Here's my curated round-up of the top news this week that impacts brands selling on the Amazon platform. Make sure you hit "Follow" to get notified of my future posts!

Amazon’s Treasure Trucks go nationwide

The Treasure Truck has now been rolled out beyond Amazon’s hometown of Seattle for the first time, becoming active in five other metro areas last week. As RetailWire explains, “the truck drives around town with a single “amazing deal” and, when it’s going to be in your area, you get a text on your phone. If interested, you click to buy on your app, pick one of the trucks as your pickup point and get over there — fast.”

By virtue of its desire to offer the best product selection of any online or offline retailer, Amazon is not strong when it comes to impulse purchasing and product curation. The Treasure Truck gives Amazon a unique opportunity to inspire impulse purchases and push specific products.

Another boon for this model is the ability for Amazon to test new product lines. Customers relish the opportunity to be first in line to try something new and Amazon accesses hungry beta users. Its a win-win all around.

Amazon launches in Singapore

Amazon last week launched its Prime Now two-hour delivery service in Singapore. Users get free delivery on orders over 40 Singaporean Dollars, but the launch hit a snag when high usage led to sold-out delivery windows.

According to Amazon, "Due to great customer response, delivery windows are currently sold out. We are rapidly opening up new windows to ensure we can continue delighting customers in Singapore.” Amazon’s Prime Now operation in Singapore is supported by a 100,000 sq. ft. warehouse, and uses workers fulfilling merchandise by hand, rather than the highly technology-enabled fulfillment centers the company operates in other locations.

As this article reminds us, Amazon is set to enter the Australian market, and perhaps Singapore is a kind of warmup. Maybe the real question is: Does Amazon’s model in Singapore give us some indication of what things will look like in Australia?

Aussies win Amazon’s robotic fulfillment technology contest

An Australian team of researchers took the top prize for an Amazon-funded contest to build robotic technology that picks and packs items in warehouses. This news tickled me, being both an Aussie and Amazon expert.

Amazon’s highest growth categories leap up 45%

Marketplace analytics firm One Click Retail has produced new data to show four of the fastest- growing categories on Amazon. Despite declines in the Health & Personal Care and Grocery markets, Amazon’s sales of these product groups grew by an average of 45% across the USA, UK, Germany, France, and Canada.

Within the overall Health & Personal care category, some categories were particularly strong, including Consumables, Baby Care, Beauty, Grocery, and Pet Supplies.

For those in the Beauty & Personal Care category, stay tuned for our upcoming article this Thursday about best practices for Pay Per Click (PPC) advertising in this category by subscribing to our blog.

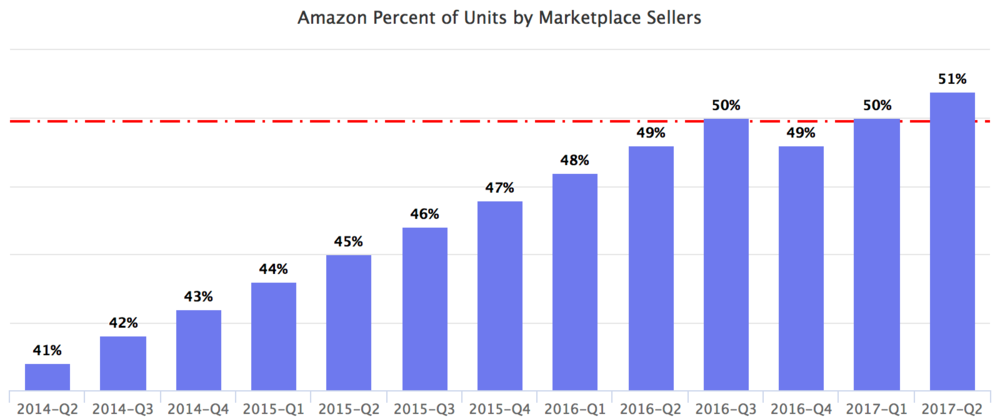

Amazon 3rd party Marketplace Sellers Now Sell More Than Amazon Itself

Some analysis of Amazon's Q2 Earnings report that I enjoyed revealed that third-party merchants sold more units during the quarter than Amazon itself. This is the first time that the balance has tipped over 50%.

Above: Screenshot from Marketplace Pulse

In the same article, the analytics company Marketplace Pulse also notes that Amazon broke out the income generated from services provided to 3rd Party Sellers last quarter (e.g., FBA fulfillment fees). We’re seeing growth in this income category as the share of marketplace sales grows overall and in proportion to 1st Party (retail) sales.

Reminder: Bi-annual Amazon inventory storage fees will be levied on August 15th.

As Amazon details here, FBA conducts an inventory cleanup on February 15th and August 15th every year. On these dates, inventory items that have been in Amazon fulfillment centers between six and 12 months are assessed a long-term storage fee of $11.25 per cubic foot. Items that have been in fulfillment centers for 12 months or more on the inventory cleanup date are assessed a long-term storage fee of $22.50 per cubic foot.

Make sure you hit "Follow" to get notified of my future Amazon news recaps!

.png)