If you want your products displayed on top of the search results on Amazon, then your best bet is focusing on product relevance. Though it may sound simple, proving to the algorithm (and by extension, Amazon’s customers) that your product is the most relevant to their search query represents a complex endeavor.

Amazon’s A9 ranking algorithm, which controls when and where products populate organically in Amazon search results takes into consideration the following factors:

- Titles

- Bullets

- Descriptions

- Backend Keywords

- Listing Conversion Rate

- Product Rank

- Star Ratings

- Customer Reviews

- Product Return Rate

- Response Rate to Buyer Messages

- Execution on Product Returns

- Seller Feedback

All things considered, your listing should meet two essential criteria. First, it has to make consumers happy. Second, it has to make money for Amazon.

Understand Amazon's Customer Centered Search Results

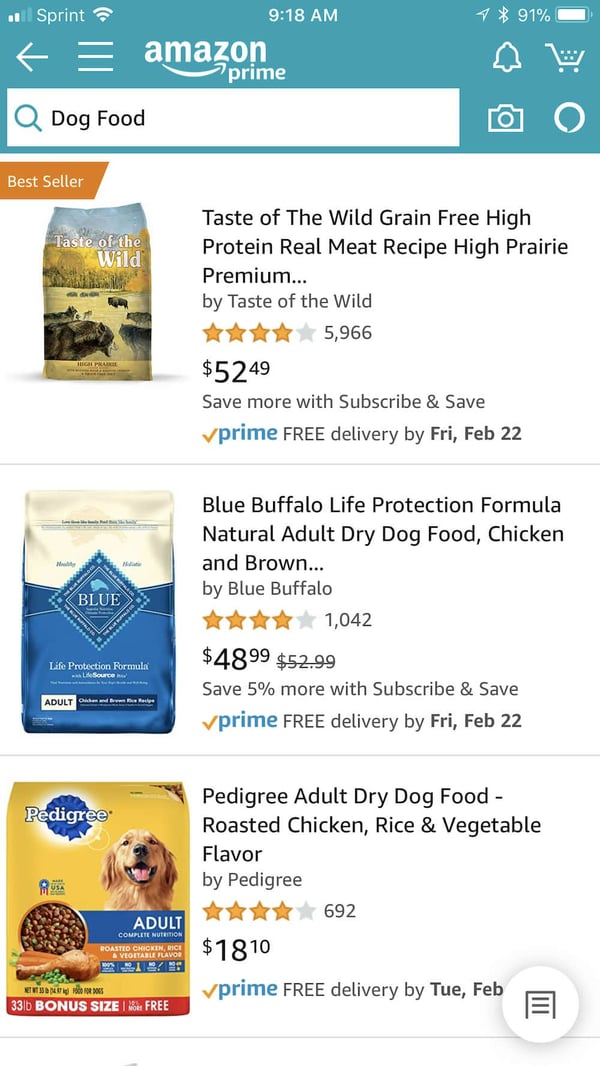

Amazon shoppers are becoming more familiar with how the market is intended to work for them. Consumers want and trust search results to be relevant to their search query. If they’re searching for a particular brand of dog food, they don’t necessarily want to see Amazon’s Wag brand as the top search result. Instead, they prefer to see the specific brand queried.

On the other hand, if they’re searching for dog food in general, they know that the search results will populate with products that are top selling items that have a high customer satisfaction rate. In other words, the products populate in a descending order on Amazon and the most viable products for purchase are commonly located within the first page of results, where Wag results might float to the top if all points considered deem it as a relevant product.

The source of a listing does not impact the search results and there’s no distinction between vendor central and seller central products as long as the listing is meeting customer needs. Products populate search results, not sellers, so it’s important to take into consideration if there is more than one seller in that product listing - then the most applicable seller will have the opportunity to make the sale.

Myth Busted: The lowest priced item does not correlate to a higher search placement. A product could be priced the lowest but have poor listing performance metrics which will always hinder search population. Remember that Amazon’s main priority is happy customers, not selling them the lowest priced item that will lead to poor customer satisfaction.

Above: Example of Search Results for ‘Dog Food’. The lowest priced product

is not at the top of the results

Craft Search Friendly Content

As most, if not all sellers know by now, content plays a crucial role in product visibility on Amazon. Amazon has shared little specifics on exactly what, when or how content is indexed by the search algorithm, however, based on the data supported through case studies, conversion-focused content optimization should be achieved in the following areas:

- Product Title

- Product Bullet Points

- Product Description

- Backend Product Listing Keywords

Amazon recommends a standard approach to most of these areas, however the best formula will always have one key area of focus - the customer.

