Want to leave no stone unturned when it comes to selling on Amazon over the Holidays? This selling guide is for you!

Bobsled experts Jordan Ripley and Ross Walker have shared all of their tips and tricks when it comes to maximizing sales across Black Friday to Cyber Monday until the end of Q4. We’ve covered off every aspect of Amazon account management – high level strategic insights for brands looking to smash sales targets over the Holidays.

Read on to learn more!

✍️ Find Inventory Management, Customer Service, Brand Protection, Organic Marketing/SEO and Promotions recommendations below from Bobsled Project Manager Jordan Ripley.

Inventory Management

At a high level, Q4 is a distillation of all the factors that have made inventory management challenging during 2020.

The biggest inventory challenge this year has been SKU-level inventory caps getting pegged to trailing volume. This presents headaches for products that are newly launched (and therefore have no volume), products that have had out-of-stock (OOS) periods, products that were otherwise inactive, or products that are intensely seasonal and thus prior volume isn’t predictive of future demand. Mitigation strategies include:

- Switching to Fulfilled By Merchant (FBM) - a double edged sword for most brands. During periods of volatility, adjust handling times to provide an extra buffer, make sure inventory feeds are correct and understand what segment of your assortment critically requires FBM as a back up. If you’re considering this option, FBM fulfillment should be something you’ve ideally experienced prior to Q4, as it will place more operational and customer service demands on your team. Consider using a fulfillment partner like Deliverr, or a similar 3PL, equipped to do direct fulfillment if order volume becomes too overwhelming.

Other common inventory issues that aren’t unique to this Q4 but will likely be exacerbated by this year’s massive ecommerce volume swell include:

- Delays in receive times. Small parcel patch shipments still have a chance of receiving in time for the Holidays, pallets sent LTL/FTL should be queued up to replenish for Q1. Standard receive times are 4 days SPD and 10 days pallet - expect this to double over Q4.

- Expect delays in ship to customer times. Amazon will prioritize fulfillment to try and keep order to delivery times as close to Prime expectation as possible, but we saw FBA delivery times go as high as multiple weeks during peak Covid surge buying, so it’s reasonable to expect that these ship-to-customer times will lengthen again as volume spikes.

Think about whether you need to adjust your advertising/promotion strategy to reflect your current inventory position. You may choose to be more conservative in terms of paid growth strategies if you are running low on inventory.

- Look at your top moving SKUs and assess the risk of current inventory positions. Analyze YoY comps + Q3 → Q4 2019 comps to get a sense of reasonable holiday lift, and use that to dictate level of risk. Consider scaling back advertising and promotions accordingly - there’s a temptation to blow out inventory given the desperation of most brick and mortar business shifting online, but if you don’t have enough inventory to cover the Holidays, there’s no sense in eroding your profit margin to find top moving SKUs OOS by mid-December.

💡 Check out Amazon Q4 Inventory Planning

Customer Service

Much like inventory, you’ve likely already made your bed when it comes to customer service by this point in the year. The immediate goal should be to risk-proof your existing process as volume grows during the Holidays. This means:- Software integrations to provide auto responses within SLA + triage/queue inquiries

- Templates/FAQs/process docs that outline responses to FAQs so agencies/virtual assistants/whoever is managing your customer service can scale up to handle inquiries without needing a lot of ad hoc guidance

- Ensure there’s a tight connection between your ops and customer service teams if you decide to process FBM orders. Understand which orders have shipped when, what returns have been processed, and what type of orders are eligible for refunds

- Expect customers to be more adamant due to the pressure of the Holidays. Savvy brands choose to be a little more liberal with refunds, returns, and general customer concessions at this time of year to mitigate the risk negative reputational backlash

💡 Bobsled was ranked one of the Top Amazon Firms by Business Insider

Brand Protection

Many unauthorized 3P resellers will wait in the wings until products hit a certain level of volume before they manage to get inventory and list against you. For brands with relatively clean channels, resellers likely started popping up around Prime Day and will stick around through the Holidays because they can undercut MAP and make a quick buck. Here are some mitigation strategies:- Test buys + lotting to try and trace back inventory source

- Cease and desist letters sent to unauthorized sellers

- Price match in the hopes that they don’t keep lowering price

In general, proactive policies to limit grey market inventory access is the best solution. This means avoiding large changes to distribution in the lead up to the Holidays.

Less common but still an important thing to monitor - IP infringement or counterfeit products. Knock-offs and fakes are far more likely to emerge during peak buying seasons given the likelihood of capitalizing on spiking traffic volume prior to getting suspended by Amazon. Searching for brand terms, using software that monitors infringements, and signing up for Brand Registry programs like Project Zero can help keep this particular issue under control.

