Last week, Amazon published a landing page inviting interested brands to apply to sell on the platform. And industrial property agents have recently confirmed that Amazon has signed a lease deal for a large purpose-built warehouse in Sydney's Eastern Creek.

Amazon is notoriously secretive, and details are very scant at this stage. When is Amazon launching? Where will their fulfillment centers be located? How will the Prime program work?With so many unanswered questions about Amazon’s launch in Australia, I will be covering this subject in a lot more detail in a new video & blog series.

1. Amazon Australia Part 1 - Threat or Opportunity?

Why Amazon will dominate the Australian retail landscape

Will Amazon really make a big impact in the Australian market, or is it over-hyped? In this video, I talk about Amazon as an industry disruptor, and what we can learn from Amazon's expansion in other markets. Learn what makes Amazon so appealing to consumers and why getting prepared for its launch in the Australian marketplace matters right now.

Amazon the retail juggernaut is no longer *just* a retail juggernaut. Amazon, which originally destroyed bookstores, is now opening their own. It operates hundreds of warehouses the size of several sports fields put together and tries to operate them with as few people as possible. It is one of the biggest companies in the world, and for 10 years made close to zero in profit.

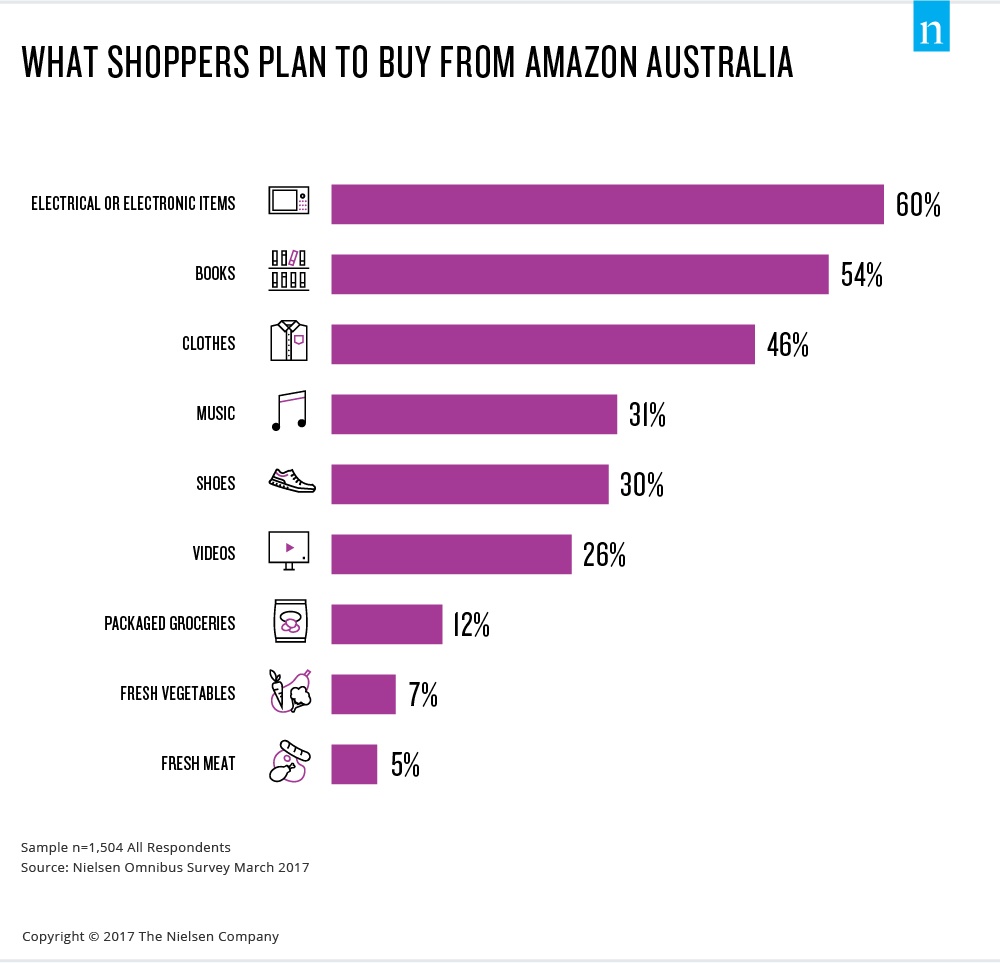

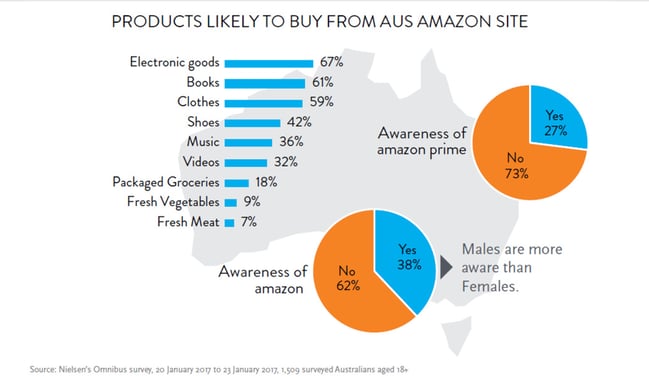

According to a Nielsen poll, already, more than half of Australians plan to buy on Amazon when it launches. They are eager to experience the convenience and selection that our American friends have been enjoying for the past decade.

