The online grocery market is growing incredibly fast, yet it’s also convoluted and difficult to master. With so much change and uncertainty, how can brands determine the best path forward?

Last week, Bobsled CEO Kiri Masters co-hosted the webinar ‘Succeed in the Amazon Online Sales Age’ alongside Foresight CFO. The session provided a breakdown of the playbook that innovative Grocery & CPG brands are using for their online marketplace channels.

Attendees gained:

- A diagnostic to determine which digital channels should be prioritized

- A roadmap for improving your brands’ Amazon sales channel

- Case studies of CPG brands who have optimized their digital channels

We’ve compiled a few key takeaways from the webinar below.

📽️ Watch the full webinar recording here.

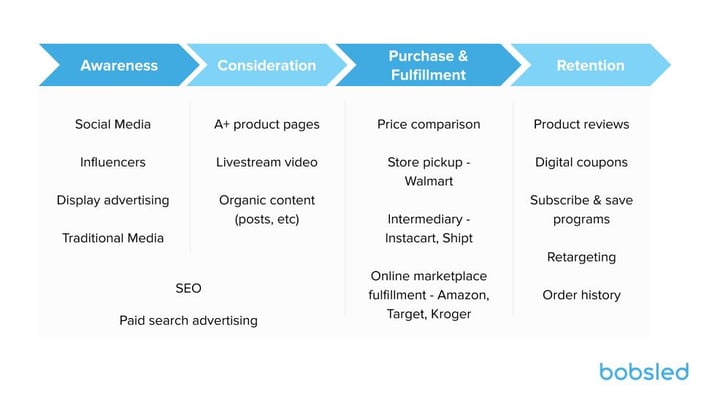

1) The Shopper Journey Has Changed

Traditionally, it was easy for Grocery and CPG brands to control the shopper journey. Awareness was achieved through traditional media advertising, product packaging and in-aisle placements covered off the shopper’s ‘consideration’ phase, the vast majority of purchases would occur at the checkout of a brick and mortar grocery store, and coupons were utilized for customer retention.

Simple, right? But then along came ecommerce, which facilitated an incredible amount of fragmentation within the market. Gone are the days when all of your target grocery shoppers were in the same place at the same time, metaphorically speaking.

In the webinar, Kiri breaks down all the ways in which ecommerce grocery shoppers could potentially be engaging with your brand online, and how to modify your market positioning accordingly.

