Recap of Bobsled’s webinar which included best practices for the Walmart Partner Program, Walmart Sponsored Product Ads and the key differences between PPC on Walmart vs Amazon.

Last week Bobsled CEO Kiri Masters hosted a webinar about the Walmart Advertising Platform alongside Tom Harlukowicz from Bobsled’s ad-tech partner Kenshoo.

Hi Kiri! Why are brands starting to take Walmart.com more seriously?

Walmart is Amazon’s most serious online marketplace contender. Recently, there’s been incredible growth on the channel, they’re fleshing out Walmart Fulfillment Services (WFS) and they continue to add new features to Walmart Advertising.

As of right now, what does the Walmart opportunity look like for brands?

Based on current data, most product categories see approximately 7% of Walmart.com accretive revenue compared to Amazon.

For some brands who see the upside in becoming an early adopter, this 7% figure is highly attractive. On the other hand, some brands are likely to be underwhelmed with the current size of the Walmart marketplace, and will stick with Amazon until there’s more volume.

How is Walmart positioned compared to Amazon?

Right now there’s a much higher barrier to entry for brands looking to sell on Walmart. This means on the whole there’s far less competition. It also means far fewer unauthorized sellers and counterfeiters. So although the marketplace has a similar look to Amazon, it has more of a “premium” feel.

On the theme of exclusivity, Walmart currently has a closed API for advertising. Only 4 ad tech providers have access, and Bobsled’s partner Kenshoo is one of them. So this means unlike Amazon, there’s less info for brands to pull directly from the platform.

-1.jpg?width=237&name=0%20(1)-1.jpg) On the left: Tom Harlukowicz, Director of Sales

On the left: Tom Harlukowicz, Director of Sales

& E-Commerce at Bobsled’s ad tech partner Kenshoo.

