There’s already a lot of commentary available regarding Amazon’s performance on Prime Day. Even just a few days later, we all know that Amazon had a record sales day: the company had an estimated $1 billion or more in revenue, tens of millions of Prime members made purchases throughout the 30-hour event, and its own Echo Dot became the best-selling item overall.

But I want to cover what’s most relevant to our clients and readers of this blog: How did Prime Day shake out this year for brands selling on Amazon? What lessons can be drawn out?

I looked at the aggregate performance of the brands we work with at Bobsled Marketing, spoke with our project managers and specialists to discover their top observations and most helpful tips, in addition to sifting through a lot of Amazon forum commentary. In this post, I cover what the successful sellers did right, what the big failures were, and what lessons can be taken forward to occasions like next year’s Prime Day.

Amazon made a lot of brands happy on Prime Day 2017

To begin with an observation which shapes a lot of the following commentary, the fact that Amazon extended many more 3rd party (3P) sellers the privilege of promoting deals this year turned out to be a boon for both Amazon and brands alike.

To give a brief history lesson: In 2015 many of Amazon’s deals sold out within a few hours because most products being promoted were Amazon’s own inventory. This prompted public criticism of the event, leading to the common hashtag #primedayfail on social media to describe the underwhelming selection of deals and customers’ disappointment. No one won in this scenario--Amazon lost the confidence of shoppers, 1P (1st party, or brands who sell directly to Amazon on a wholesale basis via Vendor Central) brands sold out of inventory too quickly and lost the potential for more sales both on Prime Day and in the following weeks while inventory was refilled, and 3P sellers had no way to join in.

This year, perhaps because of past experiences like this, sellers now expect 1P products to move fast. In fact, it seems from comments made in the sellers-only Seller Central forums that a key part of some sellers’ strategizing was to expect 1P inventory to sell out early and then present them with a chance to rack up sales. As one seller posted, summing up a common thought, “once Amazon runs out of stock, the Third Party Sellers can make bank.”

In 2016, to continue stepping through history, Amazon invited only a select group of sellers to participate in limited Lightning Deal promotions, which once more created an upper limit on potential selling opportunities and inspired a fair amount of public criticism.

Rarely one to need the same lesson twice, Amazon made Prime Day 2017 even more accessible to 3rd Party Marketplace Sellers. This year, brands invited to promote products on Prime Day were given access to Lightning Deals several weeks before the event and were prompted to send in inventory well ahead of time. For the first time, some brands were invited to start using Headline Search Ads to drive traffic to their deals, products, and brand pages. Previously, this ad placement was only available to Vendors using the AMS (Amazon Marketing Services) PPC platform.

Because many brands participated in Prime Day 2017 who weren’t able to do so in 2016, there was a predictable increase in Amazon’s Gross Merchandise Volume. It also helps that Amazon extended the event from 24 hours to 30 hours, giving shoppers another six hours of precious buying time. From the looks of it, sellers benefited from this as well: many report higher total sales across both days because of the extended time frame.

While analysis of this year’s event can’t be a true apples-to-apples comparison with other events, there are still some clear insights that brands should heed for future Prime Day events, as well as other yearly events like Cyber Monday or holiday promotion planning in general.

The timing of Prime Day is a blessing and a curse

Prime Day is conveniently situated in the midst of the slow season for most brands. It creates a big incentive for customers to shop when they might otherwise be more interested in taking a vacation or spending time with kids who are on summer break. (Amazon did this very much intentionally, since its goal here is to boost revenue during an otherwise lackluster quarter and get slow-moving inventory out the door.)

In some client accounts, we noted a couple of days of decreased sales leading up to the week of Prime Day. This seems rather likely to be because consumers suspect better deals are on the horizon, and are deferring purchases shortly before the event in hopes of seeing a better deal during Prime Day itself.

As one seller posted this week in the Seller Central forum: “Last year’s Prime Day had so much hype that I believe people stopped buying as much on Amazon for as long as a week prior to Prime Day. Our sales last year were half of what they normally were for the week leading up to Prime Day. Yes, we had a surge in sales on “Prime Day” but it was [nowhere] near enough to make up for the losses from the previous week.”

While holding off a few days may well be due to Prime Day, the slump in sales is also very likely due to the 4th of July holiday, summer break, and the general summer sales inertia that motivated Amazon to pick this time of year for Prime Day in the first place.

This is what my research consistently revealed: Brands that made an effort with pricing promotions, ads, and in driving external traffic to Amazon were the winners on Prime Day 2017.

