Amazon is no stranger to branching out, and doing it with precise intention. That’s why they have created a whole host of programs to attract and assist brands on the platform. From programs to help market your products, to new marketplaces, and programs designed for specific categories; these programs indicate where Amazon sees opportunity in the market, and as a result, opportunity for sellers.

Bobsled has a unique viewpoint on these programs, as we help our client brands navigate the choices and make use of programs where there is a match. As a result, we’ve had the opportunity to learn more about and harness the features of several programs, from beauty, to fashion, and more.

Bobsled has a unique viewpoint on these programs, as we help our client brands navigate the choices and make use of programs where there is a match. As a result, we’ve had the opportunity to learn more about and harness the features of several programs, from beauty, to fashion, and more.

This landscape is an ever-changing one, and we make it our business (quite literally) to keep up with what’s new, what’s changed and what Amazon has decided to shut down. In this blog post we’ll dive a little further into a few of Amazon’s special programs and our experiences with them in the hopes of making more brands aware of the opportunities available to them.

The Fashion Accelerator Program

Fast fashion is a term we’re hearing more all the time, so it’s no surprise that Amazon is a big proponent of this trend. When you look at the ease of adding new products on the Seller Central platform you can see why it’s such a great avenue for testing new products quickly. As a result, Amazon has approached the fashion industry very intentionally with the Fashion Accelerator program.

Amazon invites fashion brands to the program and helps them identify the types of products they should be testing on the platform. The brand can then create styles, size runs and quantities based on Amazon’s provided data and advice and start selling them on Amazon. This program allows fashion brands to test new products and then react to results by quickly creating larger runs of successful products.

If a product is successful in the Fashion Accelerator it could then potentially be sold as a part of Amazon’s private label. So, Amazon is essentially using the Fashion Accelerator program to feed their private label, but the brand can also maintain their own listing of the product through SC.

Amazon shows they are serious about making this program work as each account is assigned a rep to help move the account through the different phases of setting up product. A wealth of tools are shared with accounts to help them optimize pages, copy, and their Seller Central account, and Amazon handles so many aspects of this program, from product photography all the way through to marketing, making the Fashion Accelerator a very different kind of program for sellers who are already familiar with Amazon’s selling ecosystem.

Photography is extremely high-quality, but can take weeks to complete, once Amazon receives product samples. Marketing is exceptionally good, with high-value placements all over Amazon, but no data is given to explain how that marketing is performing, which - for anyone who has used the advertising portal in Seller Central - will feel like a disadvantage.

The good news is that the marketing help and tools unique to this program can drive much higher sales than a seller might be used to. The bad news is that these higher sales can lead to stock-outs. Amazon will try to help sellers keep inventory levels high, but it helps to stay on top of this as early as possible, and to identify which styles are really taking off, as part of the test and react model. Finding those early bestsellers, and then using those as templates for additional styles, is a key to success for future iterations of product within Fashion Accelerator.

Luxury Beauty

The beauty market is a multi-billion dollar opportunity, and Amazon is pursuing a good chunk of those dollars. That’s why they have created the Luxury Beauty category, to operate alongside the standard beauty category.

Bobsled has been learning about the Luxury Beauty category a fair bit in recent months, as it has changed the way that different types of brands sell on the platform. Amazon is pursuing large beauty brands to feature in this category, alongside many high quality, niche products. Brands like Stila and Dermablend set the tone for the kinds of brands you find in this program.

Here at Bobsled we have the opportunity to work with several beauty brands that produce high quality (often on-trend, natural) beauty products. These products are a great fit for the Amazon Luxury Beauty program, because they cater to a higher end market.

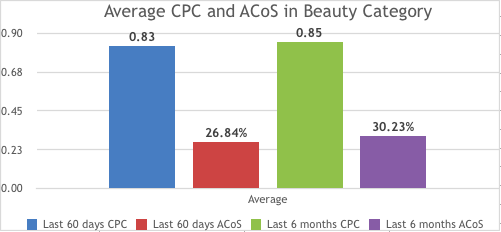

With average CPC among our beauty brands brushing a relatively high $0.80 and ACoS averaging out at just over 25%. There are no free rides in the beauty category, but there is also a lot of opportunity to be had here. One of our beauty brands increased sales by 1551% same week Year Over Year (YOY). January 2017 (sales $879.69) - January 2018 ($14,527.61).

While Amazon’s Luxury Beauty category has long been an exclusive group known to be “invitation-only”, Bobsled recently learned that this may be changing. Bobsled works with a brand that focuses on high end face moisturizers and is currently in the Beauty category. We opened a case with Amazon to request consideration for admission into the Luxury Beauty category based on the brand’s placement as a high-quality, niche product. Instead of the expected Amazon response that we must wait for an invitation to the coveted Luxury Beauty category, Amazon responded with the following:

"I have investigated the issue with our internal team and they have informed us that for this restriction their is no invitation process you need to go through the approval process.

To seek approval to sell in Amazon Luxury Beauty category, please follow the below mentioned process:

_________________________________________________________________- I would request you to send all the proof to this team via email: notice@amazon.com this team deals with Luxury Beauty category restriction.

- I have reviewed the screen-shot which you have provided as a proof I would suggest you to submit in PDF format.

- The manufacturer has to write an email to this team: notice-dispute@amazon.com approving you to sell this product."

Instruction on how to apply for the Luxury Beauty category was not expected as, at this point in time, Bobsled had not seen official instruction on a change in this process. Application to the Luxury Beauty category is currently in progress for this brand, based on Amazon’s instructions above and this can be a game changer for other beauty brands that seek admission into Luxury Beauty.

Vendor Express

The Vendor Express program is a program that Amazon has now phased out, but while it was still live, it served brands wanting to have a wholesale relationship with Amazon without needing an invitation.

This program allowed any brand to hand over their product and have Amazon fully manage the listing, selling, shipping and customer service. You could say that this program operated somewhat like a junior version of Vender Central; handing over control of a product to Amazon, but wasn’t a fully fledged wholesale situation.

We’ve never been huge fans of this program as it seems to contain the cons of both the Seller Central and Vendor Central platforms. As Kiri mentions in her recent commentary on Forbes “It was a halfway house with all the cons of both models - unlike with the full Vendor Central platform where brands are assigned a real human being to negotiate wholesale terms, pricing, and to workshop other issues - brands on Vendor Express were relegated to algorithmic pricing of their products and no human support. And unlike on Seller Central, brands on Vendor Express couldn’t access many of the new promotional tools and programs like Brand Registry 2.0.”

It seems that Amazon has learned its lesson with this program, as it has now been taken offline. This shows that they are pushing to have two defined platforms (SC and VC) and that a halfway program like this was not beneficial for Amazon or for brands.

Amazon has also implemented a hiring freeze on representatives for VC as they work to push more brands towards SC, with the addition of marketing tools previously only available to VC and Vendor Express members. This indicates that Amazon is looking to grow their revenue with less human capital by encouraging more of a self-serve environment on the more fully-featured, SC side.

Find the Right Amazon Program for Your Brand

Amazon continues to expand their variety of programs and capabilities for brands wanting to sell on the platform. If your brand has been hesitant to try this selling channel the Bobsled team can say for certain that opportunities exist for all kinds of products. Contact us to learn about how we can optimize those opportunities for your brand.

.png)