It’s that time of year again!

To avoid any lumps of coal, that means it’s crunch time for brands. With over 2 million sellers on Amazon, no shortage of competition, and total e-commerce sales expected to grow by up to 18% during Q4 this year, it’s time to strategically plan for the cheery holiday season ahead on Amazon.

The Basics of Q4

The looming but exciting three-month period presents a major sales opportunity for brands on Amazon. While Amazon has not shared projected growth for Q4 just yet, over the last five years, Q4 sales have grown on average by 23% year-over-year.

In Q4 2018, Amazon reported $72.4 billion in revenue—up 20% from 2017—which accounted for over 50% of total online Q4 retail sales. With the opportunity for repeated growth being high and the competition higher, brands will be fighting hard this year for their share.

The best bet in order for your brand to avoid any uncertainty during the 2019 holiday season is to utilize performance data to strategically plan and implement your plan of attack on Amazon.

Prerequisite Pit Stop

Before diving into the data, let’s cover the basics of successfully prepping for Q4 on Amazon that fall outside of the analysis approach used today but are obvious first steps to succeeding on Amazon (at any point).

- Getting FBA inventory shipped to Amazon by Nov. 6, 2019

- Making sure product listings are in tip-top shape with conversion-driving content that mirrors the brand narrative

- Having high quality and informative imagery that captures the consumer (Prime shoppers are quick, especially on mobile)

- Implementing A+ content on the top-performing products, at the very least - this can help improve the listing conversion rate by up to 10%

If you’re new here and need additional resources on basics for your brand listings, feel free to check out more of our resources available here.

Prime Day—Your Personal Data Gold Mine

Outside of the basics, the brands that have the largest opportunity to capitalize on the increase in holiday demand this year are those that implement data-driven approaches.

The closest data gold mine? Prime Day. In 2019, over 175 million items sold during the 48-hour event, bringing in more sales than Black Friday/Cyber Monday (BFCM) 2018 combined on Amazon. Most brands anticipated a pleasing increase in sales, but even if that was not the case, Amazon Prime Day data still offers plenty of insight into leveraging the market during peak sales periods. This insight can help brands prep for this upcoming holiday season.

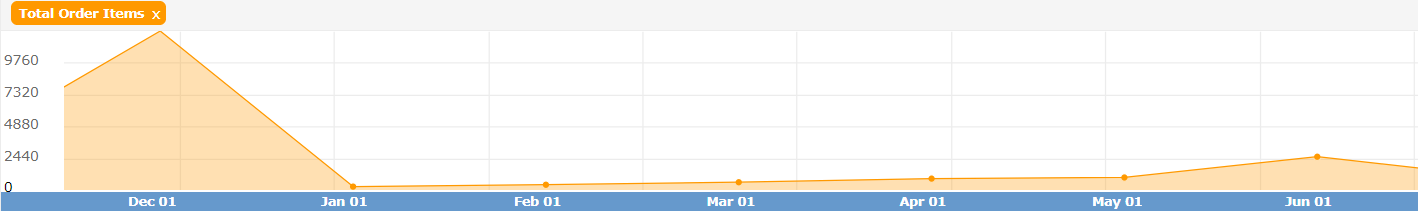

Inventory

If you’re lucky, you may never experience the wrath of what even the shortest of stockouts does to product relevancy and visibility on the market. The incredibly frustrating process of playing catch-up for the next 90 days (at least) to reestablish the prior product momentum is daunting, even for the most experienced of brands. That’s why inventory planning is the first step in holiday planning.

Here are some helpful areas to consider from Prime Day to better align inventory for the upcoming season:

- How long did it take for Amazon to process the receiving inventory? Amazon lead times increase by 2x around peak sales seasons.

- What was the sell-through of the inventory received? If you just barely squeaked by, the forecasting model needs to be adjusted. There’s more at risk during the holiday season. Even if you stockout right on Jan. 1, 2020 the impact of rank loss can be brutal, lasting well into the new year.

- What was the impact on product sellthrough following Prime Day? If your brand is selling more products, this momentum fuels the algorithmic ecosystem on Amazon. More sales leads to more product visibility on Amazon, which leads to even more sales. You’ll want to consider the logistics of this impact and have some room in your inventory.

Recommendation: Don’t leave any goodies in the bottom of the stocking by not monitoring and correcting incorrect product fee charges, returned inventory, or warehouse damaged goods.

Promotions

Although there are plenty of promotions available, it’s important to implement the ones that have been tested and scaled prior to Q4.

Using Prime Day data, consider the below promotion options to help improve performance during the holidays.

