In this Amazon Seller's Week in Review, Kiri Masters, our CEO and founder, shares her take on recent news highlights and what these could mean for brands selling on the Amazon marketplace.

1. SURVEY REVEALS GROWTH PLANS OF 2,700 AMAZON SELLERS.

Software provider Jungle Scout’s first Seller survey of 2,700 Amazon Private Label sellers generated some interesting insights about how private label sellers view their future prospects on Amazon.

The findings reveal that these sellers are generally very bullish on growth prospects on the platform. The path to growth is seen as expanding a product assortment; diversifying across multiple Amazon marketplaces; and diversifying across selling platforms (e.g. eBay, their own e-commerce store, and Walmart.com). Jungle Scout has created a great infographic of their research findings which shares some more insights from their audience of emerging private label brands.

Infographic Source:Jungle Scout

2. NEW SELLERS FLOCK TO AMAZON AT AN ASTONISHING RATE

In related research, marketplace analytics company Marketplace Pulse suggests that half a million new sellers have joined Amazon since the start of 2017. Roughly half of those new sellers are launching on Amazon USA, while others spread across the smaller marketplaces. Marketplace Pulse's data also suggests that only a small percentage of these sellers continue selling for a longer period, and that many are actually scammers.

3. AMAZON'S STOCK PRICE REACHED AN ALL TIME HIGH

Thursday saw Amazon's shares reaching $999 before falling back before the end of trading. But analysts think it could climb even higher before year's end. JPMorgan has a December 2017 target of $1100 per share, saying "We believe Amazon continues to show strong ability to take share of overall e-commerce, and its flexibility in pushing first-party vs. third-party inventory and its Prime offering both serve as major advantages."

This is an important point: of Amazon's estimated 350 million SKUs, only about 13 million are "First Party" or Vendor-supplied. These SKUs are likely fast-moving household name products which Amazon is happy to carry on their balance sheet so that they can deliver on their price promise. The 'long tail' of third party products allows Amazon to deliver on their selection promise. This blended model allows flexibility to deliver on their brand promises as well as maximize profitability across the entire catalog.

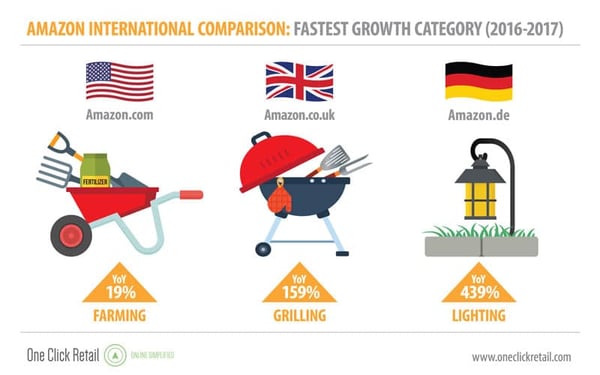

4. THE LAWN AND GARDEN CATEGORY MOVES INTO THE 21ST CENTURY

Analytics firm One Click Retail suggests that Amazon is stealing market share from large brick and mortar retailers. Part of the driver here is that Millennials are starting to settle down and start home improvement projects, and naturally the first place that Millennials search for these products is online. The full article at One Click Retail provides some great insights for brands in this category.

Let me know what Amazon has been doing lately that has you puzzled or excited. Until next week's round of Amazon Seller's Week in Review, join us in our private community for brand owners and Channel Managers on Facebook: Amazon Chanel Mastery for Brands. We share insider tips about e-commerce and selling on Amazon.

.png)