2. Amazon Australia Part 2

How Amazon Australia Will Work for Sellers

In this second video of our Amazon Australia new content series, we go over what we do and do not know about Amazon launching this new marketplace and we recap how Amazon works for sellers on their platform.

VIDEO TRANSCRIPT

Intro 0:05

Amazon the retail juggernaut is no longer *just* a retail juggernaut. Amazon, which originally destroyed bookstores, is now opening their own. It operates hundreds of warehouses the size of several sports fields put together and tries to operate them with as few people as possible. It is one of the biggest companies in the world, and for 10 years made close to zero in profit. But e-commerce is at the core of what Amazon does and they do it really well.

Why is Amazon so successful? 0:48

It all comes down to high trust scores, customer satisfaction, and the Amazon Prime program.

1. Trust scores & customer satisfaction

In 2016, Amazon was scored by consumers as the most trusted company in America, for the third year in a row. It just got ousted to #2 position this year. People love shopping there because they get free returns, they always get treated well, if they ever have a problem with the product or seller, it’s taken care of immediately. Legendary customer service has always been one of the cornerstones of Amazon’s brand promise.

2. Amazon Prime

Prime is Amazon’s membership program. There is a whole host of benefits and freebie available to members who pay their annual dues of $99 but the most compelling of these is free, 2-day shipping on millions of “Prime-eligible” items.

Prime members are so important to the e-commerce giant is quite simple: they spend more money on the platform than regular customers. According to CIRP, Prime members spend an average of $1,200 a year on Amazon, whereas non-members spend just $500. Amazon is creating great friction to leave the Prime program, by adding more and more benefits to the program. Recently this has included their entertainment platform, which is kind of like a Netflix equivalent with their own programming.

Many consumers will ONLY buy Prime eligible items, and they are usually willing to pay up to 20% more for an item that’s Prime-eligible versus the one that’s not.

How selling on Amazon works: Fulfillment 3:09

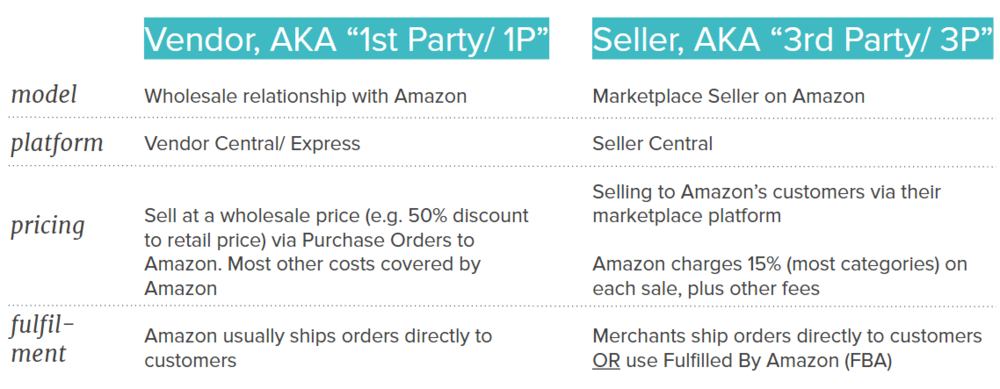

Amazon offers two main selling programs: selling as a Vendor on a wholesale basis TO Amazon, and selling as a third party seller ON Amazon’s platform. Within this 3rd party model, you can choose Fulfilled by Amazon or FBA is where you ship your inventory to Amazon and they fulfill each order as it comes in, and Merchant fulfilled, where you fulfill each customer order yourself.

There are pros and cons to each model of selling, which we’ve discussed in great detail on our blog.

The big question people usually have is around fees. Simply put - merchant-fulfilled orders attract a percentage based fee which varies by category. In the US it’s usually around 15%. FBA orders attract the same percentage based selling fee, plus fulfillment fees. There’s a fixed order fee, pick & pack fees, and weight-dependent shipping fees. Amazon may offer a more competitive fulfillment rate than your own capabilities or it might be slightly more expensive. But using FBA means your items will be eligible for Prime. And this means you’ll likely get much more sales because customers really want the credibility of buying “from Amazon” and the free shipping.

