It’s officially go time! Sales on Amazon traditionally screech to a grinding halt a few days before December 25. Meaning brands only have a few precious days to pivot before the Holidays wind down for another year.

Although the Bobsled team ensures that our clients are ready for Q4 months in advance, there are a few last minute tweaks brands can make to their Amazon strategy. Read on to learn more!

Despite market volatility, brands should expect strong ecommerce performance until the end of 2020

Although Reuters reported that consumer confidence had slipped three days before the ‘Turkey 5’ online retail event that spanned Thanksgiving to Cyber Monday, Bobsled clients achieved fantastic T5 results on Amazon. Adobe analysts agreed that overall Turkey 5 performance was strong:

- US consumers spent $9B online on Black Friday, up 21.6% compared to 2019.

- Smartphones continued to account for an increasing proportion of online sales, with this year’s total Black Friday mobile sales up 25.3% YOY to $3.6B

- Unsurprisingly, due to ongoing social distancing precautions, alternative delivery methods such as in-store and curbside pickup were up 52% YOY.

| Total Revenue ($B) | YOY Growth (%) | |

| Thanksgiving | $5.1B | 21.50% |

| Black Friday | $9.03B | 21.60% |

| Small Business Saturday | $4.68B | 30.19% |

| Cyber Monday | $10.84B | 15.10% |

Source: Adobe

Since Thanksgiving, markets have been buoyed slightly by the roll-out of the vaccine, but mass uncertainty remains mainly due to the lapse of government coronavirus relief spending. However, considering the strength of the Amazon channel in the eyes of consumers, it’s unlikely that any further drop off in consumer confidence will impact Q4 volumes on Amazon in any significant way. Compared to brick and mortar retailers which have been seriously impacted by stay-at-home orders and general trepidation about in-person shopping, millions of consumers have relied heavily on Amazon as an essential service through every phase of the pandemic.

Takeaways for brands: Even if overall retail volume drops, Amazon’s market share is on track to grow or remain steady, so try to re-allocate resources (inventory, ad spend, promo strategies) where appropriate from brick and mortar over to ecommerce.

We are entering the ‘Winter Lockdown’

New York City just shut down indoor restaurant dining because of rising Covid-19 cases. This will no doubt boost food and grocery delivery volumes in the area. There’s also the booming real estate market to account for. New home owners will be voluntarily spending a lot of time personalizing their new abodes over the Holidays.

Long story short; as we enter the coldest months of the year, whether it be because of social distancing restrictions or a personal preference, many across the U.S. will choose to hunker down for the winter.

Takeaways for brands: Over the next few months, there may be a return to the shopping patterns of the ‘quarantined consumer’ that we saw during the first lockdown at the beginning of the year. This would mean a boost to sales across Toys and Games, certain ‘quarantine-friendly’ grocery items, and Home & Decor, to name a few obvious examples.

Brands that saw a spike earlier in the year should consider the likelihood of strong online sales volume continuing into January to account for this ‘Winter Lockdown’. If you envision this happening, be sure you’re prepared from an inventory perspective.

Amazon PPC advertising during the Holidays is

becoming more expensive

Adam Hutchinson, Director of Marketing at Bobsled’s ad tech partner Pacvue, shared some fascinating Turkey 5 insights based on Pacvue’s first-party data across hundreds of advertisers.

Adam Hutchinson, Director of Marketing at Bobsled’s ad tech partner Pacvue, shared some fascinating Turkey 5 insights based on Pacvue’s first-party data across hundreds of advertisers.

Turkey 5 Data Insights

- Average spend on Sponsored Products advertising was up 37% on Black Friday and 35% on Cyber Monday, year over year.

This is a smaller year-over-year growth rate than experienced in 2019, which saw 98% and 116% year-over-year growth respectively. - Sponsored Brand ad spending was more pronounced, with 95% growth year-over-year on Black Friday and 122% on Cyber Monday. This aligns with the overall trend Pacvue saw in 2020, in which Sponsored Brands saw accelerated growth as Amazon made investments in this ad type and more brands leaned in.

- Interestingly, Cost-per-Click (CPC) on Black Friday did not follow the same trend as last year. Sponsored Brand CPC only rose 20.67% week-over-week and grew a mere 1.69% year-over-year on Black Friday. Cyber Monday CPCs were up only 13.23% year-over-year. The Saturday and Sunday between Black Friday and Cyber Monday saw CPCs down 7% and 21% in 2020 versus 2019.

- While less pronounced than Sponsored Brands, Sponsored Products also saw a smaller CPC growth this year, up 16.20% year-over-year on Black Friday and 20.13% on Cyber Monday. Both days had experienced yearly growth of over 30% in 2019.

