Many brands choose FBA because it makes selling on Amazon so much easier. Not only will Amazon store, pick, pack and ship your items, they’ll also handle customer service and manage returns. Doing all that yourself is time-consuming and often costly.

In addition, FBA merchants are automatically enrolled in Amazon Prime. With more than 100 million shoppers registered with Prime, that can be a huge advantage. Especially when you consider that Prime members spend more than twice as much as non-Prime shoppers.

Of course, all of that benefit comes at a cost. Merchants using FBA must pay Amazon’s FBA fees. By planning ahead and understanding how fees will affect your bottom line, you can protect your profit margin while using FBA.

Different types of FBA fees

Merchants using FBA will incur at least some of the following fees:

- Fulfillment Fees

- Referral Fees

- Monthly Inventory Storage Fees

- Long-Term Storage Fees

- Removal Fees

- Disposal Fees

Fulfillment fees, monthly inventory storage fees, and referral fees are unavoidable fees. Consider them the cost of doing business - just as paying rent on your storefront is an unavoidable part of having a brick and mortar. On the other hand, long-term storage fees, removal fees and disposal fees can be minimized or avoided entirely if you plan ahead.

Essential FBA Fees

Referral fees are charged to every seller, whether they choose FBA or FBM. In most cases, your referral fee will equal 15% of the sales price. A few categories, such as jewelry, have slightly higher referral fees.

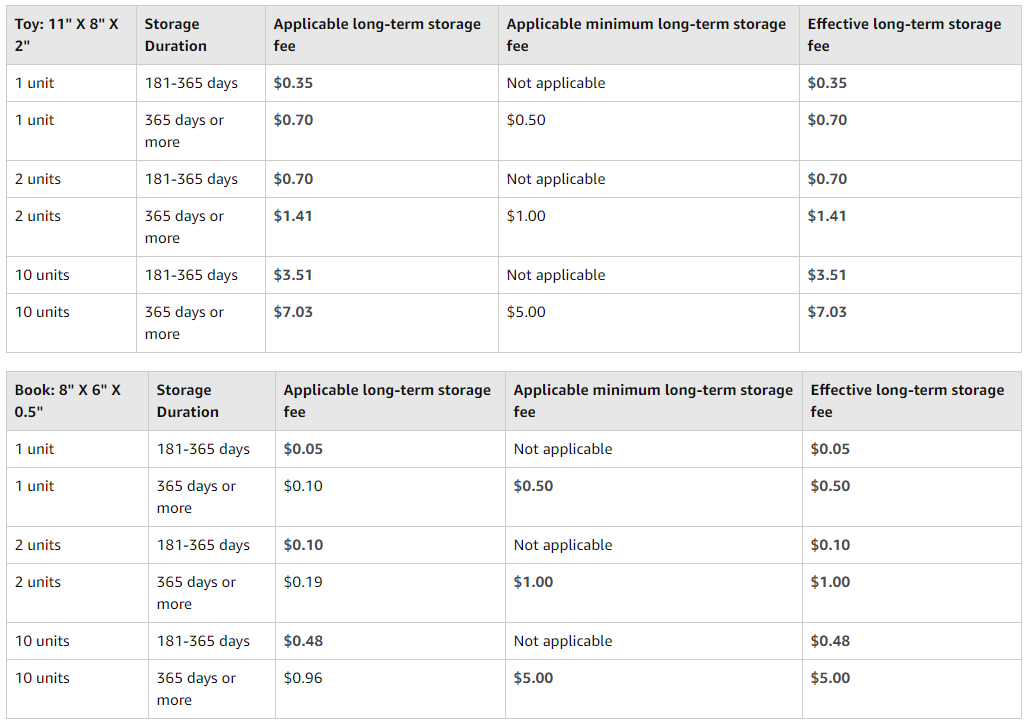

Fulfillment fees are the price you pay for the convenience of letting Amazon pick, fill and ship your items. Fulfillment fees are calculated based on the size of your item.

Standard-size items meet the following criteria:

Above: Screenshot from https://services.amazon.com/fulfillment-by-amazon/pricing.html

Size is calculated based on a fully-packaged item. Anything larger than the sizes above is considered oversize and may be categorized as small, medium, large or special oversize. These items incur fulfillment fees from $8.13 up to $137.32 per unit. Amazon’s Seller Central guidelines give a deeper look at these fees.

Amazon charges monthly inventory storage fees to cover the cost of storing your items in their warehouse. Storage fees are based on the daily average volume of the space your inventory occupies. So more units in storage will mean higher fees, while fewer units result in lower fees. If your sales remain steady, you should be able to forecast this number from month to month.

Inventory storage fees go up around the holidays. From October to December you’ll pay an additional $1.71 per cubic foot for standard-size items and an additional $0.72 per cubic foot for oversize items.

