In this Amazon Seller's Week in Review, Julie Spear, our Operations Manager, shares her take on recent news highlights and what these could mean for brands selling on the Amazon marketplace.

1. Amazon for Business Sellers Program Now in UK

Last week, Amazon launched their Amazon Business program in the UK, aiming to gain a foothold in the B2B market. The program opened on April 14 focusing first on SMEs, multinational companies, hospitals, nonprofits and universities.

According to Bill Burkland, the head of Amazon Business UK, Amazon Business customers will have access to more than 100 million products as well reporting and analytics capability. Working in conjunction with Visa, Barclaycard, Citi, HSBC and Lloyds Bank U.K., Amazon Business will offer participants line-item details on purchases made. These organizations can use that information “for spend management and reconciliation purposes”.

The launch of this program opens doors for third party sellers to access another share of the UK market through the Amazon Business Sellers Programme. Amazon touts the benefits to sellers to include among others:

- Increased chances of winning the buy-box with the display of VAT-exclusive prices to verified business customers.

- Catering to business customers with Business Pricing, Quantity Discounts and Business-Only Offers

- Lower referral fees on large business transactions in certain categories

- Increased visibility for your offers with a Business Seller Badge displayed on the product detail page.

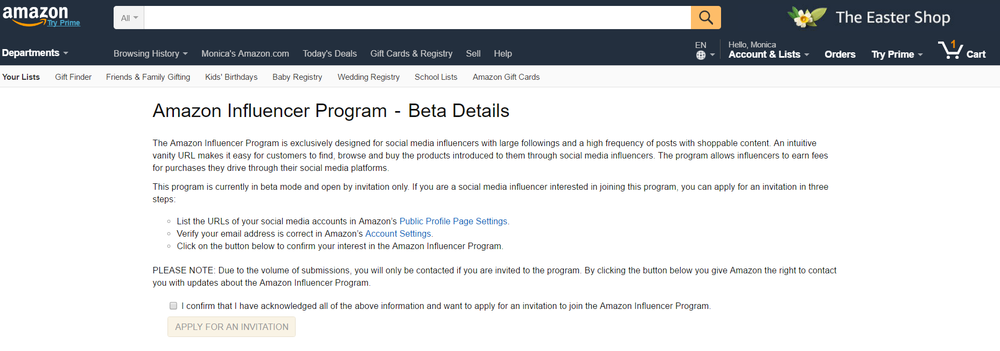

2. Amazon Launches Social Media Influencer Program

Amazon recently quietly launched the “Amazon Influencer Program,” a program aimed at getting social media influencers to promote products. The influencers would earn a commission on the products sold. Sound a lot like the Amazon Affiliate program, which allows participants to sign up for the program and build links and ads to include on their websites and blogs. When a reader clicks on the link and purchases the product, the affiliate then earns a commission on the sale. A key difference to the two programs is the exclusivity of the Influencer program. At this stage, interested parties can apply to join the program but only those with large followings will be accepted. It also can offer more for the customers since influencers will have the ability to build a catalog of recommended products. They will have a unique URL that can be posted on their site, giving their followers an easy way of finding their favorite products for purchase on Amazon.

Amazon Influencer Program

Amazon Influencer Program

TechCruch shared news of this program, emphasizing it’s in beta phase. They were also careful to note that Amazon does not participate in the product selection with influencers. While influencers might have relationships with brands, Amazon does not recommend products for inclusion on their site.

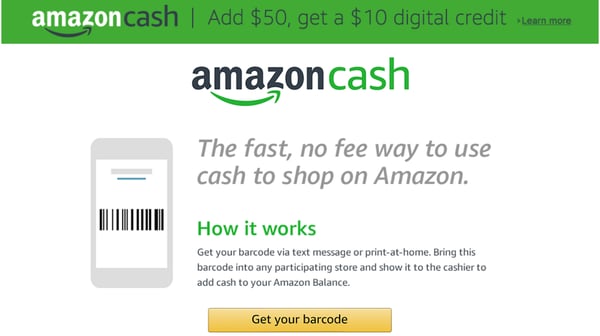

3. Amazon Cash

Amazon just keeps making it easier for customers to buy! No credit or debit card? On Amazon, that’s no problem with Amazon Cash. By visiting the Amazon Cash site, customers can generate a barcode and then access the code through Amazon.com or the Amazon app. Customers display a barcode at a participating retailer and deposit cash directly to their Amazon account. Deposits can range anywhere from $15 to $500 and purchases will be debited from their account. Participating retailers currently include CVS Pharmacy, Speedway, Sheetz, Kum & Go, D&W Fresh Market, Family Fare Supermarkets, and VG's Grocery. Amazon Cash is similar to services already offered by Walmart and Paypal.

Amazon launched Amazon Cash

4. Customers Can Now Opt Out of Messages

As you may have already heard, in late March Amazon updated the Buyer-Seller Messaging system, enabling customers to opt out of receiving “non-critical” messages from third party sellers. Non-critical messages include delivery confirmation, requests for feedback & reviews, and proactive customer service emails. However, sellers are able to contact customers regarding critical matters such as product customization questions, delivery scheduling and issues with a shipping address.

If a third party seller attempts to message a customer who has opted out, the seller will receive a notice letting them know the message was blocked. In the event of a seller having a “critical” message for a customer, he or she can contact the customer by going to Manual Orders in SC and selecting the customer’s name. From there, they will want to select Additional Information Required as the subject line and then send along the critical message.

So what’s your take on this change? How could this impact the rate of product reviews and seller feedback? Clearly, this is a positive change for customers who are bothered by multiple follow up emails. Some could say, however, that those who take action to opt out of messages might be less inclined to post reviews or feedback in the first place. So from that perspective, this change could have limited impact. We’ll have to keep a close eye on buyer seller message rates and the rate of product reviews to measure how significant of an impact this change will have moving forward.

5. Amazon Australia

News and analysis of Amazon’s expansion in Australia continues to grow. Latest reports predict a full launch by the end of 2018. While plans for Prime Now and Amazon Fresh appear to be in the works, brick-and-mortar Amazon stores could be a ways down the road. Sources say Amazon would consider such a move only after it has established its e-commerce presence in Australia and has the data to determine the potential market for brick and mortar stores.

For now, Amazon is busy building out its infrastructure in Australia, finding warehouse locations for distribution centers and hiring employees. Broker Credit Suisse underscored both the appeal and the potential of the Australian Amazon marketplace saying, "Attractions include a growing, high-income population; population concentrated in a relatively small number of cities and adequate population density; high internet penetration and online shopping propensity; high retail labour costs; and attractive retail sector profitability.”

Until next week's round of Amazon Seller's Week in Review, join us in our private community for brand owners and Channel Managers on Facebook: Amazon Chanel Mastery for Brands. We share insider tips about e-commerce and selling on Amazon. This is where you can get to know us, and your peers, a little better.

.png)