When it comes to generating conversion-driving content that is conducive to the customer, the most reliable sources will be:

- Keyword Performance Data: Start with PPC search terms and keywords that have good performance metrics. Also taking the time to research search velocity overall on the marketplace in general will provide insight on how and what consumers are searching for on Amazon.

- Customer Review Insight: One of the most valuable areas of insight is already there, in writing, in the customer review section of the product page. Review this content for key pieces of feedback that can fill gaps in your content, increase the likelihood of purchase, and decrease the likelihood of return.

- New to Seller Central Amazon Analytics: Earlier this month Amazon released Amazon Analytics in Seller Central that is currently available for third-party sellers who are brand registered (previously only available to Vendors at a additional fee). In addition to search term data, the Analytics dashboard contains valuable data like click data associated to ASINs and search terms.

Myth Busted: Repeating keywords does not increase indexing power. Keyword stuffing is a dated and ineffective strategy on Amazon. Aside from indexing frequence caps, it’s not attractive to the customer which in turn can lead to a decrease in listing conversions and therefore placement on Amazon.

Monitor The Buy Box & Seller Performance Metrics

It’s important to note that the buy box algorithm is a separate process, but can impact product visibility and search placement on Amazon.

If there is no buy box, meaning the product is either out of inventory or the buy box is collapsed due to the product being available at a lower price on a different online market or site, then the products will become less visible (if at all) due to not being able extend an offer to customers.

The A9 is going to prioritize listing performance metrics, however if there are multiple sellers in the product listing, Amazon is also going to take extra precautions by evaluating the combined seller performance metrics. Along with the seller feedback, Amazon will want to know if the sellers are responding to buyer messages, customer questions or customer reviews. If not, this can be seen as a risk leading to a bad customer experience. It’s crucial to establish seller expectations for retailers selling your products, as they have a direct impact on the success of the product on Amazon.

If there is only one buying option or an exclusive seller for a product on Amazon, then there is much more control over the integrity of the listing.

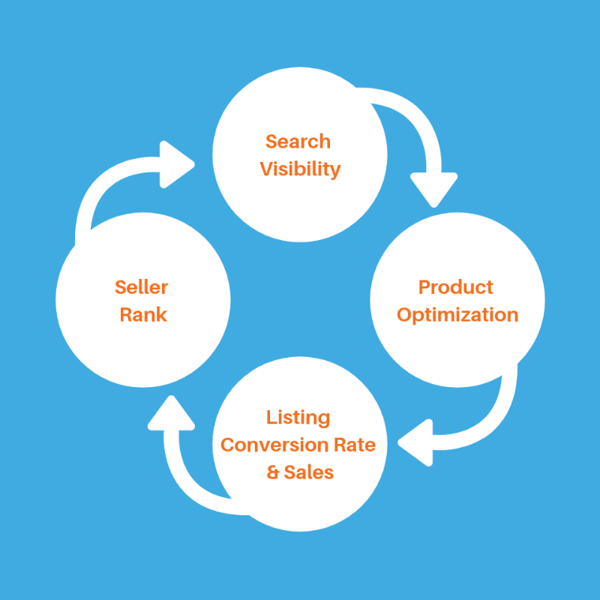

Connect The Dots in The Product Visibility Ecosystem

Visibility on Amazon is extremely vulnerable as it’s continually being impacted by customer behavior and outcomes. Although the A9 directly controls the organic search results, that is still just one piece to the puzzle.

It’s best to think of the process as interconnected and consider a long-term perspective. For example if a product is new to the market, efforts that support the listing performance metrics like PPC ads and promotions are needed to establish performance history for the A9 to recognize. The product could also need to explore the Early Review Program to establish listing substance for the customers. Lastly, it’s important for the seller to develop an extensive customer service strategy to ensure customers are satisfied, even if the product ended up not being the right fit for the consumer.

Any adverse result of these efforts is going to negatively impact visibility. For example, if the Sponsored Ad campaigns are not targeting correctly and bringing customers that are not purchasing to the listing - that will bring down the listing conversion rate and impact the listings relationship with the A9 algorithm. Another example is inventory stockout - not only sales are not being made but the longer products are out of stock, the more severe is the impact on product relevancy. This means it will be more difficult to establish the previous sales velocity once the product is restocked.

Developing consistent consumer-focused strategies on Amazon, while acknowledging there is no one-size-fits-all approach will support long-term visible placement on Amazon and therefore healthy channel growth.

Above: Amazon's Optimization Cycle

I hope this article offered you a few new tactics you can implement right away, but if you are still on the fence in your approach, we are here to help. Our team of Amazon experts can provide personalized coaching for brands looking to create a strategic approach to Amazon. Contact us for a consultation and get started today.

.png)