Organic Marketing/SEO

Adding a better main product photo or more compelling A+ Content is fine, but Q4 isn’t really the time for mass-scale content changes. The risks – Amazon processing updates incorrectly, parent products breaking apart – are simply too great. If you do decide to update content during peak season, consider using an index checker (Helium10 offers this in addition to several other tools), to ensure that your product is still indexing correctly for your top keywords.

A safe and effective content update is to use the Brand Analytics data or your favorite keyword research tool to identify any seasonal keywords (e.g. candy for christmas stockings) that are spiking in volume and could be relevant to your product line. Refreshes to backend strings in tandem with some cautious paid bidding against these terms will give you an indication of how well your products can rank against these seasonal terms. Consider using a rank tracker to monitor how your product tracks in SERP against your highest potential value terms.

💡 Check out Amazon SEO Strategy - Bobsled's Crash Course

Promotions

The key when it comes to promotions during Q4 is integration. Do not blast out various promos across disparate channels with staggered prices and timing. If Amazon picks up another large competitive retailer with better prices, they will almost always suppress the Buy Box. Time promos across sales channels so that they’re in sync and no one retailer is punishing another.

At Bobsled, we’re observing compelling sale price merchandising across the Amazon ecosystem. For my book of clients, I had gravitated to Prime Exclusive Deals (PEDs) during peak retail holidays such as Prime Day because of the enticing deal badge, no promo fee, and good control over price and flight dates. But if sale prices get similar merchandising in SERP and on product display pages, they could unseat PEDs as discounts of choice as they’re available for all customers, not just Prime customers.

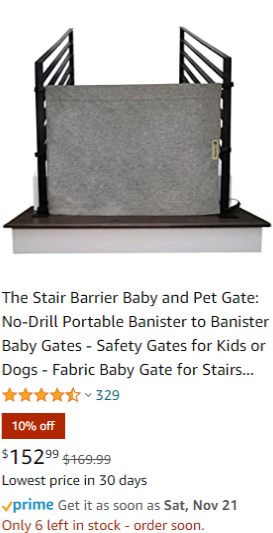

On the left: Example of sale price merchandising on an Amazon product display page

Make sure you’re aware of each promo’s respective requirements so that one promo sequence doesn’t end up disqualifying you from another. The more complex your promo plan is, the more thoughtful you’ll have to be about any one promo’s impact on eligibility of another.

💡 Check out Which Amazon Promotions Work Best?

✍️ Find PPC and Amazon DSP recommendations below from Bobsled PPC Manager Ross Walker.

Amazon PPC

- Obvious advice, but it warrants highlighting – focus on your winners. Prioritize budgeting for top sellers and products that have historically done well in Q4.

- Utilize Sponsored Products Product targeting and Sponsored Display Product targeting to cross sell your catalog. Advertise complementary products, gift sets and promoted products targeting your top sellers. This will defend the ad placements on those pages against competitors and increase awareness of your product line to high intent customers visiting your product pages.

- Utilize Sponsored Products Product targeting and Sponsored Display Product targeting to push your products that have promotions against your top competitors. By letting visitor’s that view your competitor’s products know that your offer is currently discounted, you are more likely to potentially steal them away and get the sale.

- Refresh your Sponsored Brand Creative with holiday themed imagery or just fresh imagery because you anticipate higher traffic. Updating creative for Q4 for your top campaigns is now easy - there is no need to copy the whole campaign and start from scratch. Simply navigate to the creative section and edit the current campaign. Even if you don’t win the sale immediately, this is a key period for growing brand awareness, so put your best foot forward. Utilize the new custom image creative features as they are now displaying on both mobile and desktop!

- Increase your budgets for the major retails holidays (e.g. Black Friday, Cyber Monday), but be careful about raising bids. Amazon recommends it, but at Bobsled, we find that our performance typically scales well by simply adjusting our budgets to take into account higher traffic. Caveat: carefully monitor your hero keywords though! If you are not getting the placements you want, be sure to get more aggressive on your bids this season.

- Create unique holiday campaigns for your products and keywords with the highest conversion rates. Even if they haven’t had stellar ACOS in the past - ‘tis the season to give them room to run! You can juice up the flywheel effect by supporting high velocity products with ads in order to improve organic rankings for these products.

💡 Check out Bobsled’s Turkey 5 Prep Guide

Amazon DSP

- Refresh creatives for Q4 if you are utilizing custom images or video

- Utilize the new ASIN performance report to find out which of your products are actually getting sold from your responsive or dynamic creative ads. Use the data to create fresh custom ads or refined responsive ads.