Above: Breakdown of the ecommerce grocery shopper’s journey

2) Ecommerce Has Democratized CPG and Grocery

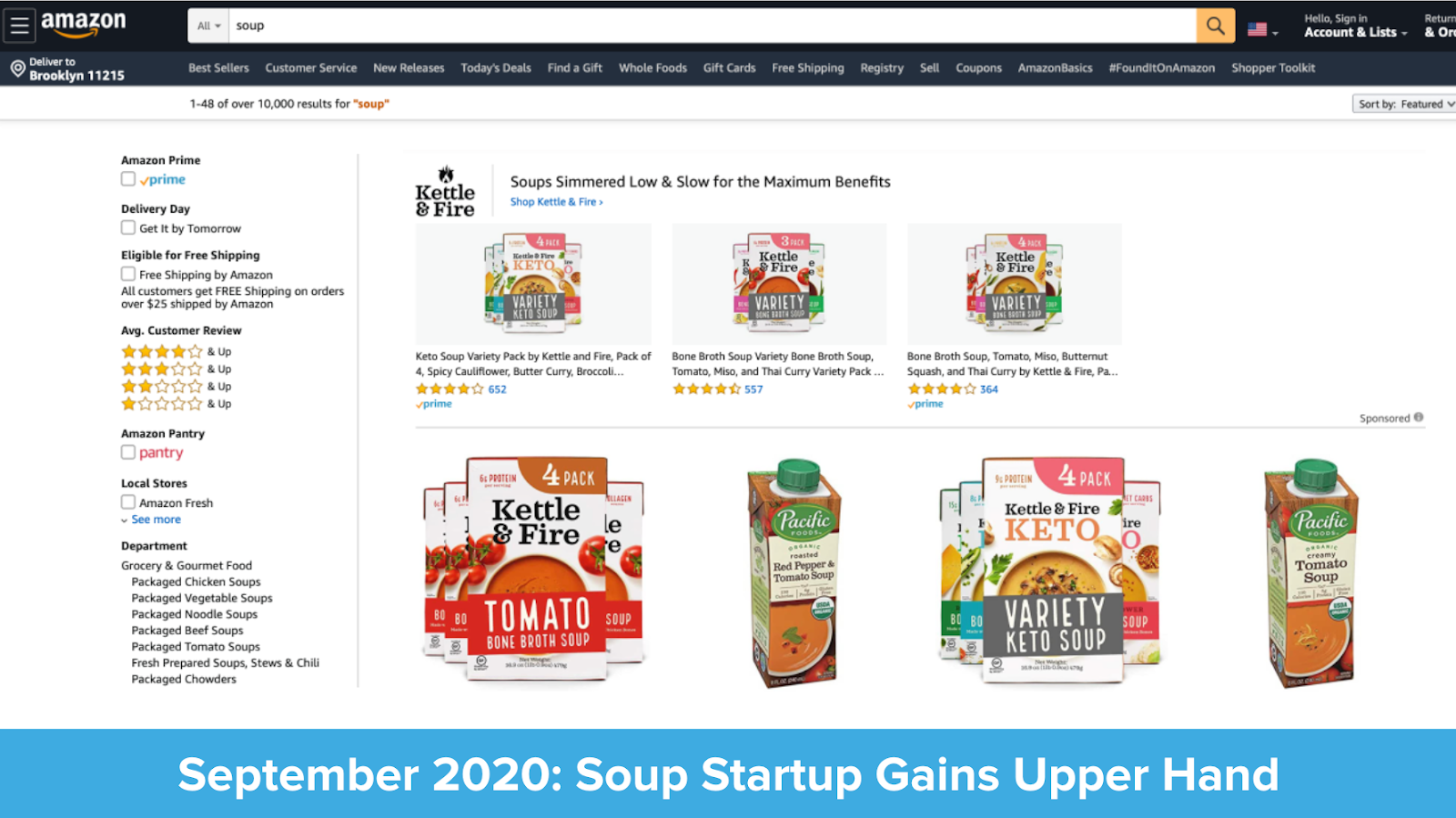

A huge upside of the complex ecommerce landscape is that emerging brands can effectively compete with household names.

For example, during the webinar Kiri explains the ‘Soup Wars’ she observed during COVID-19. When consumers stocked up on household essentials during the first phase of the lockdown, Campbell’s soup & other major competitors quickly ran out of stock, and subsequently this led to their native Amazon PPC ad campaigns stopping too. Kettle & Fire, an emerging organic soup brand, quickly shifted media spend to take advantage of low ad costs & shopper interest. Kiri says that Kettle & Fire captured the majority of share-of-voice for most of March, and continues to benefit from this bold strategy six months later with strong organic performance for key search terms on the Amazon platform.

Above: In September 2020 Kettle & Fire have 2 of the 4 top organic product listings for the search term ‘soup’ on Amazon.com

This Kettle & Fire anecdote illustrates how smaller brands can outperform much larger competitors with nimble strategic adjustments based on changes in the behaviour of online consumers.

