And just like that, Prime Day has been and gone for another year. Hopefully, the event was a huge success for your brand!

The results are still settling, and early next week Bobsled will publish a full recap with all the finalized data on our blog. In the meantime, we wanted to share our immediate impressions and first sets of results.

Huge Number of Deals

Amazon told various news outlets in their huge media blitz that 2M+ deals would be running on Prime Day in 2021, an increase from last year.

“This huge number of deals shows the adoption rate of brands buying into the event,” says Bobsled’s Jordan Ripley.

“This huge number of deals shows the adoption rate of brands buying into the event,” says Bobsled’s Jordan Ripley.

“It also indicates that it's easy for any promos to get lost in the tide of discounts. Going into Prime Day, the Bobsled team viewed these deals as fuel for existing organic and paid discovery efforts plus conversion boost, rather than a customer acquisition tool in and of itself.”

And many brands began running deals over the weekend, before the official Prime Day kick-off.

And many brands began running deals over the weekend, before the official Prime Day kick-off.

“For the 50 products I had on my shopping wish list, about 1/3 of those products were offering some type of promotion over the weekend,” explains Bobsled’s Jesse Chembars.

“And the majority of those deals included pretty steep discounts, at least 25% off.”

Small Business Focus

Amazon did their best to combat negative PR by implementing a Small Business focus. Some journalists were sent branded Prime Day swag prior to the event kick-off. This swag included some messaging about the amount of revenue small and medium businesses generate on Amazon each year, a direct counter to much of the criticism that gets lobbed Amazon’s way.

On the left: Example of the Prime Day 2021 swag that was sent to journalists.

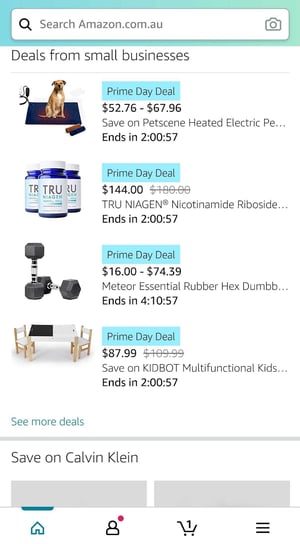

On July 21-22 there was a whole section and story about small businesses on the Prime Day homepage.

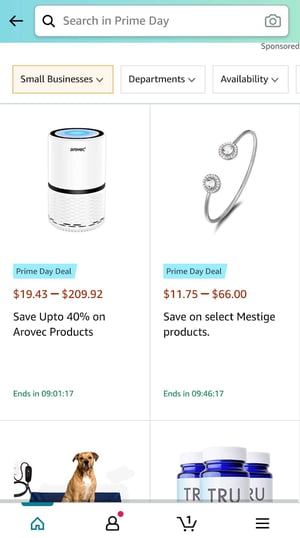

Ethically-minded shoppers also had the ability to use a new filter feature on the search results page which allowed them to browse deals by small businesses.

Above Left: Shoppers could select the ‘Small Businesses’ tab at the top of the search results page.

Above Right: Allowing Amazon customers to support Small Businesses exclusively with their Prime Day purchases.

Some Compliance and Eligibility Issues

Like past years, there were some unforeseen compliance and eligibility issues.

“We had two skincare clients that had significant portions of their catalogs suspended for random and unfounded non-compliance reasons on the Friday before Prime Day,” says Jordan Ripley. “The Bobsled team was able to implement a swift resolution prior to the event kicking off, but this incident highlights the importance of heavy monitoring of accounts at all times, especially during peak traffic events. Amazon compliance bots can go wild at any moment.”

There were also reports of approved Lightning Deals scheduled for Prime Day not running. Amazon’s provided the following reason;

Not featured. The funding provided did not support our lowest price guarantee.

This happened to ASINs which have not been associated with any Amazon promos in the past and were not being sold elsewhere for a lesser price. This is another reminder that Amazon’s compliance bots can make snap decisions seemingly out of nowhere, and it always serves to have backup promo plans at your disposal.

💡 Check out Bobsled CEO Kiri Masters’ article on Forbes – The Halfway Point: How Is Amazon Prime Day Performing For Retail Brands So Far?

Big Sales Numbers!

The Bobsled team observed some massive sales numbers over Prime Day. All of the data is still settling, but some early highlights include:

- Beauty brand did $317K in sales on Day 1 of Prime Day, and Day 2 was shaping up to be just as good. That’s 7-8X daily average volume and 3X what they did on Prime Day last year.

- Top-selling Electronics accessory was up 1,996% on Day 1 compared to the day prior

- Footwear & Apparel brand did 3X compared to their daily average on Day 1 and was shaping up to do the same on Day 2.

- Baby brand did 3X compared to their daily average on Day 1 and was shaping up to do the same on Day 2.

- Grocery brand did 3.5X compared to their daily average on Day 1 and was shaping up to do the same on Day 2.

- Sports & Outdoors brand did $20k on Day 1 and $39k on Day 2, exceeding last year’s total Prime Day result.

- Beauty brand did $136k sales on Day 1. And the ACoS was 13.82%, which was under the target, so the PPC budget got boosted for Day 2, waiting for those results to settle.

- Hair Care brand’s product got ranked #9 in Amazon’s Top 100 on Day 1, helped spike sales across Prime Day for this ASIN.

🔔 Bobsled will be publishing a Prime Day 2021 Results recap next Tuesday, June 29 – sign up for our free newsletter so you don’t miss a thing.

Prime Day has ended – what now?

Brands that invested marketing and advertising budget into Prime Day should be looking to capitalize on the halo effect from the spike in sales. On the other hand, brands that didn’t participate are now playing catch up.

To figure out your next move, read our article from earlier this week – What Should Brands Do After Prime Day Ends?

If you need further assistance diving into your Prime Day numbers, don’t hesitate to book a free consultation below. The Bobsled team will be able to use our internal data sets to benchmark your performance compared to other brands selling within your category.

Tagged: Amazon Account Management

.png)