Finally, on the Vendor program, Amazon will make Purchase Orders based on a wholesale price which you negotiate with them plus other ancillary fees.

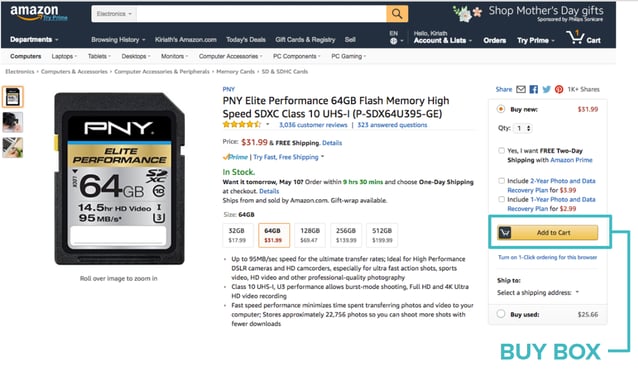

How selling on Amazon works: Buy Box 5:31

Amazon is not always the cheapest place to buy products, in fact it's often not. That’s because Amazon tries to facilitate competition from multiple sellers on the same product.

Unlike eBay where there can be multiple pages or offers for the exact same product, Amazon operates like a catalog with only one instance of each product. “Winning the Buy Box” is the process by which your offer is assessed by Amazon’s algorithm as the best option for the customer when multiple sellers are listing the same item. Winning the Buy Box is just Amazon’s way of saying that you win the purchasing click from the customer.

When there are multiple sellers of the same product, Amazon has to have a way to figure out who should get the sale. For example, if there are 10 sellers of a product, and they all have different offers (such as different prices or fulfillment terms), who should win the sale? To solve this, Amazon has their search algorithm that prioritizes relevance, sales velocity, and conversion metrics, as well as comparing whether an offer is eligible for Prime (i.e. an FBA seller fulfilling through the Prime program, or Amazon themselves fulfilling through the Vendor program). Amazon will often win the sale if they have an offer on the product.

Amazon Australia: What We Know 7:09

While Amazon is notoriously secretive and we still don't know a lot about its plans to expand in Australia, there are a few things that we do know.

Grocery brand AmazonFresh will make an early appearance. Public position descriptions show Amazon is hiring for this brand specifically. This service will compete with Coles and Woolworths’ online offerings. Amazon will only build physical stores once the concept it was proven (quote: Amazon will "build physical grocery stores and launch Amazon Go only after Amazon has become more established in the country and analysis determines the market will support physical stores," said Brittain Ladd, senior manager, Amazon Global Logistics).

2. Amazon aggressively seeks market share above profits 7:44

Amazon’s warehouse and distribution costs would be higher compared to other markets due to the low population relative to size in Australia. And history shows us that Amazon can and will sustain losses in the short term to build market share and establish loyalty.

3. Importers will have to collect and pay GST 8:48

Amazon is highly likely to enforce sellers to register for GST before being allowed to sell on the platform. Recently in the US Amazon has been forced into collecting sales tax on ALL sales, to get ahead of States individually pursuing Amazon for uncollected & unpaid taxes. When launching in the UK & Europe, new sellers MUST provide a valid VAT number. Amazon wants and needs to comply with consumption taxes in each country they operate in. So, importers will be on the same footing as local companies from a GST perspective. Further, the Australian Government has announced some hefty tax restrictions for sellers on online marketplaces (not just Amazon). It’s unclear how these proposed rules will shake out.

Amazon Australia: What We Don't Know 10:01

- Exactly WHEN it will launch - Some early reports this year cited September and the latest news is that Amazon will be “fully operational” by the end of 2018.

- WHERE fulfillment centers will be located - We don’t know what the placement of FCs will look like. It logically makes sense to have an FC in the 4 major Australian cities where 2 thirds of Australians live, but this hasn’t been confirmed.

- HOW orders will be delivered and under what timeframe (2-day free shipping?) - As a result, we don’t know if the free shipping with Prime will be available immediately or in the future. Though most of the population is located in the urban centers, will Amazon be able to offer the same delivery guarantee and pricing for customers outside the major 4 capital cities?

3. Amazon Australia Part 3

How to prepare for Amazon’s launch in Australia

In Part 3 of this video series, I talk about the types of businesses that will thrive when Amazon enters the Australian market. Australian Branded Manufacturers, retailers & distributors with exclusive distribution rights from brands, and the import trade industry all stand to gain enormously from Amazon's launch in Australia.

Who Will Benefit 0:28

1. Australian Branded Manufacturers - 0:32

Amazon has already launched a registration form for Australian sellers.

Core to Amazon’s strategy is offering a wide selection, so you can bet they will take on as many sellers and brands as possible at this point in the game. Australian brands are extremely well placed to take advantage of Amazon. With local inventory and existing brand recognition, Amazon will serve to augment their existing sales distribution, likely accessing, even more, potential customers locally. Australian brands will already be familiar with the regulatory and tax landscape.