PPC observations & lessons learned

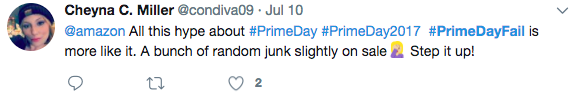

Our PPC Specialists were kept very busy on Prime Day. Though we spent the weeks leading up to Prime Day preparing clients’ Sponsored Products and AMS campaigns, the nature of Prime Day still requires close monitoring of campaigns even after budgets are set and campaigns are set up.

The average increase in spend on Prime Day across our clients’ campaigns was 46% compared with the average spend from July 1-10, but it was not uncommon for some of our clients’ daily budgets to be spent within just a few hours.

I asked Stefan Jordev, one of our PPC Specialists at Bobsled Marketing, what his key takeaways were from Prime Day. Here's what he said:

1) Check your account every few hours. Campaigns run out of budget very quickly.

2) Get ready with bids and budgets before Prime Day.

3) CPC rates do not necessarily increase during Prime Day.

4) Every single account saw increased sales on Prime Day.

Stefan points out that setting a higher budget before Prime Day is definitely a great first step, but is far from all that sellers must do. Sometimes even a 100% increase in daily campaign budgets will not be enough.

Many times sellers reported glitches during Prime Day, such as Lightning Deals running for the whole day last year instead of 4-6 hours, so checking in every few hours is something that sellers can do to be confident that everything is in order.

Cost Per Click (CPC) did not necessarily increase around Prime Day. My personal assumption was that CPC costs would become much more expensive around the Prime Day period, as more brands competing for clicks logically equates to a more competitive bid environment. However, we didn’t see consistent CPC increases across the board. On average, CPCs only increased 2.72% on Prime Day, as compared to the days leading up to the event. Just 1 in 3 clients saw an increase in CPC of more than 50% on Prime Day, versus the period of July 1-10.

Aleksandar Gadjovski, another Bobsled PPC expert, had this to say:

"The hype is created more by the professionals in the industry than by the actual shoppers. As with every other holiday, Amazon has been recommending increasing the bids, which of course serves Amazon very well.

But you have to go with the flow because everybody is doing it, and you don’t want to fall behind. However, I was focusing more on having bigger budgets than higher bids. With bid +, you can easily burn through the whole budget while people are only browsing for deals. Unlike other holidays, people tend to postpone purchase for Prime Day.

For other holidays, there is more of a cumulative buildup and then a sharp drop. For Prime Day, it is more of a spike."

Need expert help with your Amazon PPC campaigns? We can help with that. Learn about our Sponsored Products and AMS advertising management service.