💡 Check out Amazon DSP Retargeting - The First 30 Days

- Retarget your past customers to make them aware of holiday deals

- If you have consumable products, set up an audience that identifies purchasers as far back as 90 days (typically the max allowed for self-service accounts). Target this audience segment in your line items featuring responsive creative that will show a deal or coupon badge. This lets past customers, a high sales intent segment, know that your product is available with a discount. Make sure you negate recent purchasers that are less likely to want to purchase again.

- Utilize your audience overlap reports to target segments that you might have missed

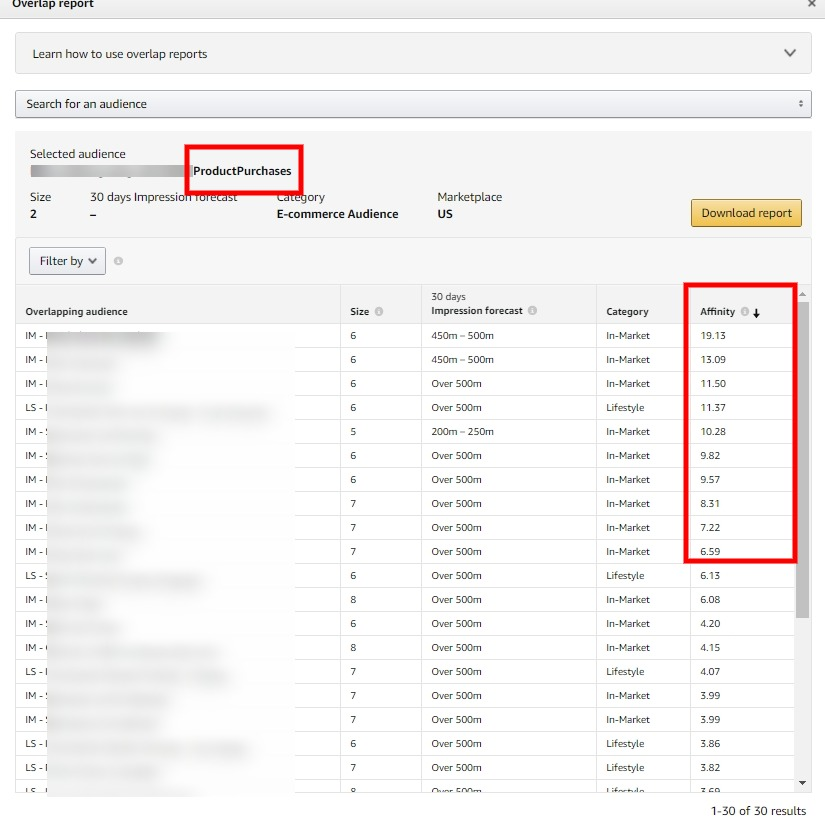

- Download an audience overlap report for your audience of people that have purchased your product in the last 30, 60 or 90 days. Look for overlapping audiences with a high affinity. That metric means people who are in your purchasing audience are similar to the people in that audience. According to Amazon: “Affinity is a measure of how similar the overlapping audience is to the audience selected to generate the overlap report. An affinity of 2 indicates that the overlapping audience is twice as likely to fall into the audience selected than the average audience on Amazon.” Consider these audiences broader segments that are potentially high value to serve your ads to. This would be higher up the sales funnel though, so think of these ads in the consideration bucket of your customer lifecycle. These shoppers may not know about you yet, but they are likely to be looking for or interested in learning about your product.

- When setting up line items that target these segments, make sure you refine for other demographic, interest or behavioral segments that will ensure you are targeting the right subset of the audience.

Above: Illustration of the ‘Affinity’ metric within the DSP dashboard

- Be careful about retargeting after the holiday rush is over. Consider lowering your max bids until Boxing Day when people start getting back into buying after the gift-giving season has died down.

- Set up competitor audience segments to target the specific ASINs you are going head to head with this season. Craft exactly the right headline for a responsive ad, or put together your own custom creative that makes your product’s own USP stand out. Target viewers of their product detail pages with inventory on and off amazon. Negate purchases of their products or your own so you aren’t chasing after customers who are already happy. Consider tighter time windows, like the last 7 or 30 days. These are the hottest leads to target, and you want to put your ad in front of them when they are still in consideration phase, and haven’t made a purchase yet.

NEED HELP MANAGING AMAZON DURING THE HOLIDAYS?

The Bobsled team would love to support your efforts! For a free consultation, please click the button and submit your details.

.png)