Takeaways for brands: PPC on Amazon has become fiercely competitive, and the rest of Q4 will be just as cutthroat. It’s important to analyze macro advertising trends, and your own PPC performance data from Turkey 5, in order to ascertain where your ‘sweet spot’ lies when it comes to spend, targeting strategies and mix of ad types.

💡 Read Bobsled’s Turkey 5 Performance Recap

Inventory is King

In a recent article on Forbes, Bobsled CEO Kiri Masters explained that Amazon.com gift cards were one of the Top 6 items sold during Prime Day 2020, a massive uptick from last year, meaning there is an abundance of gift cards out in the market that shoppers will be looking to redeem this Holiday season.

Many more shoppers will undoubtedly choose to buy Amazon gift cards before the year is up. Brands with Prime-eligible inventory are poised to capitalize on all the gift cards out in the market.

Takeaways for brands: Think long and hard about your FBA coverage plan. Consider re-allocating inventory from other channels or enabling FBM as a back up if you feel like you’re primed to get a lot of gift card orders. Prioritize December inventory coverage, but also remember that many shoppers will choose to use their gift cards in January too.

Stand out with Promotions and Store Versions

Bobsled Operations Manager Jordan Ripley provided the following recommendations regarding Q4 promos:

“At Bobsled, we’re observing compelling sale price merchandising across the Amazon ecosystem. For my book of clients, I had gravitated to Prime Exclusive Deals (PEDs) during peak retail holidays such as Prime Day because of the enticing deal badge, no promo fee, and good control over price and flight dates."

"But if sale prices get similar merchandising in SERP and on product display pages, they could unseat PEDs as discounts of choice as they’re available for all customers, not just Prime customers.”

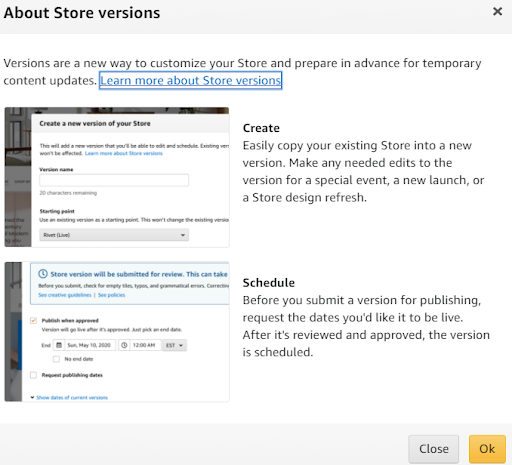

“Also, the new ‘Store Versions’ feature allows you to create a Holidays-themed storefront that would run for that day only, highlighting specific products with unique creative. Creating a Version does not resemble the typically lengthy Storefront approval process, so if you move quickly, you may be able to get something ready to achieve some last minute Holidays sales.”

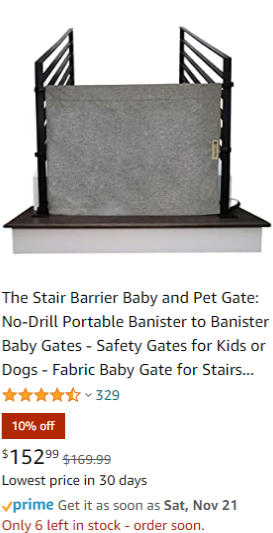

On the left: Example of sale price merchandising on an Amazon product display page

Amazon has outlined the steps for creating a Store Version here.

Takeaways for brands: Other brands in your space are likely getting creative with PPC and promotional strategies, so you should be doing the same if you want to compete for clicks and sales during Q4.

💡 Check out Bobsled's Amazon Selling Guide For The Holidays

DSP can be your secret weapon

Bobsled Team Lead Ross Walker provided the following DSP recommendations:

“If you have consumable products, set up an audience that identifies purchasers as far back as 90 days (typically the max allowed for self-service accounts). Target this audience segment in your line items featuring responsive creative that will show a deal or coupon badge. This lets past customers, a high sales intent segment, know that your product is available with a discount. Make sure you negate recent purchasers that are less likely to want to purchase again.”

“If you have consumable products, set up an audience that identifies purchasers as far back as 90 days (typically the max allowed for self-service accounts). Target this audience segment in your line items featuring responsive creative that will show a deal or coupon badge. This lets past customers, a high sales intent segment, know that your product is available with a discount. Make sure you negate recent purchasers that are less likely to want to purchase again.”

Takeaways for brands: At this point, shoppers know they only have a few days to make an order that will definitely arrive before December 25. By harnessing the swathes of shopper behavior data that DSP provides, brands can leave no stone unturned when it comes to promoting seasonal gift items.

.png)