We’ve jumped head first into 2017, and along with our personal resolutions and goals, a new year means reassessing our advertising and sales strategies for the year to come. For those of us using Amazon, it looks like we’ll continue to see pay per click advertising, or PPC, as a crucial component of our sales throughout 2017. However, while we can count on the importance of paid advertising to remain constant, we are anticipating some big changes and updates to Amazon’s PPC platform.

Our 2017 predictions: what does the new year have in store for Amazon Pay Per Click Users?

Note: As a PPC professional, some of these predictions may fall into the category of “wishes,” but participating in several online Amazon PPC communities makes pretty clear that these are issues everyone is facing. I believe Amazon will address them, having its advertisers' interests in mind.

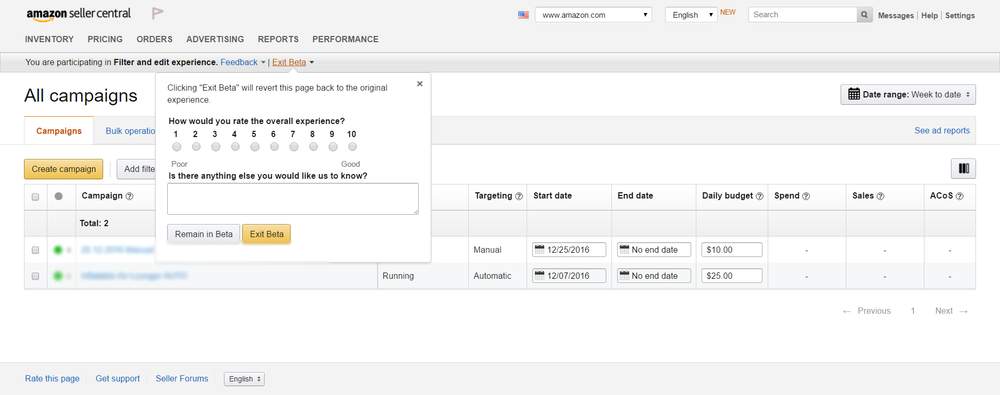

1. The Sponsored Product Interface will finally adopt the Beta look as a default view

Amazon Sponsored Product Interface - Beta View

Amazon Sponsored Product Interface - Beta View

Amazon has recently rolled out a beta view for their Sponsored Product Interface, which has been available for a few months now. It has richer filtering options and addresses the limited look back issue, which made certain aspects of analysis really difficult. In addition to this improvement, we may see Amazon adopting even more new filtering options to improve their interface.

The addition of beta view and other additional filtering options will mean quicker comparisons, less time spent on reporting, and more spent on actually optimizing campaigns.

In addition to these improvements, I think it is safe to assume we should refer to the current look and feel of Google AdWords’ current functionalities to predict the possible future changes in Amazon’s Sponsored Product Interface.

2. Amazon PPC costs will rise

Adoption of Amazon Sponsored Products grew by 100% last year. A growth rate like this makes it pretty clear to every online seller with an Amazon presence that there is new competition, and that competition will impact average CPC (cost-per-click) prices.

But it’s not only new competition that will drive the PPC cost increase - there are other factors as well. In 2016, there was a series of events which clearly indicated that we should expect an increase in PPC costs. Recent changes to the terms and conditions for Amazon’s product reviews are game changers for many new sellers in the marketplace. If they are to compete with more experienced sellers and products, they will have no choice but to implement Amazon paid promotions in their marketing strategy.

Remember, PPC costs are a revenue source for Amazon, so it's not surprising that an increase in the average CPC in 2017 would be a positive factor for them. In fact, those already using paid promotion on Amazon will likely have noticed several e-mails encouraging increased bids; the most recent of these e-mails went out before Black Friday, with another sent late December, instructing sellers to increase their bids before ringing in the new year.

It is safe to assume that sellers who see an increase of sales and decreased ACoS during that period won’t revert to old bids, thus these sellers will be leading the way to a wide adoption of higher PPC bids in their category. So if anything, Amazon is pushing users like you towards increasing bids and spending more!

Unoptimized PPC Campaigns cost you money. Request a consultation with us as see how we can fix that for you.

3. Amazon Marketing Services will get a major facelift

Amazon Marketing Services (AMS) is a service available for vendors using Vendor Central or Vendor Express. In addition to sponsored products, AMS offers two additional ad types (Headline Search Ads & Product Display Ads) which are not available in seller central.

However, the interface of AMS leaves much to be desired:

- It lacks a look back functionality.

- It doesn’t offer negative keywording for Auto Sponsored product campaigns.

- Creating reports and comparisons for previous periods is nearly Mission Impossible.

Additionally, the AMS interface lacks several other fundamental options which PPC professionals have been asking for. Being an Amazon Vendor is usually associated with investing more time, money, and inventory than with alternative options, so I don’t think Amazon can afford to leave its AMS service as it is in 2017.

4. Seller central accounts will turn to other PPC services as additional traffic sources

As mentioned above, with so many sellers coming to Amazon and spending more and more on Sponsored Product advertising, creative sellers will have to find ways to stay one step ahead of their competition. This may result in them adopting other PPC platforms which may cost less, or that simply provide an opportunity to present products in more detail (just think how much better a 15-second YouTube video ad could describe your product compared with the sponsored product ads on Amazon). So, we shouldn’t be surprised if we see Google AdWords, Bing Ads, YouTube, Facebook, or any other PPC ads leading towards an Amazon product page.

Read here about the 8 Differences Between Amazon Sponsored Product Ads and Google Adwords.

5. Amazon Remarketing Ads?

I have not read or heard anything to back the claim that Amazon is remarketing ads. However, when I was working with Google AdWords, remarketing continuously proved to be an effective method for campaigns with purchase as a goal (i.e. all Amazon Sponsored Product campaigns).

For those who are not familiar with the term, remarketing lets you show ads to people who've visited your website or used your mobile app. When people leave your website without buying anything, for example, remarketing helps you reconnect with them by showing relevant ads both across different websites they visit and across their different devices.

Remarketing is seen as one of the biggest trends in PPC this year, and I am confident this can be a major success on Amazon: display your products to users who visited your product page but did not make a purchase, as they scroll through Amazon’s huge assortment of products.

It’s clear that as we enter 2017, Amazon’s Pay Per Click platform is here to stay, but we certainly don’t think it will stay the same. Whether cost increases will drive Amazon sellers to other services, or the interface changes will improve the system just enough to keep them there is yet to be seen.

Bottom line, PPC will definitely remain a necessary component in boosting sales and keeping up with the competition on Amazon this year. To make sure your PPC campaigns aren’t costing you more money than they’re making, request a consultation with us here.

.png)