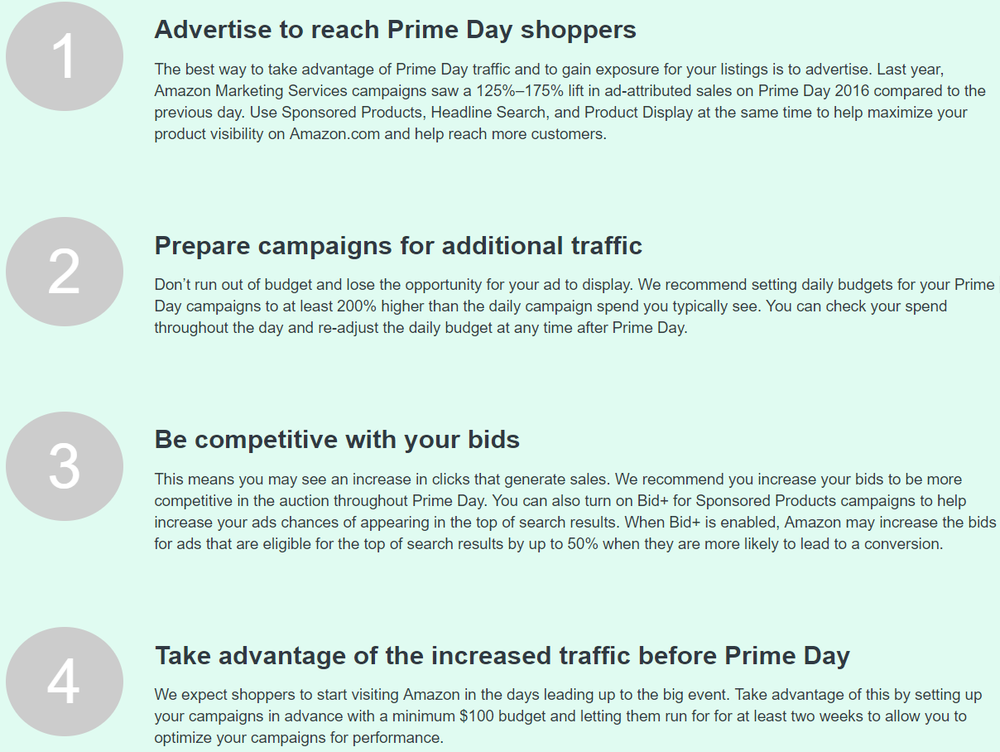

Growth across Amazon marketplaces

Prime Day was a much bigger event in the United States than it was in Canada. Across our client base, sales in the Canadian marketplace rose 128%, versus over 200% on average on the U.S. marketplace.

One client who sells in Canada was offered Lightning Deal promotions, but decided not to accept because the deal prices and quantities recommended by Amazon were not favorable. Instead, we took matters into our own hands and created a promotional discount of 20% (no code required) on Prime Day. Overall, there were 38 unit sales that day compared to a 30-day average of 16 units per day.

Winners & losers

-

Brands that ran out of inventory.

-

Sellers who had their Lightning Deals cancelled. This is an unfortunate scenario, but thankfully fairly rare (although a technical glitch on Amazon’s end apparently caused several sellers’ Lightning Deals in North America to be “suppressed” and ultimately “cancelled,” causing them to lose lots of ad spend).

-

Brands that didn’t promote their deals through other marketing channels.

Product sales by category

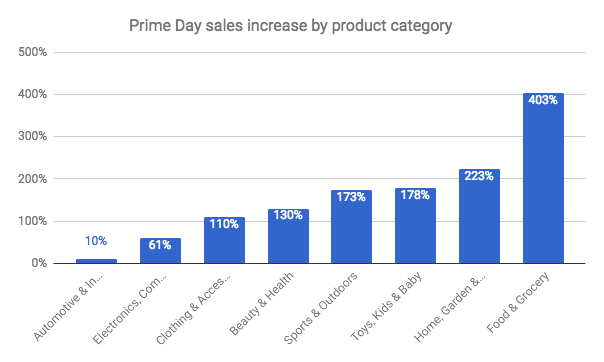

There were not any categories where brands didn’t see some increase in sales on Prime Day. Still, some categories fared better than others.

Lessons for 2018 from the Bobsled team

"Schedule product promotions (some % off, buy one get one, etc.) to start as soon as the scheduled Lightning Deal ends. This helps to maintain momentum. Even a lag of a couple of hours can mean lost sales.

"Brands should leverage their own customer or subscriber newsletter list/social media to offer a 35-45% discount on their products in days leading up to Prime Day," says Client Project Manager Lori Dinkins.

Vendors can’t access daily sales data unless they’ve invested in Amazon Retail Analytics. So Client Project Manager Noelle Barnes offers this workaround for Vendors who need a view of the effectiveness of their Prime Day strategy:

“Pull month-to-date metrics for July, then last reported week metrics, then subtract one from the other to get a closer view of Prime Day week. You can then look at daily averages from each time period.

"Start planning inventory months in advance. One Vendor client got stuck between a rock and a hard place when they were under-stocked for one of their most popular products. Following the advice of its Amazon rep, this brand had to decrease its ad spend, and consequently worried about the impact on its Vendor metrics. It turned out to be a successful day for this client, but the inventory issue probably prevented the brand from making the most of Prime Day."

"Build Prime Day into your brand’s promotional calendar, rather than restricting your marketing efforts to your Amazon channel only. Promoting your Prime Day offers to your existing list and followers will help to build much-needed momentum," says Bobsled Client Project Manager Jesse Rooplal.

In his work, he has found it makes sense to “take the extra step and go steeper with offers. Coordinate with off-page efforts if possible (social/email). Always think post-Prime gains, not single day profit loss."

All in all

Prime Day 2017 provided a much-needed boost to brands who typically see a sales drop over the summer months. As with preparing for any major holiday or peak-selling period, the gains come after diligent preparation from both an operational and marketing standpoint.

Now in its third year, and with Amazon using the day as a way to boost Prime memberships and member engagement, Prime Day looks like it’s here to stay. That means it’s very important to squeeze everything you can out of Prime Day for your brand. So take these lessons learned and use them to start thinking about your strategy for 2018 - we certainly will be!

If you were disappointed with your brand’s performance on Prime Day this year, perhaps it’s time to call in the pros. Our team of Amazon experts work with established consumer brands to manage the operational and promotional aspects of their Amazon channel. Learn more about our services and request a consultation.

.png)