Avoidable FBA fees

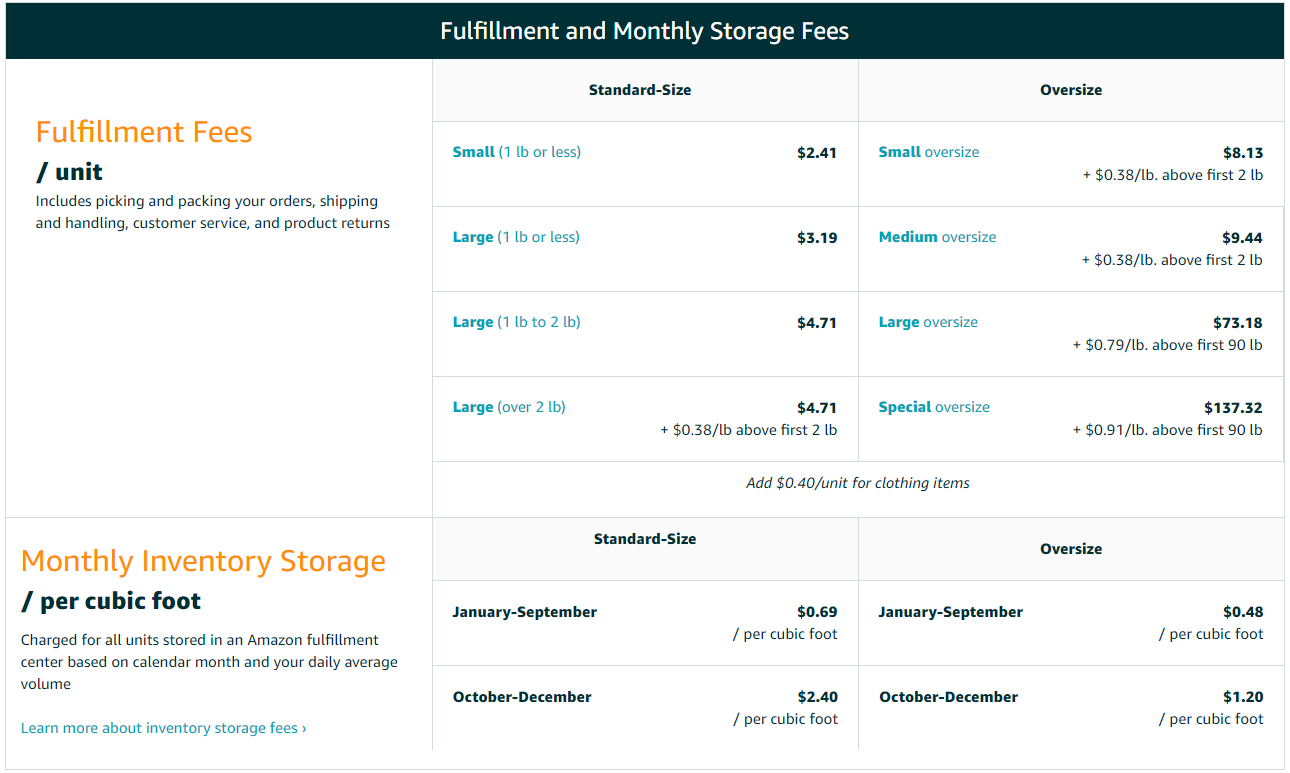

Long-term storage fees only go into effect if your item is stored in Amazon’s warehouses for more than 180 days. You can avoid paying this fee by keeping a close eye on inventory levels. Ideally, you don’t want any item sitting on the shelf for more than three months.

Above: Examples of Long-Term Storage Fees.

Screenshot from https://sellercentral.amazon.com/gp/help/external/help.html?itemID=201411300

For the sake of efficiency, you should be forecasting inventory every two to four months. Try to provide enough inventory to meet demand without going over the 180 day limit. If you do find yourself in danger of paying long-term storage fees, use promotions and sales to help quickly sell off inventory.

If inventory still isn’t moving you can pay removal fees to have the item shipped back to you. This fee covers the cost of picking, packing and shipping your items. You might choose to remove an item in the following situations:

- You’ve discovered a quality issue

- The item has been updated with new branding or features

- You no longer want to sell that item

- You no longer want to have items fulfilled by Amazon

- An item isn’t selling and the long-term storage fees are adding up

A removal order usually takes about two weeks, but may take as long as a month during the holiday season. The cost is $0.50 for standard items and $0.60 for oversize items. Keep in mind that, the more cost effective option is normally to try to move the item with promotions and sales rather than paying to have it removed.

While it is possible to pay a disposal fee and have Amazon destroy your product for you, we recommend avoiding this course of action at all costs. You have no way of knowing what happens to your product after it is marked for disposal. Essentially, you’re giving up control of your brand, which can create a dangerous situation for you. While disposal fees are smaller than than removal fees, the risk isn’t worth the savings.

Monitor your refunds and returns

Some sellers lose money over returns. If a sale is made and the customer returns the product, the customer will always get a refund. Ideally, the customer sends the product back to Amazon so it can be returned to your inventory and resold. Unfortunately that doesn’t always happen. In that case, Amazon won’t notify you that the product hasn’t been returned. It’s up to the seller to reconcile returns to ensure you’re either credited for the sale, or the product has returned to your inventory.

We recommend reconciling your returns monthly to ensure your returns are in fact returned, or that Amazon reimburses you. If you reconcile your refunds regularly, you’ll catch this problem early enough to do something about it. It is your responsibility to make sure you get the refunds you are owed.

Is FBA worth it?

FBA can be a huge benefit, but it comes with costs. Each brand has to decide for itself whether FBA is worth it. You should be very clear on your costs and how they affect your profit margin. You should:

- Know the size and weight of your product and calculate fees for that product before you even decided to sell.

- Consider your own costs including manufacturing, shipping to Amazon and FBA fees.

- Understand how promotion costs and advertising affect your bottom line.

Once you account for all of those fees and costs, you may find that you need to adjust your sales price to maintain your profit margin. Don’t wait until a few months in when you realize you’re not making any money. It’s better to know your costs up front and be secure in your profit margins from the beginning.

If you need help figuring out FBA fees or tracking your refunds, the Amazon experts at Bobsled Marketing are here for you.

Tagged: Amazon Account Management, Operations

.png)