Matt Gallagher is a PPC Specialist at Bobsled, an Acadia company

Amazon's Prime Early Access Sales event (now fondly known as ‘PEAS’) has come and gone, and it provides some great insights into what we can expect from shoppers during the Black Friday and Cyber Monday events in a few weeks. In this blog post, we will take a look at the performance of Amazon's Fall Prime Event and see what lessons we can learn about planning for the rest of the holiday season.

What was different about this year

First, let's review what was different about 2022.

- 2022 was the first year that we've had both a summer Prime Day sale and a fall Prime event.

- Many large retailers publicly stated that they were over-inventoried. While strategies for dealing with this issue vary by retailer, many decided to run sales events to liquidate inventory. These events were scheduled to run at the same time as Amazon's event.

- Amazon named this event "Prime Early Access Sale," not Prime Day. Despite this careful distinction, it quickly assumed the moniker "Fall Prime Day" in the media, which created an unfair comparison to the summer event.

- Amazon shared early deals with the media and influencers a week ahead of the event. ‘Early access’ deals for the “Early Access” event, if you will. In my opinion, this made it confusing for shoppers to know when the official event was occurring. Book a FREE consultation with one of our experts today!

Sales performance during the Prime Early Access event

Performance was mixed among our clients at Bobsled. Some brands saw great results, while others didn’t.

Still, compared to the same period the week prior, we saw:

- 134% lift in ad sales

- 4% increase in ACoS (much lower than the summer Prime Day lift)

- 10% increase in CVR (conversion rate)

- 24% increase in CPC

- Average new-to-brand sales of 62%

October's Prime event was overall less competitive with brands spending less on ads, and cost-per-click (CPCs) being less expensive than in July's Prime Day. Across our book of clients, the CPCs from this event were on average 15% lower compared to July’s.

The counter to that is that conversion rates were not as high in the PEAS event, on average, they were 24% lower compared to the July event.

What this means for brands - and the lesson to take into BF/CM - is that although traffic was less expensive, users did not have the same sense of urgency to convert. An enticing discount offer is a great way to combat this.

How much should we increase spend for BF/CM?

My view is that 50% spend is a good starting point. This would ideally be an extra budget, but if you need to reallocate from other days in the month do that. Giftable product brands or brands with repurchase potential should consider 100%+ more spend.

I expect BFCM to be much larger than PEAS. It’s difficult to change the social norms of waiting closer to the holidays to begin shopping. Most shoppers simply leave their holiday shopping to the last minute.

But PEAS was a huge blessing for advertisers, even if conversion rates were lower than on other sales events. Why? We can ensure any retargeting ad lookback windows are large enough to include the October 11/12 event. BFCM is a great opportunity to try to capture that customer when they have a higher intent for purchase.

How much of a discount should we provide?

As much as your margins feasibly allow you. If your product is replenishable, consider using a steep discount to acquire customers with Lifetime value in mind.

Before you roll your eyes at a glib answer from just another ecommerce guy, let me put that in context.

Consider the macroeconomic environment. Just comparing it against what worked for BF/CM in 2021 won't fly. In Q4 of 2021, many brands and retailers were strapped for inventory. There was a good argument then that heavy discounting was unnecessary - shoppers would snap up whatever was available on the shelves.

This year is a much different story. Target even said recently that if they could make a few billion dollars worth of inventory simply disappear, they would. Depending on your brand's category, you could be facing stiff pricing competition and shoppers whose budgets are declining due to inflation or concerns about a future recession.

Brands that don't lean into discounts during sales events can regret it.

I have a client in a very giftable niche. For the PEAS event, they were reluctant to push a competitive discount and opted to activate a 10% off coupon. Although they saw a 75% increase in sales, they missed out on seeing the 150% daily sales increase many other clients with more aggressive coupons saw.

This is your last shot to reel in those holiday shoppers. Don't be the brand that regrets not going bigger.

What advice we're giving to clients

Here's what we're recommending to most of our clients at Bobsled.

- Plan ahead, the BFCM strategy conversations should be happening now.

- Plan to increase bids ~20%+, in many cases more. Be ready to pivot to a bigger increase if your ad is not getting impressions on day 1 of the event.

- Identify a list of priority search terms you want to capitalize on. You can’t put your dollars and strategy into everything.

- Expect a “window shopping” period the days before. Users often browse the days prior expecting a deal to come the day(s) of BFCM.

- If consumer confidence continues to soften, and as many retailers look to offload excess inventory, there will be more sales and shoppers will come to expect discounts. If your conversion rate during the PEAS event was low, you may need to consider more enticing discounts.

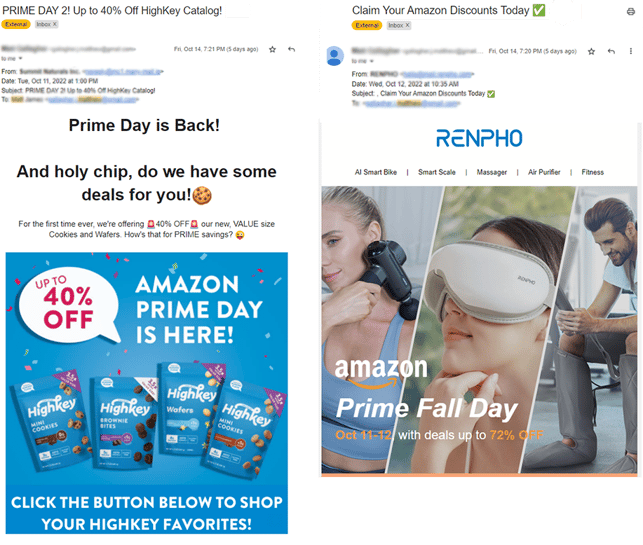

- Promote your deals to your existing customers on social media and email campaigns. Below are some examples I saw during the week.

Amazon's Fall Prime Event is a great cheat sheet for how to plan your Black Friday and Cyber Monday strategy. This year, Amazon is facing stiff pricing competition and shoppers whose budgets are declining due to inflation or concerns about a future recession. Brands that don't lean into discounts during sales events can regret it. We recommend increasing bids by at least 20%, identifying a list of priority search terms, and expecting a "window shopping" period the days before.

Book a free consultation with the Bobsled team below.

Tagged: Brand Protection & Customer Service, prime day, Bobsled Marketing, BFCM

.png)