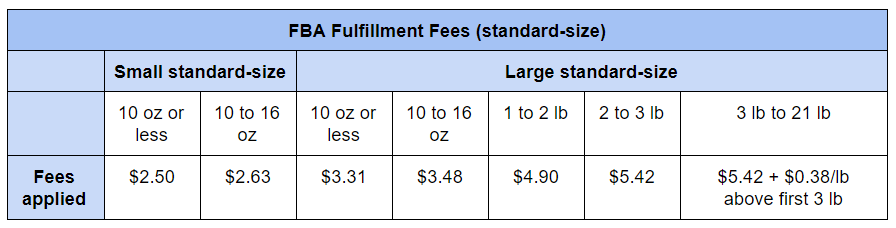

The FBA (Fulfilled By Amazon) fee is charged per unit, and its amount is based on the size and weight of the item. This is the fee for Amazon to pick your item from the FC (fulfillment center) and send it to the Amazon customer.

Sellers who use Fulfillment by Amazon can calculate their own FBA fees if they know their product’s exact size and weight. Follow the steps outlined below to calculate FBA fees:

- Determine the size tier for your product by measuring its dimensions

- Calculate the shipping weight and determine which fee applies to your product by consulting the tables below.

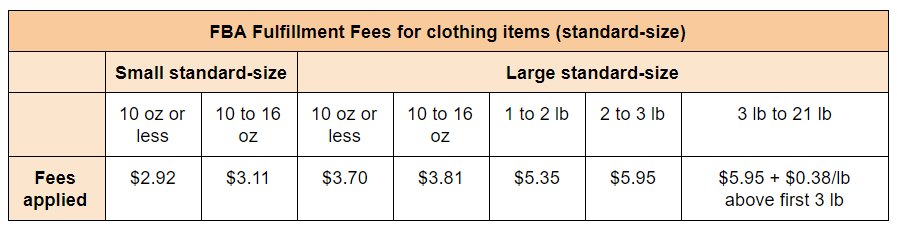

💡 Note: Products sold in certain categories such as apparel, sports apparel, and outdoor apparel will no longer incur an additional $0.40 per-unit fulfillment fee. Instead, they will implement the following changes for large standard-size (oversize clothing tiers will be charged the core FBA fulfillment fees).

💡 Note: Lithium batteries and items that contain or are sold with them incur an additional $0.11 per-unit fulfillment fee.

Be sure to check out Bobsled’s Amazon fee calculator – it’s very easy to use!

FBA Label Service

Amazon offers an optional FBA Label Service for eligible products that require an Amazon barcode at $0.30 per unit.

Monthly Storage Fees

A monthly storage fee is charged for all products that are kept in Amazon FCs.

Charges typically get processed between the 7th and 15th of each month. To see your inventory storage fee for March, look into the April Payments report for transactions from April 7th to 15th.

Monthly inventory storage fees vary by the product size and the time of year. From January to September the amount you’ll have to pay for standard-size products equals $0.75 per cubic foot, and for oversize products it’s $0.48 per cubic foot (this difference exists because standard-size products demand more delicate handling and shelving). From October to December, these fees are somewhat higher – $2.40 per cubic foot for standard-size, and $1.20 per cubic foot for oversized products. In order to calculate your products’ volume in cubic feet, use this formula:

(length x width x height)/1,728

Make sure that the dimensions you multiply are in inches.

Different storage fees apply to items sold only through the FBA Dangerous Goods program, because they require careful and complex handling and hazmat (hazardous materials) storage.

💡 Note: In light of Covid-19, Amazon waived two weeks of storage fees in March for products stored in the United States, United Kingdom, Germany, France, Italy, Spain, Poland, the Czech Republic, and Canada.

Long-Term Inventory Storage Fees

If you have items in Amazon fulfillment centers longer than 365 days, you will be charged long term storage fees. FBA conducts inventory storage clean-up on the 15th of each month, and this is when you will be charged a fee of $6.90 per cubic foot, or minimum per-unit fee of $0.15, whichever is greater.

You can avoid this fee by submitting a removal order for items that have been in Amazon fulfillment centers longer than a year before the next inventory cleanup date.

💡 Note: Due to Covid-19, removal orders have been delayed, and Amazon waived the May 15 LTSF. After removing the inventory that would be subject to LTSF, sellers won't be able to send more units of that particular product for three months after the inventory cleanup date. In order to prevent unnecessary removal orders and avoid supply chain issues, Amazon has put in place quantity restrictions just before the holiday shopping rush.

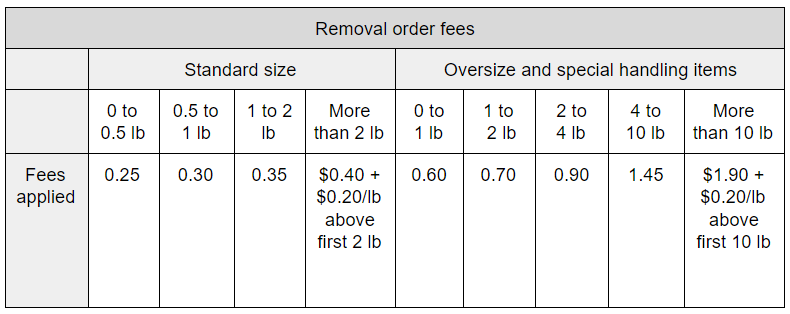

FBA Removal Order Fees

If you have unfulfillable inventory, or items that are subject to LTSF, you can create removal orders in order to avoid higher fees. However, per-item fees apply here, too. As of February 18, 2020, whether you choose to remove or dispose of unfulfillable items, you will be charged a fee depending on shipping weight of the item. Removal fees are charged when the removal order is completed.

Returns Processing Fee

The FBA returns processing fee applies to customer-returned products sold on Amazon in categories for which Amazon offers free return shipping. The returns processing fee is equal to the total fulfillment fee for a given product (for more information, see returns processing fee page).

See Also

-

Bobsled Fee Calculator (Downloadable Zip File)

Further Reading

-

Complete Guide to FBA Fees (Bobsled Blog)

-

How to Reduce FBA Fees (Bobsled Blog)

Tagged: Seller & Vendor Central, Amazon Account Management, Operations

.png)