Kiri Masters is Head of Retail Marketplace Strategy at Bobsled, an Acadia company, and the Founder of Bobsled Marketing.

This article was originally published on Forbes.com as ‘Instacart Just Gave Grocery Retailers The Keys To The Castle'. It has been reproduced here with permission.

On March 23, Instacart announced the launch of Instacart Platform™, a suite of tools for grocery retailers to deliver omnichannel experiences for shoppers.

This platform will allow retailers to essentially white-label many elements of Instacart’s digital and retail operations capabilities - a huge boon, particularly for smaller and mid-sized retailers who lack the capital to invest in building their own omnichannel capabilities.

“The grocery industry is undergoing a digital transformation where customers expect a seamless experience across many channels, but behind the scenes, it’s taking an incredible amount of work and investment for retailers to deliver these new services,” said Fidji Simo, CEO of Instacart. “We’re looking to change that with Instacart Platform. We started as the e-commerce and fulfillment partner of choice for grocers, and we’ve been building on that foundation to broaden and deepen our capabilities, in order to help retailers innovate faster than ever on their own properties.”

Instacart counts grocers Publix, ALDI, Schnuck Markets Inc., Good Food Holdings, Plum Market, Key Food, Food Bazaar as launch partners.

There are three capabilities that Instacart announced today: Carrot Ads, Carrot Warehouses, and Carrot Insights.

Carrot Ads capture the retail media ‘moment’

The move also comes at a time when retail media is in the limelight. Retailers are realizing the tremendously accretive effect that a digital media offering could have, and brand advertisers are hungry for advertising channels with measurable performance in the wake of the depreciation of third-party cookies.

Insider Intelligence analysis of the most important attributes of retail media networks to digital ad buyers.

Source: INSIDER INTELLIGENCEInsider Intelligence’s Retail Media Networks Perception Benchmark 2022 report found that the top 3 attributes that advertisers seek from an advertising platform are traffic quality, traffic scale, and in-store / omnichannel sales data. Instacart’s existing advertising platform has delivered on these attributes for many brand advertisers, and Instacart was ranked #5 overall among retail media networks in Insider Intelligence’s report - well ahead of competitors that play heavily in the grocery and CPG space: Walmart Connect, Kroger Precision Marketing, Costco Wholesale, and Roundel (Target).

The challenge that individual retailers will have with promoting their own advertising platform is meeting that first direct attribute: traffic scale. A smaller or mid-sized grocery retailer may not be able to attract enough shopper traffic to be “worth the squeeze” to a brand advertiser.

Instacart is currently piloting its new ad service with Schnuck Markets Inc., Good Food Holdings, Plum Market, and other select retailers, with plans to roll it out more broadly later this year.

Carrot Warehouses make ultrafast delivery accessible

Instacart will build new nano-fulfillment centers (NFCs) that are capable of 15-minute ultrafast delivery, which can be white-labeled by a retailer.

Building the rails to offer ultrafast delivery is an extremely costly proposition for retailers, so Instacart is solving a real need here.

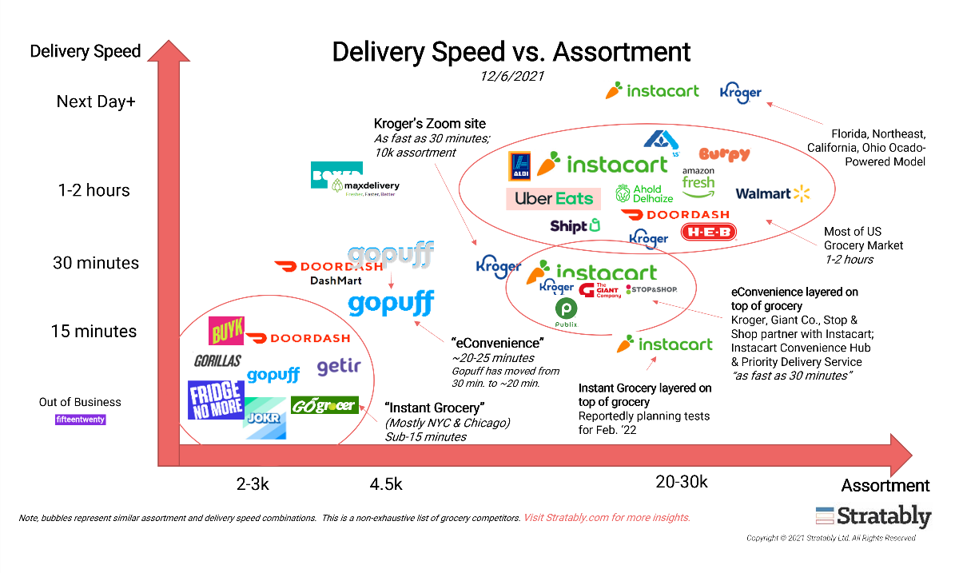

Stratably analysis showing ultrafast delivery players in 2021. With Instacart’s Ultrafast delivery capability launched in 2022 and the new Carrot Warehouses feature, a lot more retailers will be able to meet a 15-minute delivery speed.

Stratably analysis showing ultrafast delivery players in 2021. With Instacart’s Ultrafast delivery capability launched in 2022 and the new Carrot Warehouses feature, a lot more retailers will be able to meet a 15-minute delivery speed.

Source: STRATABLY.CO

This service will be piloted for Publix customers in Atlanta and Miami over the coming months.

Carrot insights

One pervasive challenge in grocery retail is a given retailer’s ability to track and maintain accurate store inventory levels. In my world, this affects brands who want to advertise to reach customers (but can’t when inventory is unavailable - whether that’s true or a data error), but this also affects shoppers who can’t purchase a given item, Instacart themselves, and the retailer. Carrot Insights promises to track key performance and operational metrics such as order volumes and out of stocks across Instacart Platform and retailers’ own Instacart App storefronts.

Visualization of a retailer's grocery delivery app, run on the Instacart platform.

Source: INSTACART

This feature is now live and in use by Key Food.

Grocers’ feelings about Instacart have been complicated in the past

As I wrote in my book Instacart For CMOs, Instacart challenged the traditional grocery retail business model in three key ways:

- Losing the customer connection: personal information, product information, and household info all sit with Instacart. Retailers lose both their current and future direct relationships with the customer.

- Margin erosion: Instacart charges a platform fee to retailers. Some choose to pass this on as a markup; others absorb it and lose margin.

- Instacart may put vendor allowances and retail media spend in jeopardy as brands shift their marketing budgets online.

Providing retailers with a platform that essentially white labels Instacart’s front-end and back-end capabilities addresses all of these issues. I presume that Instacart would charge retailers to initially deploy the solution, customize it, and then maintain it each year. But retailers own and control all the customer data and can stand up a new profitable revenue stream, all at a far lower cost of capital and time compared to building their own system from scratch.

Beyond grocery?

Instacart has its roots in grocery, but over the past year or so has tried to expand its reach into broader categories. In 2020, Instacart partnered with non-grocers including Best Buy, Staples, and CVS.

This development is purely focused on the grocery category though. Even the carrot-themed names of these tools indicate alignment with the grocery sector. That could indicate that this is the sector in most need of technology enhancements, or it could be Instacart returning to its roots.

Tagged: Instacart, Bobsled Marketing, Omnichannel

.png)