So, your brand was just invited to the Amazon Lending Program. Now, you’re left wondering, “Is this worth it?”

For many, it’s a difficult, if not impossible, question to answer. According to Amazon, “Sellers on Amazon worldwide used capital from Amazon Lending loans to grow sales by an estimated $4 billion.” That’s an impressive number, and, for many brands, getting cash through Amazon is an appealing and unique alternative to traditional lending through a bank.

But, even if you haven’t been invited to the program yet, it makes sense to assess its potential just in case you get the OK from Amazon. If you know lending is in your brand’s future, it makes sense to research all the options for their opportunities and threats.

Solid details about the success of the lending program are few and far between, but we parsed information straight from Amazon, the praise and criticism from customers new and old, and what we’ve seen from our own clients. Before we get into the pros and cons of going with the Amazon Lending Program, let’s make sure we know what it’s all about.

Amazon Lending Program Q&A

“We created Amazon Lending to make it simple for up-and-coming small businesses to efficiently get a business loan, because we know that an infusion of capital at the right moment can put a small business on the path to even greater success,” said Peeyush Nahar, VP for Amazon Marketplace. “Amazon is providing capital to small businesses to help them expand inventory and operations at a critical period of their growth.”

According to a recent Amazon statement, more than 20,000 small businesses have received a loan via its lending program and more than half of those have returned for a second loan from the company.

How long has the program been around, and where is it offered?

The program began in 2012, and was originally only available for brands in the United States and Japan. In 2015, Amazon expanded into the United Kingdom, and is currently looking into seven more countries: Canada, France, Germany, India, Italy, Spain, and China.

How much does Amazon loan out?

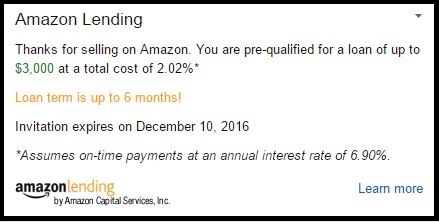

Loans can be for as little as $1,000 to as much as $750,000.

What are the typical terms for these loans?

Typically, terms for loans given out by Amazon are short—4-6 months—compared to more traditional short-term loans from banks, which can range from 3-18 months.

What can the loan be used for?

With traditional lenders, there’s often more flexibility how you spend the cash, but the bank will certainly want to know about your plans. With Amazon, these loans must be used to finance more inventory. If a lack of inventory is holding your business back, this could be an ideal scenario, although the inventory purchased with an Amazon loan must be sold through the Amazon marketplace.

What kind of interest rates can I expect with an Amazon loan?

Amazon has published no information about what the standard APR is, or even the potential range. Between information available via discussion boards and from our own clients, we can safely say that most interest rates range between 6% and 14%, which are generally in-line with traditional loans from banks.

How is payment handled?

During the loan application process, you and Amazon will come to an agreement about how quickly the loan will be repaid, based on the terms of the loan. Amazon takes a fixed amount from your Seller Account each month, regardless of your sales performance.

3 Key Pros and Cons of the Amazon Lending Program

Pro: The easiest loan application you’ll find anywhere

One of the biggest pain points in applying for a traditional business loan with a bank is the amount of paperwork required in order to get approved. Even smaller businesses are looking at an administrative process that can take weeks or months. For those who need to move quickly, a bank might not be the best option.

With Amazon, they do the hard work of determining your eligibility for you, based on your sales performance. On one hand, that means you can’t rely on getting an invitation, but if one is offered to your brand, there’s nothing more that you need to do—other than accept it—to get up and running with some more capital.

Con: Taking a loan with Amazon might make you even more dependent

As mentioned earlier, these loans can only be used to purchase more inventory on Amazon, and must be repaid through your Seller Account. This means you’re locked into buying more inventory and selling it on Amazon as opposed to diversifying with another sales channel. You’re also committing to paying off that loan exclusively through your Amazon sales, so those numbers suddenly become much more important to your business.

For some brands, the commitment might be too much. For others, they wouldn’t want to go anywhere else.

Pro: It’s great if you can’t yet qualify for other loans

Many businesses struggle to grow because they don’t yet have the credit, or relationships that are necessary to get the best loans from banks. As part of the massive paperwork process, banks look not only for solid financials but a sound business plan that guarantees their investment.

This is particularly true for smaller businesses, and Amazon presents a unique opportunity for these brands to pull together capital that might be impossible to get otherwise. By offering easy qualification based on previous sales performance, a loan with Amazon feels like them looking to grow your business, and not just make a quick buck.

As one Seller posted on the Amazon Seller Forums, “We use it all the time because the cash they are offering up is WAY more than I could ever pull from a CC. We tried going through a bank for a lower rate but the paperwork was insane and we were looking at a 2-3 month process.” Amazon Seller Forum, 19 Jun 2016.

Con: An Amazon loan requires lots of strategy

By taking out a loan via Amazon, you’re able to rapidly grow your inventory levels, but that doesn’t actually create any sales. Potential customers don’t care whether you have one or a thousand of your products in stock, as long as there’s at least one for them.

As you inventory grows, and so do your obligations to Amazon, your sales need to do the same. That means you need to have a solid strategy in place before taking the loan. Will you optimize your listings to get more conversions, start PPC campaigning, or increase outside marketing efforts? Without a plan, the warehouses will be filled, but you’ll be scrambling to actually profit from Amazon’s investment.

Pro: The interest rates and fees could be lower than other loans

There’s no doubt that getting a loan through Amazon will offer a better interest loan compared to something like a credit card, and based on our research, Amazon Lending interest rates are at least competitive, if not a little better, than a traditional bank loan. Because Amazon knows how you’re going to spend the money and has more control, they might be more willing to cut you a good rate.

When you’re talking about hundreds of thousands of dollars, potentially, even a single percentage point can make a big difference.

Con: Fixed payments could hurt you, and the consequences

of delinquency are high

Unfortunately, Amazon isn’t too concerned with how your sales are doing after you take out a loan. If you take out $300,000 to increase your inventory, and your sales don’t grow afterward, Amazon is going to continue pulling repayments from your Seller Central account until they get their money back.

If those funds get depleted, Amazon retains the right to hold onto your inventory and restrict your sales until you can pay them back. After that, Amazon can seize your inventory and sell it themselves to get their money back. That could put a severe damper on the future of your business, whether or not you continue to sell on Amazon.

Are Amazon loans worth it?

That’s a difficult question to answer because no two brands are the same. Some love the ease by which they can use capital to grow their inventory and sell more, and others are scared away by the ever-deeper commitment to Amazon.

We recommend that any brand starts by examining their vision for the future of their company. If you have a strategy for growth, and Amazon is part of that future, then there are probably few better options.

After all, Amazon claims the lending program has grown sales by $4 billion, and half of the sellers took the option for a renewal. The numbers don’t lie, but are they the right numbers for your brand?

.png)