In a previous article, I laid out my personal predictions for the Amazon marketplace in 2017. Those included a deeper expansion into international markets and further updates to the policy on soliciting reviews.

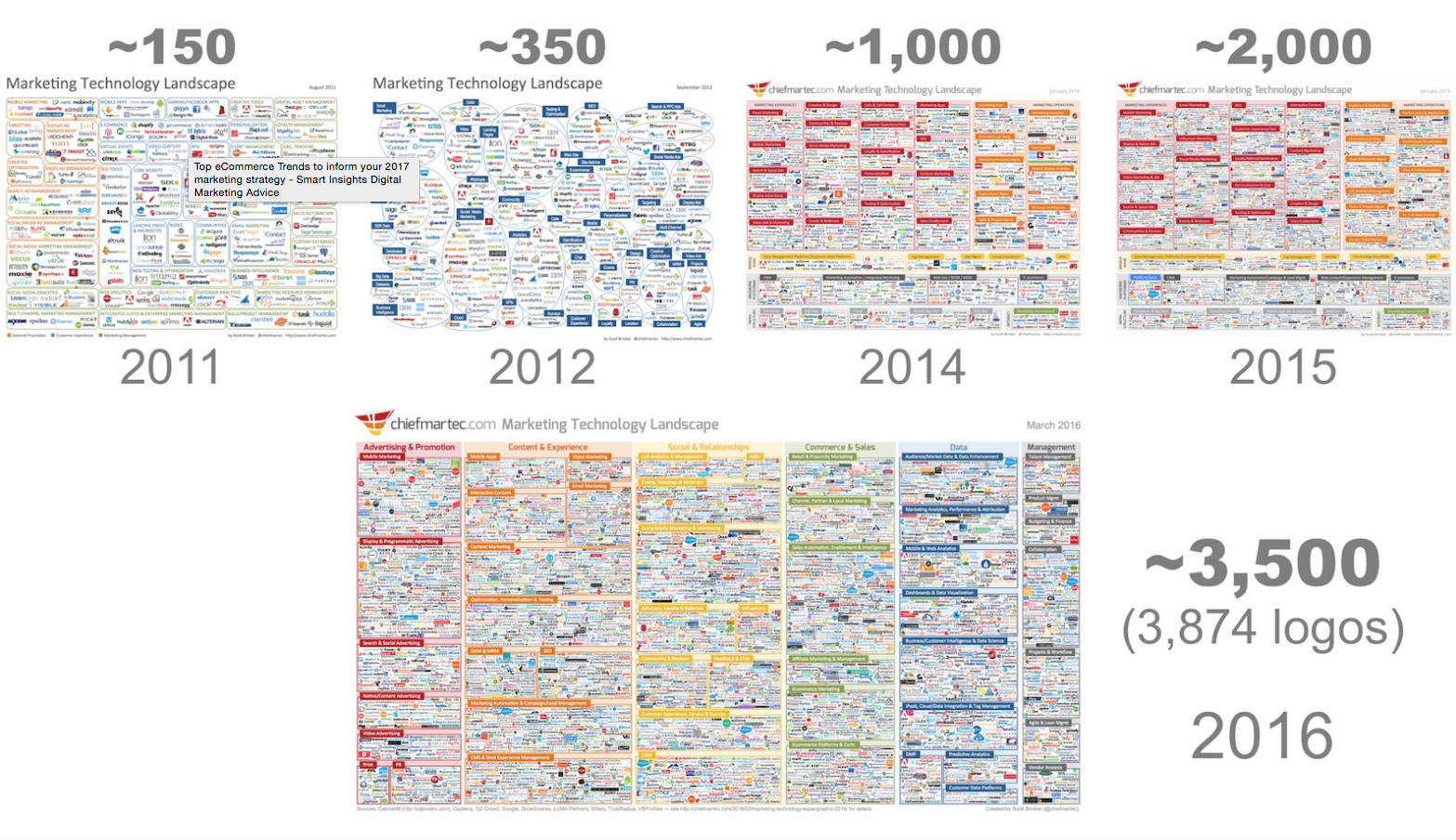

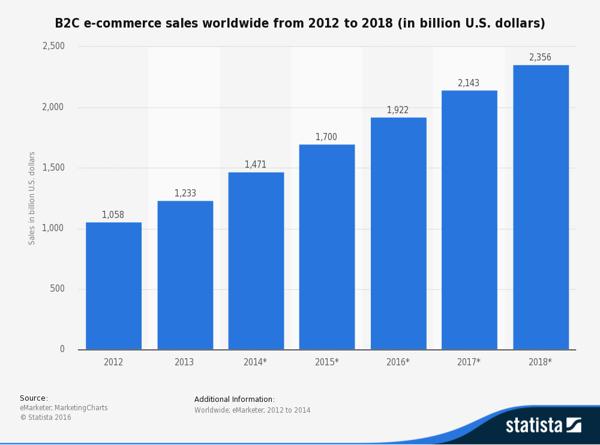

You’ve probably heard it before, but this can’t be overstated: e-commerce is a rapidly changing game. Brands need to stay on top of their game when it comes to online retail. This is a motto that applies both for Amazon sellers and for brands outside the marketplace. Whether you’re an established digital-first brand, or simply considering e-commerce it as the next big step for your business, you need a strategy that adapts to the times.