Amazon Lightning Deals and 7-Day Deals this year are costing between $300 and $500. While deals remain a great option for the holidays and Prime Day, over the years the deals page during the peak holiday-deals season has become overwhelmingly saturated, causing overall deal performance to decrease.

Saving and reviewing the historical deal performance to determine which deal type yields the highest return, what price point performs the best, and lastly what discount is needed will help protect and increase your return.

Recommendation: During Prime Day 2019, the top performing deals offered between 30% and 50% discounts and were priced under $50. Consider which of your products can support the deal that seekers are most attracted to.

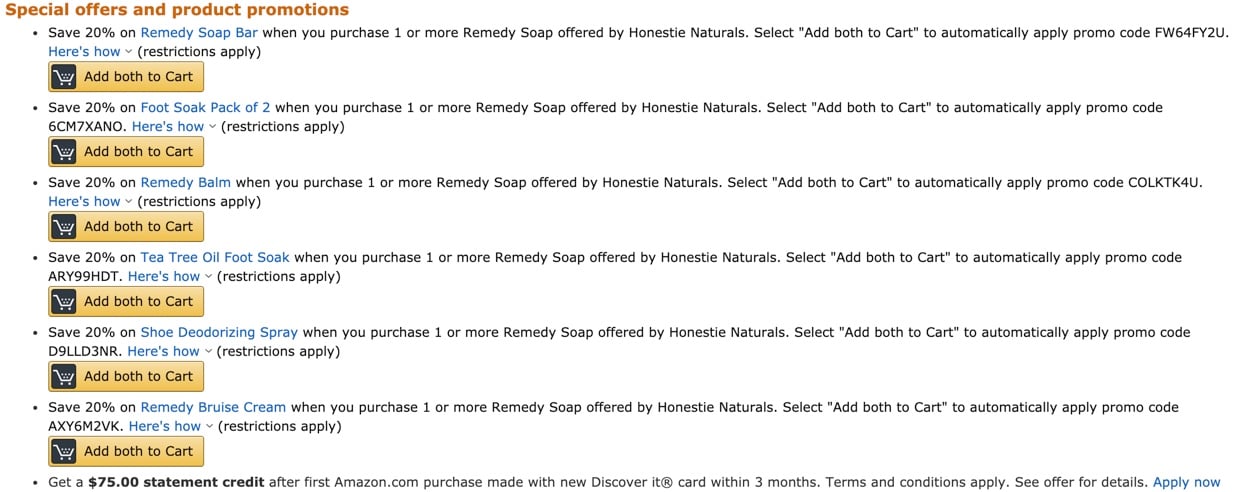

Amazon Coupons have grown in popularity and effectiveness over the years. To help implement effective coupons, take a look at past coupon performance and identify:

- Whether “% off” or “$ off” performed better

- Whether single ASIN coupons or coupons featuring multiple ASINs outperformed

- Which discounts generated a high conversion rate and the largest amount of redemptions

This approach will help brands set up coupons that are more likely to attract qualified shoppers.

Recommendation: Determine your coupon strategy and play it safe - have all Black Friday and Cyber Monday, along with December coupons, submitted by the beginning of November.

Prime Exclusive Discount (similar to coupons) - It all comes down to knowing the performance data and setting up the promo based on what has historically proven to work best. Additionally, since Prime Exclusive discounts don’t require a budget, these might be a better option than Amazon Coupons if the budget is tighter this year.

Recommendation: Don’t miss out, all Black Friday and Cyber Monday Prime Exclusive discounts need to be submitted by Nov. 15, 2019.

Listing Promotions, such as Percentage Off and Buy One Get One, are considered on-listing promotions, since Amazon does not promote the offering anywhere but on the product display page (PDP). When reviewing the performance data, it’s important to consider the sales attributable to the promo, the number of redemptions, and the length of the promo. After identifying the ideal structure of a successful promotion, use this approach for all on-listing promos.

Recommendation:Typically, the performance of these promotions can be underwhelming compared to other promotions available. To help improve performance, ensure efforts are in place to drive awareness of the promo, such as sharing it with brand subscribers on social media or partnering with an influencer.

PPC Advertising

With new features and initiatives being released on what feels like a weekly basis, PPC advertising is going to play a large role in sales increasing during Q4 on Amazon.

PPC ads expand awareness to acquire new customers, protect brand interest, and help brands to occupy more landscape on the booming market. In fact Amazon Advertising, during their recent holiday webinar, mentioned sellers who advertised during Q4 experience a higher order lift in baseline sales in January than those who don’t.

Given the large role PPC plays during peak sales seasons, here are some areas to consider from Prime Day that will help capture the increase in consumer interest and intent this upcoming holiday season.

