This year Prime Day fell at the beginning of Q4, and changed the Holiday shopping season for brands big and small. Some brands decided to invest aggressively, whereas others sidestepped the event entirely.

Want some additional context about your Prime Day 2020 performance? The Bobsled project team has shared some highlights, as well as how they’re approaching the rest of Q4.

Lauren Sutehall - Bobsled Project Manager

On Prime Day 2020

One of my Beauty clients saw 3x their units sold versus the same time last month and 7x their units sold over PD Day 1 last year.

Aggressive promos were in place - up to 40% off some SKUs in the catalog.

On the remainder of Q4

The results of the coupons that we had in effect for Prime Day has informed our strategy about our plan for the rest of Q4. Prime Day results validated coupon usage as the best promo tool over the peak season for most of my accounts.

💡 Check out Which Amazon Promotions Work Best?

Jesse Chembars - Bobsled Project Manager

On Prime Day 2020

On Prime Day 2020

My clients who ran coupon promotions did see an increase on PD: average bump of 3-5x daily sales vs October daily average. Oddly enough my best performer was a client who struggles for BB ownership due to distribution.

On the remainder of Q4

Our approach for Q4 hasn’t been impacted by PD results. I'm anticipating that most clients will experience a similar lift for BF/CM as they experienced on PD.

Jordan Ripley - Bobsled Project Manager

On Prime Day 2020

I'm more bullish than ever on Prime Exclusive Discounts (PEDs). All of my top performing clients ran full catalog PEDs of 20%, 30%, and 50% respectively, and saw crazy DoD sales multiples (5-10X).

Fitness Client:

PD 1: $32,849

PD 2: $24,608

Pre-PD MTD daily average: $3,100

Grocery Client:

PD 1: $35,858

PD 2: $39,662

Pre-PD MTD daily average: $4,610

Beauty Client #1:

PD 1: $112,709

PD 2: $88,165

Pre-PD MTD daily average: $34,241

Beauty Client #2:

PD 1: $19,137

PD 2: $23,695

Pre-PD MTD daily average: $3,571

As this was only the second year that PEDs were available, I was thinking "are these too good to be true?” Mainly, I was concerned that PEDs wouldn’t be merchandised as well as they were in their inaugural Prime Day. But from everything I observed, PEDs have equivalently good SERP/PDP merchandising for Prime customers as a Lightning Deal, but without the fees or set up headaches. It seems like Amazon is committed to offering great promo merchandising that leads to Prime subscriptions/member value even if it means losing out on some deal fee revenue.

Also, one of my clients said on a call yesterday (paraphrasing), "It was genius of Amazon to delay Prime Day until the start of Q4, because it puts priority on all of our inventory, promos, marketing to Amazon vs. other retailers/channels at the very start of the holiday season." I thought this was a very prescient observation - Q4 on Amazon is definitely front of mind for many brands right now.

On the remainder of Q4

Prime Day did not change how I’m viewing the rest of Q4 in any significant way. Across the board, PD performance was strong, so my clients are more willing to double down on promos during peak periods such as Turkey 5.

💡 Check out Amazon Q4 Inventory Planning

Armin Alispahic - Bobsled Project Manager

On Prime Day 2020

On Prime Day 2020

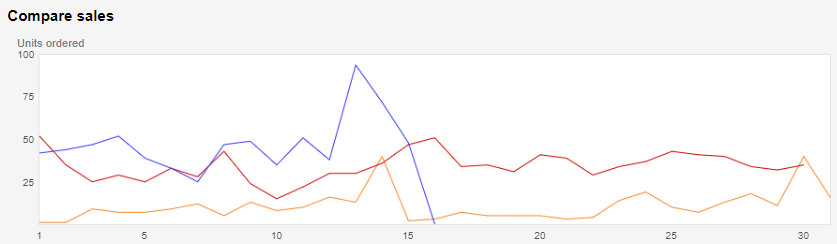

- Both Day 1 and 2 were equally strong for my accounts

- Standard 2-3x bump with regular promo activity (20-30% off)

- I always feel Electronics does better than any other category: got 6x MoM sales on a regular promo with one client, and doubled sales without any promos in VC

- Clients that decided to bring off-Amazon traffic did amazingly well: up to 10x MoM for one client

On the remainder of Q4

- PD has given me a better understanding of what to expect from Turkey 5 and Christmas in respect to inventory management, promo selection and off-Amazon marketing strategies.

- Due to all the additional traffic, our PPC teams will be digging deeper into keywords and competitor products to identify new targets

- On the whole PD won't change how I look at the remainder of Q4 too much; it just gives me more recent data to analyze compared to a standard mid-year Prime Day

💡 Check out Amazon’s Prime Day Performs Strongly

For Retail Brands, Early Reports Show

Lindsay Baker - Bobsled Project Manager

On Prime Day 2020

On Prime Day 2020

Few of my clients participated in promotions during PD. One that did saw roughly 2.5x daily sales vs. daily average for the month of October prior to PD.

On the remainder of Q4

Q4 approach won’t be impacted much by PD. Will likely run similar promos for most clients during Turkey 5.

Ross Walker - Bobsled PPC Manager

On Prime Day 2020

On Prime Day 2020

All of my clients that were running coupons/deals on Prime Day saw lift. Another client that has been running coupons for months and did nothing special for PD saw almost no measurable increase in demand. Focused promotion FTW!

On the remainder of Q4

Prime Day results haven’t changed our approach for the rest of Q4. As of yet, I'm not worried that overall demand for holiday buying will have been sated. If anything, I expect the impact to be on Turkey 5, however, I am coaching clients to be prepared for lower than average lift between Black Friday and Cyber Monday because of the relative proximity to PD.

Also, brands who have hit the glass ceiling with traditional Amazon PPC should definitely be exploring Sponsored Display and/or DSP.

💡 Check out Amazon Sponsored Display vs DSP

Need help with your Amazon Q4 Strategy?

Book a free consultation with the Bobsled team below.

.png)