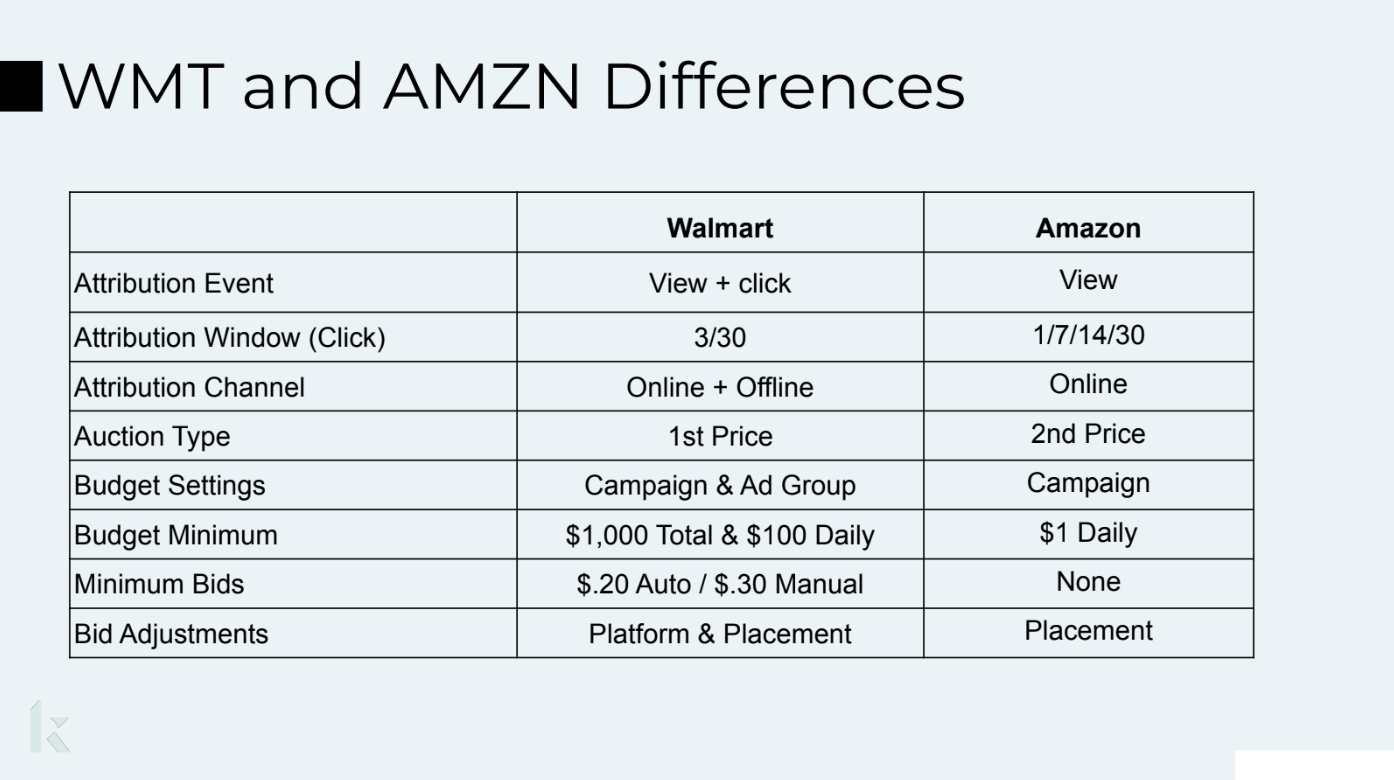

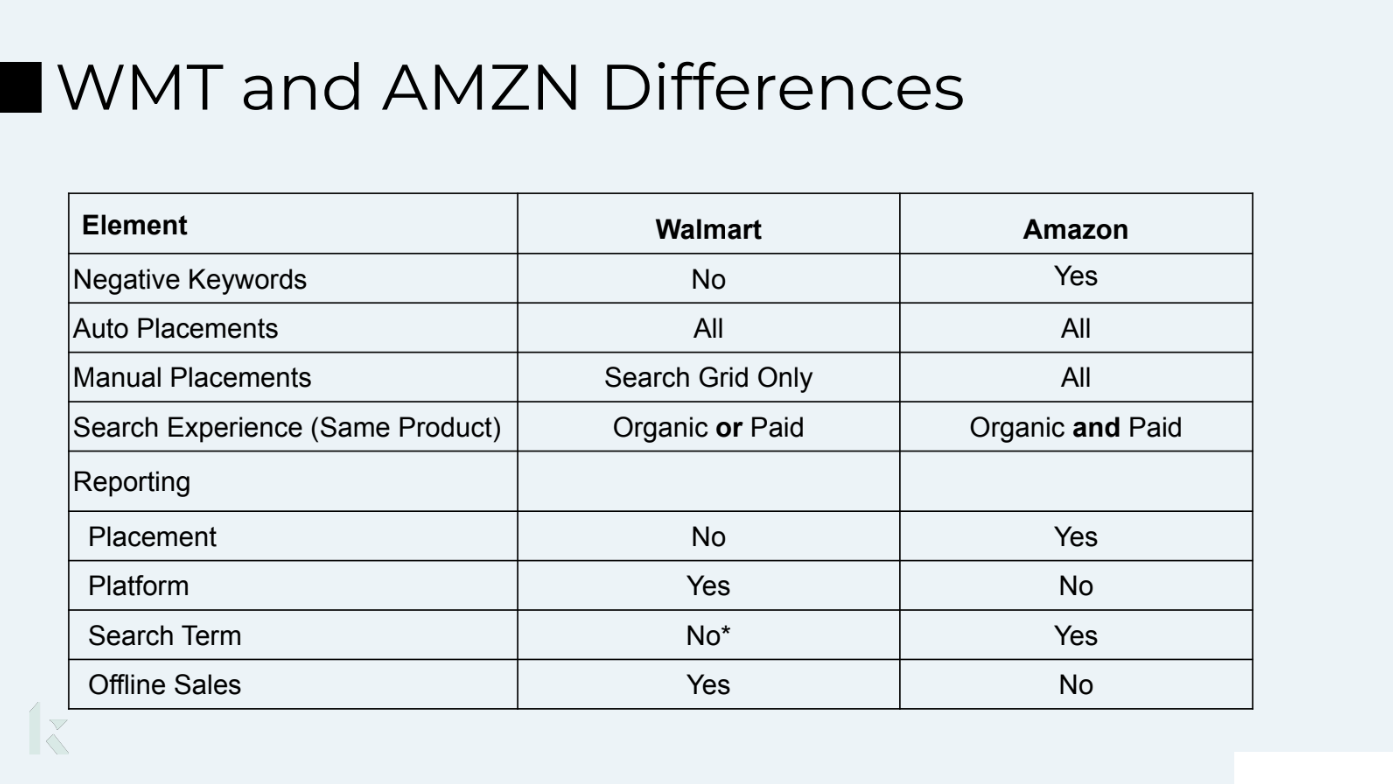

When it comes to Walmart Advertising, what are the key differences compared to Amazon Advertising?

It was illuminating talking with Tom from Kenshoo on last week’s webinar. Although he’s confident that Display and Video ads are coming in the future, at the moment brands can only run Sponsored Product ads on Walmart.com.

Tom helpfully put together a couple of tables that summarize the key differences between the two channels.

What are the 3 main Walmart vs Amazon PPC differences that you took note of?

- Top 128. Right now, in order for your Walmart PPC campaigns to function, your product needs to be organically ranking somewhere within the top 128 products relating to the relevant search term. Considering the infancy of the marketplace this shouldn’t be a problem for the vast majority of brands, and Walmart may relax this policy as more brands join the marketplace.

- 1st Price (Walmart) vs 2nd Price (Amazon). Amazon and various other online ecommerce platforms use a “2nd Price” PPC bidding model. This means that if you bid $3, and the nearest competitor only bids $2, you will only pay $2.01 and win the auction. With Walmart’s “1st Price” model, if you bid $3, and the nearest competitor only bids $2, you will pay $3. Therefore, if you don’t work with a partner who intimately understands the Walmart platform, there’s a good chance you may end up over-bidding for ads on Walmart.

- Search Experience (Organic or Paid on Walmart). On Amazon, it’s possible for a single product to appear twice on the search results page - Organic and Paid. This doesn’t happen on Walmart.com. If you’re already ranking organically for a search term, your ad won’t run, therefore the model could be considered Organic or Paid (not both). Some brands with deep pockets may prefer the Amazon model because it allows them to dominate real estate on the search results page. Other brands may appreciate the Walmart model, as they feel like they’re currently buying PPC ads they don’t necessarily need on Amazon.

Want More Expert Insight From Kiri?

The above is just a snippet of Kiri’s latest Amazon Weekly News Digest, which is delivered via email to subscribers every Friday. In last week’s digest we shared a full replay of the Walmart Advertising webinar. Here’s all the news items topics that were covered in this latest edition.

For $20/month you’ll get a round up of the week’s biggest news and what it means for brands selling on Amazon. Also, as part of your subscription you’ll get access to our bi-weekly Office Hours where Kiri Masters and the Bobsled team conduct webinars, answer member questions and discuss Amazon best practices. To sign up, click the button below.

Tagged: Amazon Updates

.png)