2. Retailers &distributors with exclusive distribution rights - 1:24

Retailers who sell other brands may have an advantage if they move quickly on the Amazon platform. Part of the “Buy Box” algorithm mentioned earlier favors sellers with a longer selling history. The more years your account has been active and the more reviews you have, the more credible a seller you are. Even better are retailers and distributors who can secure exclusive distribution rights from brands. If you can negotiate a year or a longer period where you will be the only seller of that brand on Amazon, you stand to gain all the sales on the platform over that time period. But, be aware that anyone can list products on Amazon within categories they’re approved for, - so you might still have to defend your exclusivity.

One report cites a major electronics brand who’s scaling back their distribution rights to Australian distributors, so they can ensure pricing integrity on Amazon. This is because Amazon will automatically match advertised prices online so if a retailer is using a loss-leading strategy, the product’s price on Amazon will be matched or reduced, often hurting the brand’s price strategy and profitability metrics on Amazon.

3. The import trade industry - 2:47

Finally, companies involved in import trading like customs brokers and freight forwarders will probably get some new business from overseas brands looking to start importing and selling on Amazon.

Reasons to expand your brand to Amazon.com.au - 3:05

For brands already selling on Amazon.com, Amazon.co.uk or other marketplaces, consider putting Australia in your international expansion plan for 2017 and 2018.

- Australians have high wages and are advanced technologically, with high rates of internet access. Chances are that your brand has received inquiries from Australian customers desperate to buy their products and often willing to pay very high postage costs to get products they want from overseas.

- 56% of Australians say they will buy on Amazon when it arrives locally.

The e-commerce industry in Australia is overdue for a shakeup - 4:24

Australian retailers are traditional and analysts see the industry is overdue for a shakeup. The large Australian retailers have rested on their laurels for many years; most offering poor customer service and most being slow to effectively add robust online ordering & return capabilities or not offering it at all.

Retailers are unprepared

Research from Commonwealth Bank shows that only 14 percent of Australian retailers have a plan to compete with Amazon, with only 11 percent of retailers viewing Amazon as a significant threat. From the CBA report:

- 30 percent of Australian retailers are unaware that Amazon plans to enter the Australian market, and of those that are aware, only 14 percent have a plan in place to effectively compete.

- Almost half (49 percent) of retailers are unfazed by Amazon’s entry, and 11 percent see it as an opportunity for their business.

- Only 11 percent of Australian retailers see Amazon as a significant threat.

To which I say, famous last words. Gerry Harvey, in particular, has spoken out about the substantial threat that Amazon means to his company and retailers in general. It’s true, Amazon has led to many retailers in the US shuttering their doors and what we see now is a retail apocalypse in the US with iconic stalwarts like Macy’s and Sears closing thousands of stores. Retailers in the US were complacent and unwilling to recognize how the consumer landscape and preferences were changing. Now they are desperately trying to play catch-up, but it’s too late.

Retailers in Australia have had it good for a long time, so they haven’t bothered to innovate.

What to do now - 4:52

1. Refine unit economics for online retail - 4:56

Calculate your unit margins to figure for Amazon’s fees & shipping expenses. Use other marketplace fees (e.g. US, Canada) as a proxy for now.

2. Consider launching in Amazon's other marketplaces - 5:58

Launching in Amazon’s other marketplaces now will give brands an opportunity to build their expertise. the US market, while the largest, is very saturated and competitive. Brand new marketplaces like Australia will have far less competition. The UK, EU, Canada markets are all more intermediate.

3. Register interest for Amazon Australia - 6:39

Amazon put up a registration form for Australian sellers in late April - sign up on that page to possibly secure an early invite or at least get notified of updates as they happen.

Finally, study Amazon further. Last year I published this book, a great starting point for learning about Amazon and how to get the most out of it as a brand. ‘The Amazon Expansion Plan’ is all about how to launch and scale your brand on Amazon, with a focus on leveraging Amazon’s international marketplace network to grow your global reach.

"This book is full of clear actionable strategies for anyone looking to expand into the Amazon sales channel. It covers everything from the basics of the marketplaces to advanced tactics for beating out the competition.Money and time well spent!"

— Greg Mercer, Jungle Scout

So far, in the Amazon Australia content series:

- VIDEO 1: Amazon Australia - Threat or Opportunity? Why Amazon will dominate the Australian retail landscape - Watch now.

- VIDEO 2: How Amazon Australia Will Work for Sellers - Watch now.

- VIDEO 3: How to prepare for Amazon’s launch in Australia - Watch now.

More coming soon. Make sure you subscribe to our YouTube channel or blog to learn more.

.png)