A week after Prime Day and there is still a buzz in the air as brands pour over sales data to determine how they performed. Here at Bobsled Marketing, we’re generating our own buzz as we evaluate the impact on our clients’ accounts.

A vivid memory for most Amazon sellers and agencies, Amazon’s technical glitch last year (more like a meltdown) was front of mind leading up to this year’s Prime Day. This year thankfully, buyers and sellers were able to search and shop without any notable disruptions to service.

After an initial recap and review of our internal data, it seems that Prime Day 2019, the 5th for Amazon, topped previous years. According to Amazon’s press release, Prime Day 2019 surpassed Black Friday and Cyber Monday combined as members worldwide purchased more than 175 million items.

How was this year different?

The most obvious difference we noted this year was Amazon extended Prime Day to two days, up from a day and a half last year. This certainly accounts for a portion of the total sales lift from 2018 to 2019 but comparing day one from both years, we reported an increase in sales and sales from advertising for our clients, in some cases up 1,400%. A longer Prime Day event also signals growth in adoption and participation as more brands and customers turn to Amazon as the go-to shopping platform.

Here are some of the results we collected from client accounts on the Friday following Prime Day, to give you an indication of how significantly the event can boost sales, given the right advertising strategy:

- CPG brand increased best daily revenue by 3.7X ($8k to $27k)

- Baby product brand increased best daily revenue by 5.5X ($14k to $77k)

- High-end kitchenware manufacturer: advertising revenue increased significantly from an average of 2.5k - 3k / day to 7.8k in the first day and 9.8k in the second day without running any deals!

- Mens fashion brand advertising revenue increased from $200-$300 normal daily sales to $1,200 in the first day of Prime Day;

- Home goods company advertising revenue increased from $100-$150 regular daily sales to $650 - $780 in prime days;

- Boutique personal care brand advertising revenue increased from $70-$120 regular daily sales to $600-$900 in prime days and the day after prime day the sales were elevated to $600.

From a customer’s perspective, having a full second day to complete a purchasing decision eliminates the stress of having to make a quick decision on a deal. Although sales typically decline over the course of any sale period, conversion rates follow the opposite trend. We noticed much higher conversion rates on the second day as the bulk of product research and consideration had been done on day one, if not days and weeks in advance.

With a few Prime Days under our belt, we’ve locked down some fundamental prerequisites that set our clients up for success this year. As obvious as it may seem, we always encourage our clients to participate, provided their margins and cost structure permit. While some clients still see an uptick in sales without participating in Prime Day, (due to the sheer volume of traffic passing through the site), the opportunity for even greater sales and exposure through Prime Day is often worth the investment.

“Agencies, clients, and vendors have accepted that this event does come with reduced profit margins, and it does lead to increased CPC, but to boost sales during the summer period and increase reviews on a listing, I would choose to make the investment.”

- Stefan Jordev, Bobsled Advertising Director

Teikametrics found that although third-party sellers who kept their prices the same or even increased their product prices on Prime Day saw an increase in sales (496% on average). The sales volume of merchants who reduced their prices over prime day saw an increase in sales almost twice that amount (820%). The question for brands is whether profitability during the event is the priority, or boosting sales more significantly with the hope that doing so will have a longer-term effect on product rank and customer acquisition.

We noticed a significant increase in interest and intrigue around Prime Day this year with most brands deciding to take the plunge and participate. The more successful accounts took a thoroughly integrated approach that included weeks of planning, a detailed promotional strategy, strong inventory levels, competitive price discounts, and realistic paid advertising budgets to drive traffic to promoted listings.

Our pay-per-click (PPC) advertising strategy

On the paid advertising front, some clear organisation tactics helped us actively and agilely manage advertising campaigns this year. One such approach was creating campaigns specifically for Prime Day, to include a specific assortment of promoted products and limiting the duration to the Prime Day event days. This helped us intervene quickly and adjust the budget and bids if necessary. The added benefit of a focused approach is the ability to analyse data very soon after the event without spending time reconciling for non-event day performance - as would be the case with longer running campaigns.

Although conventional wisdom says that “Amazon runs on coal” and advertising campaigns need time to mature, brands can still capture the essence of this rule by launching campaigns closer to the event day (i.e the day before) and exporting negative keywords collected over the years and adding them to the campaigns - this gets them up and running quickly and effectively. Ultimately the ability to intervene and adjust a budget for a sub group of campaigns during the event is a more efficient use of time than raking through hundreds of campaigns and adjusting budgets and bids manually.

Big deal events like Prime Day have trained customers to expect generous and comprehensive deals, and more so if they find a product via an ad. Driving a prospect via an ad to a listing without a promotion is an expensive way to stall sales, even if the product meets their needs. The disappointment of not seeing a deal often drives the customer to a competitor listing instead. Conversion rates will always be higher with an additional incentive to buy, such as a price cut, lightning deal or coupon.

A welcome boost from other retailers

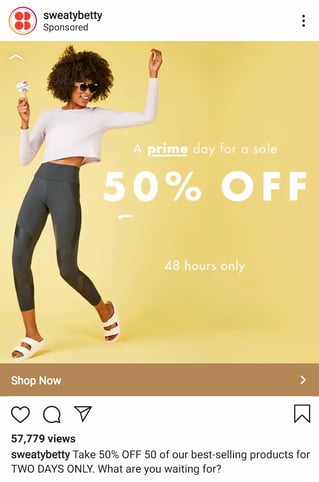

Perhaps the most unique characteristic of this year’s Prime Day is the ripple effect of success felt off Amazon as well, as big retailers caught the bug and decided to capitalise on the flurry of deal seekers.

“Prime Day for other retailers is like a massive gift, in the middle of summer when nothing much happens and nobody is spending any money, they’ve seized the opportunity to run their own promotions.”

- Kiri Masters, Bobsled Founder & CEO

With consumers in “buying mode” around Prime Day, some big brands such as Nike, Macys, The Gap and Best Buy decided to time their own deals to fall on the 15th and 16th July.

According to Chain Store Age’s report on the Jumpshot findings, this strategy led to a sales gain of 150% compared to a typical Monday.

This is a sign that brands on and off the platform are finding creative ways to ride the current of Amazon’s marketing efforts and boost sales.

While the Prime Day event may have passed, the lessons learned, data and winning strategies can be repurposed for Q4 which is just around the corner. To get a headstart on Q4 planning, read up on the Top Growth Lessons Learned Before, During, and After Q4.

.png)