Key Performance Indicators. Review data to determine when KPIs started to change due to customers anticipating Prime Day deals and what the final impact was on performance following Prime Day.

Amazon anticipates holiday customers starting to research holiday purchases as early as Oct. 21 and peaking on Nov. 25. That means that Nov. 1 through Nov. 25 advertisers can expect to experience not only an increase in impressions and clicks but also an increase in ACoSs due to customers holding out until Black Friday or Cyber Monday for the much appreciated hot discounts.

Advertisers who recognize the advantage of the exposure during the research phase and are not scared off due to the slight decrease in KPIs leading up to BFCM are more likely to gain more sales during the consumer purchasing period (Thanksgiving - Dec. 23).

Recommendation: Know your product margins and your limits. Developing strategies around the ideal CPC will help ensure opportunities are not missed over profitability concerns.

Budgets. Plain and simple, no budget means no sales. Using available reports, review the per day spend and sales before, during, and after Prime Day. Money was left on the table for competitors to grab if campaigns consistently ran out of budget.

Ideally, Q4 and the holiday season is a period when you want to remove as many budget limitations as possible when it comes to advertising on Amazon. Running a campaign with a limited budget brings the risk of your campaign running through spend before the day ends, terminating your ads, inviting your competitors to steal your advertising spaces during the highest sales time of the year.

Recommendation: Consider having an open budget where if the KPIs are being met, the budget can be continually increased. It’s important to understand that spending more on PPC during the holidays will yield more sales volume than Q1 & Q2 can make up for combined.

Campaign Performance. There are plenty of aspects to consider when creating PPC ads on Amazon, such as the ad type, keyword selection, and targeting options. Each of them can be utilized strategically to create a holistic approach on Amazon.

Consider reviewing performance data to determine which ad types performed the best and when, or what targeting options outperformed others. Moreover, discover the placements that performed the best and even what keyword match types generate the most volume vs those that generated the most sales (were they the same keyword, but different match type?). Metrics that support top performers would include:

- Click-through rate

- Conversion rate

- Cost per click

- ACos

Recommendation: Keep the customer journey front and center, and create PPC strategies around meeting that customer at every phase of that journey.

Optimization Strategies. Did you change up your regular campaign optimization strategies during Prime Day? Did it pay off? Amazon has been known to recommend increasing bids by 50% during peak seasons, but often times the extra cost does not always support the outcome. Take time to closely review the possible relationship between metric performance and optimization tactics deployed. For instance, did you increase placement data and experience an overall decrease or increase in the campaign ACos?

Recommendation: Assuming optimization changes start prior to BFCM, consider increasing bids slowly when the KPIs support a positive outcome. Also, if your product has never ranked for a keyword before, unfortunately it’s not going to magically rank during holiday.

Amazon Storefront

Lastly, let’s talk Amazon storefronts. Amazon storefronts provide the perfect branded shopping experience for consumers on Amazon. With consumers growing to become more attracted to the brand value on Amazon (sorry see-through leggings), storefronts offer great insight into how consumers navigate your brand.

Take time to review and utilize Prime Day data to optimize your Amazon storefront for the upcoming holiday season. Using available storefront analytics, consider which pages perform the best. Was it a homepage? Was it a category page? Did the page feature a video or well-developed branded imagery?

Recommendation: Create your own volume by bringing off-Amazon traffic to your Amazon storefront, and don’t forget to create a customer tag for the traffic via storefront analytics.

Oh Wait, More Gold

It may be hard to isolate this data to just Prime Day, but I could not miss the opportunity to mention the latest on utilizing Amazon Brand Analytics. If you’re a brand registered seller and have access to Amazon’s Brand Analytics, this is another incredible resource for a strategic Q4.

Some quick ways to utilize the insight available to prep for Holiday 2019 include:

- Using “Amazon Search Term” data to refresh content and incorporate into your ad copy

- Using the demographics to craft ad content and cater the brand narrative to in the product listing content

- Using the “Market Basket” insight to decide what products to target using PPC ads

- Using the “Item Comparison Data & Alternate Purchase Behaviors” to perform a competitive SOV analysis

We only expect more when it comes to utilizing Amazon Brand Analytics. In the meantime, feel free to get up to speed on how the program has grown and changed recently from our founder, Kiri Masters, in one of her Forbes features.

HAVE A PRIME HOLIDAY SEASON

With little time to waste and big expectations, we know the holidays are bound to be stressful. Taking this data-driven approach to your Amazon efforts this year will help better align your brand for a successful and profitable season. Not only will this help your team savetime, budget, and resources, but the confidence afforded from the numbers will also help ease any uncertainty.

Tagged: PPC Advertising, Seller & Vendor Central, Amazon Account Management

.png)