In today’s article, I’m expanding on my original predictions for 2017 to include trends for e-commerce marketplaces in 2017. The new year looms just around the corner and for many brands this is the best time to do the math and see what worked and what didn’t and plan for growth in the new year.

For brands who rely on e-commerce as a distribution model, staying on top of new trends is essential. But it’s not just Amazon you should be on the lookout for. E-commerce is growing at a pace faster than ever before and each year offers brands new opportunities to expand their reach and grow their revenue. However, with such appeal, comes great competition and brands have to stand out amongst the noise in order to win new customers.

Trends for e-commerce marketplaces in 2017

2017 is expected to bring a lot of exciting trends in e-commerce. From chatbots and social selling to an evermore focus on mobile e-commerce and data personalization and customization, brands better be on the lookout. Amazon is the 800-pound gorilla in the room not only when it comes to e-commerce, but retail in general. Wal-Mart and Google are the two big names which could conceivably compete with Amazon in the Western world, and I believe we’ll see some big moves from these behemoths in 2017.

Wal-Mart will add a FBA equivalent service

Last year, Wal-Mart ranked 4th in terms of web sales of the leading U.S. e-retailers, with $13.7 billion compared to Amazon’s whopping $92.45 billion.

Wal-Mart is working hard to position itself as a value-oriented alternative to Amazon. This year, Wal-Mart purchased Jet.com for $3 billion, a new platform that, according to its founder Mark Lore, is 5% cheaper than Amazon. It’s a marketplace with far less product range than Amazon, but Wal-Mart saw a lot of value in the smart shopping cart technology that Jet had built, as well as the inroads that the brand had made in the Millennial and urban consumer market - a demographic that walmart.com would struggle to win on its own.

In 2016, we saw Wal-Mart re-allocate capital expenditure away from retail stores and into its e-commerce division and looks laser-focused on making good on its investments in 2017. In fact, I’m expecting them to double down on e-commerce and having Jet.com CEO under their belt is a very good sign. Marc Lore, hailed as an e-commerce visionary after selling his first major retail properties (diapers.com and Quidsi) to Amazon several years ago, is now leading Wal-Mart’s online retail efforts and no doubt has some very interesting things to unveil in 2017.

There is room for improvement. What walmart.com is missing right now is assortment. While Amazon carries an estimated 400M SKUs, Walmart.com sells a mere 4M, or 1% of the range that Amazon does.

To properly compete with Amazon in terms of assortment, Wal-Mart needs to attract more merchants and brands to its platform. One compelling way to do this is to offer a similar fulfillment network as Amazon’s “Fulfilled By Amazon” program, where merchants supply inventory to Amazon, who then fulfills each individual customer order from stock held in Amazon’s own warehouses.

Building out infrastructure which can be leveraged by 3rd party sellers will only help to consolidate the quality and scalability of its own network. The technology which drives Jet.com provides a great platform for Wal-Mart to offer fast, efficient and profitable delivery options to customers across the US.

What this means for brands: Apply to sell on walmart.com - the approval and onboarding process can take weeks to months - and be an early adopter in this growing marketplace.

Google will invest in its own e-commerce platforms

In 2013, Google launched Google Express - a platform which lets people buy online or through an app and have items delivered from local stores the same day, overnight or within two days, depending on where you live and the time you order. Instead of selling their own inventory, like Amazon Fresh or Freshdirect, Google Express works with more than 50 merchant partners, including include Costco, Whole Foods Market, Kohl’s, PetSmart, Road Runner Sports, Sur La Table, Fry’s, Walgreens, L’Occitane, Payless ShoeSource and Guitar Center.

Think about the swaths of information that Google has about shoppers online. They know more than potentially any other company (including Facebook and even Amazon) about buyer behavior, through their Google Shopping and AdWords units. 2016 saw Google invest more in this platform, rolling out coverage to 13 more States.

“We think of ourselves as a technology platform because that’s what we’re really good at. We’re trying to build a platform that lots of merchants can participate in,” says Google Express’ General Manager. By partnering with merchants directly, Google could very quickly create its own marketplace made entirely of third party merchants. This potentially buries Amazon’s claim as having the “Earth’s biggest selection”.

I predict Google to make more investments in technology hardware - following the release of its first mobile phone product in 2016 - as well as deepening and broadening the available selection on Google Express.

What this means for brands: keep a close eye on Google Express’ developments as they begin to recruit more and more merchants. Ensure you have robust fulfillment capabilities to take advantage of Google Express - and other emerging marketplaces.

Even if Amazon remains a behemoth in the e-commerce world, its competitors are starting to learn their lessons and implementing options that would allow both sellers and buyers a more profitable experience. Obviously, not all options work just as good for all sellers, but some of them have global implications and from time to time have the potential to set the trend for e-commerce players.

It’s fun to look at the potential developments in the e-commerce marketplace world. But even if Google and Wal-Mart ramp up their game in 2017, Amazon is still America’s #1 most trusted company and accounts for a huge portion of online spending. If your brand’s Amazon sales channel is underperforming, you are missing out.

Contact us for a consultation and see how we can help boost your brand’s revenue on Amazon in 2017.

We are also launching a free course in 2017 for brands which need help in making the most of their Amazon Vendor accounts. Sign up to take the course for free when it launches.

.png)