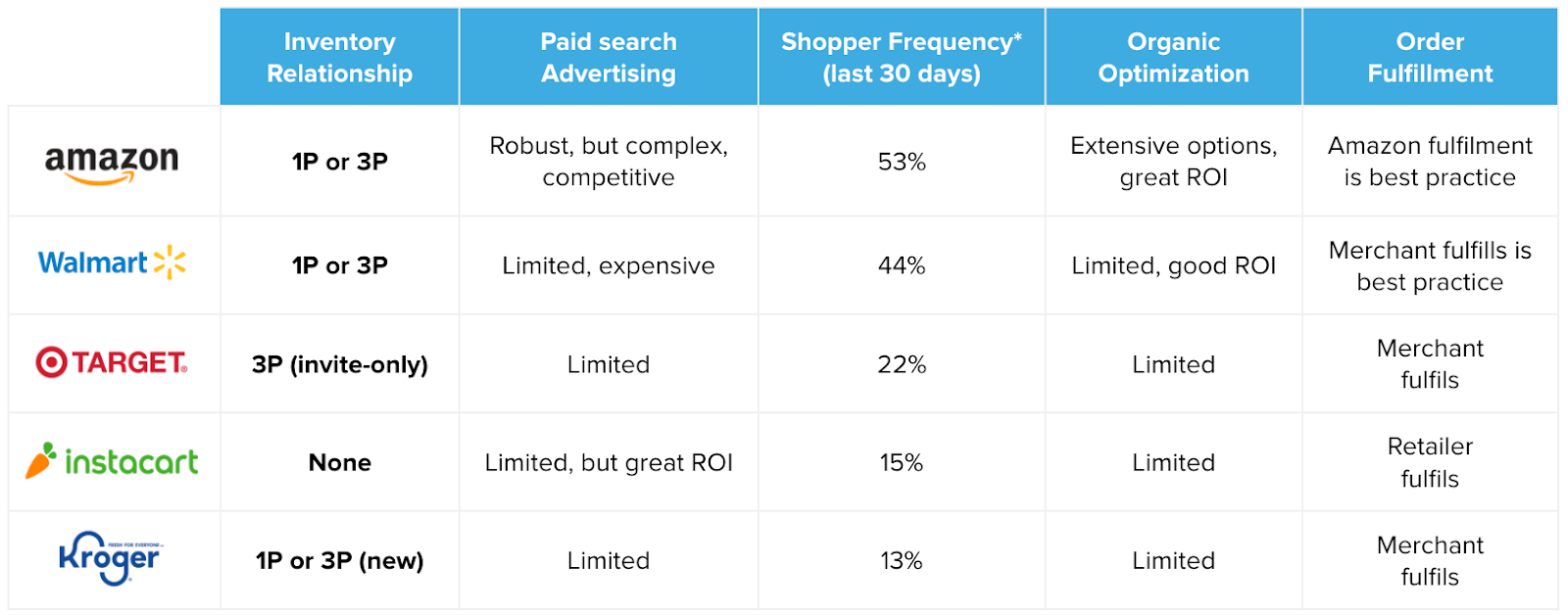

3) Choosing Where To Play

According to Kiri, brands within the Grocery and CPG space are not prioritizing different sales channels in an intelligent manner.

“COVID has illustrated the importance of making sure your products are available where online customers want to shop,” Kiri says. “Ecommerce shoppers don’t care about your established vendor relationships. They care about competitive pricing and fast shipping. If your brand can’t deliver, the customer will look elsewhere.”

In the webinar, Kiri breaks down all the pros and cons of all the major online retailers for CPG brands.

Above: Not all online retailers are created equal - it’s your responsibility to select the right combination of channels

4) Future Expansion Opportunities & Trends

Here are the expansion pathways most CPG brands are considering at this point in time:

Amazon - International Markets

- Canada generally 10% accretive to US sales

- UK generally 10% accretive to US sales

- 5 EU markets generally 10% accretive to US sales

- AU generally 5% accretive to US sales

- Amazon Fresh only available in US & UK

Walmart

- Walmart has launched a charm offensive for both brands and shoppers in 2020 with new programs to beef up selection & ease to shop

- 90% of US shoppers live within a 10-mile radius of a Walmart

- Online Grocery Pickup (1P) is the immediate opportunity for most CPG brands

Whole Foods, Prime Pantry, Prime Now, Fresh

- Currently each program is administered separately, including advertising campaigns.

- Huge inefficiencies for brands and Amazon to operate multiple channels.

- Outlook is that online ordering process for these programs will consolidate

In the webinar, Kiri explains what CPG brands should be considering when creating an expansion strategy.

📽️ Watch the full webinar recording here.

Tagged: Seller & Vendor Central, Amazon Account Management, Grocery & Gourmet Food

.png)