According to Cowen’s 4th annual eCommerce study, the Covid pandemic caused US ecommerce sales to increase by a whopping 48% YOY in 2020. Amazingly, despite this unprecedented amount of growth, Cowen is projecting a further 11% YOY increase in 2021.

Here lies the challenge for ecommerce teams – where is that growth going to come from? Existing giants are constantly rolling out enticing improvements, plus shiny new marketplaces are emerging at a rapid rate. How should brands be thinking about distribution, fulfillment, budget allocation, innovation, and diversification within this complex online environment?

Be where your customer wants to transact

The new ecommerce world has a growing number of customer touch points, and is a huge departure from the traditional retail landscape. Brands need to identify where their target shoppers like to shop, and the best way to connect with them.

Your brand messaging needs to be finessed to account for a potentially disjointed path to purchase. For example, your product content on Amazon should be conversion orientated, but should also include more ‘new to brand’ messaging, along with lifestyle assets, to account for shoppers at different points along the customer journey.

Halo effect from retail media

The Digital Shelf Institute recently published an article that claimed for every $1 spent on retail media campaigns, brands are seeing $7-10 spent in store. This figure was calculated through media mix analysis, with brands claiming that retail ad campaigns improved repeat purchases, helped nurture the goodwill of retail partners, and facilitated invaluable social validation.

Not only does the halo effect of media campaigns vindicate online retailers – it forces brands to start thinking beyond ROAS (Return on Ad Spend). Due to the fragmented nature of the market, it can be tricky to know the precise collective impact of your online ad campaigns. However, it’s important to acknowledge that your online media campaigns definitely have a huge impact on your entire business.

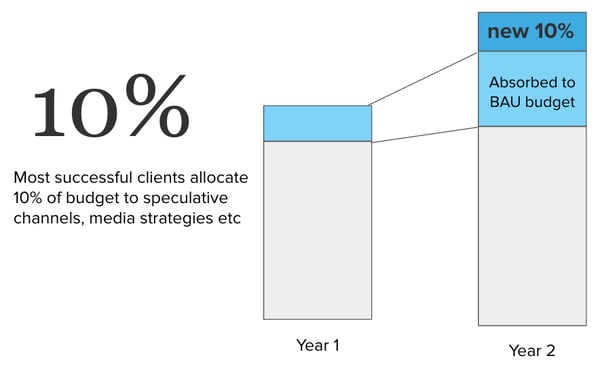

Budget for innovation

At Bobsled, we encourage clients to allocate 10% of their online budget for innovation. This portion of resources can be used to pursue newer media strategies as well as speculative media and distribution channels.

“If you expect to grow and at the very least keep pace with the market, you can’t stand still,” explained Bobsled CEO Kiri Masters in a recent episode of the Ecommerce Braintrust podcast. “The idea is that whatever return your innovation budget generates gets absorbed into ‘business as usual’ budget for the following year.”

Underlying infrastructure

Successful Amazon sellers prioritize inventory availability. When you run out of stock on Amazon your product ranking plummets, advertising doesn’t run, and it can take a long time to regain lost ground. A slick inventory tracking and fulfillment system is an absolute necessity in today’s omnichannel world.

It would be nice to have just the right amount of stock available at all times across all channels. But in reality, it’s impossible! Therefore, brands need to get really serious about which marketplaces mean the most to their customers and allocate inventory accordingly.

“New channels like Instacart are particularly problematic for brands from an infrastructure perspective,” explains Kiri Masters. “This is because product availability on Instacart is determined by the inventory levels of brick and mortar retailers selling on the marketplace. So this ups the ante in terms of complexity for brands, as there’s a middle man influencing their Instacart inventory levels, and brands need to foster good relationships with participating retailers in order to win market share on Instacart.”

In Bobsled’s upcoming book, Instacart for CMOs, we’ve shared hundreds of strategic insights about this burgeoning channel. The book includes contributions from leading executives from Clif Bar, Revlon and e.l.f. Cosmetics to name just a few.

To get a notification when it goes live, sign up here.

Which online marketplaces to prioritize in 2021

Amazon

Let’s start with the obvious – Amazon is worth approximately 50% of all ecommerce. Most brands will see most bang for their buck by prioritizing the Amazon channel.

Brands can double down on their Amazon investment by increasing their PPC budgets, experimenting with Amazon DSP and expanding to new international markets.

💡 Check out How To Become An International Seller On Amazon In 2021

Instacart

Instacart now owns 71% of all online grocery delivery orders in the US, according to data from research firm Second Measure. Importantly, Instacart is no longer just a channel for CPG brands – they’ve expanded their reach into Beauty, Baby and Pet Supplies through their partnerships with Best Buy, Walmart, Staples, Bed Bath & Beyond, Buy Buy Baby, Sephora, and 7-11 among others.

💡 Learn more about the Instacart opportunity - Instacart Trends For 2021

Walmart

By all accounts, Walmart is still limited as a marketplace. Serious issues exist with their first price PPC bidding auction model, product content update process, and fulfillment options. The Walmart marketplace is likely to remain unattractive for most brands until these issues are addressed.

💡 Check out How To Sell On Walmart

Developments Across Emerging Online Marketplaces

- Last year Criteo rolled out a self-service option for brands looking to sell on Target, which helped level the playing field

- Home Depot is investing more in B2B ecommerce, search and online fulfillment

- In 2020 Kroger announced their own 3P digital marketplace

- Lowe’s committed $1.7 billion over the next five years to modernize its supply chain with digital technology – many brands are now watching this marketplace with great interest

Other useful data points

- For most brands, Amazon DSP spend should be approximately 10-15% of their Amazon Advertising spend

- Amazon Advertising spend on Amazon US should be roughly equal, or slightly greater than all 5 Amazon EU markets (UK, Germany, France, Italy and Spain) combined. For example, a Bobsled client in the electronics category has spent $15k on Amazon US and $15k on EU5 so far in February 2021.

- Amazon’s non-US business accounts for 35% of worldwide gross merchandise volume

- Canada generally 10% accretive to US sales

- UK generally 10% accretive to US sales

- 5 EU markets generally 10% accretive to US sales

- AU generally 5% accretive to US sales

- When thinking about new platforms, identify whether any tech partners are supporting the channel. A tech partner can help shorten the learning curve and improve channel profitability (learn about Bobsled’s partnership with ad tech leader Pacvue).

NEED HELP WITH ECOMMERCE MANAGEMENT?

Bobsled was picked as a top Amazon firm by Business Insider.

Book a free consultation with one of our experts below.

Tagged: Amazon Account Management, Amazon Updates, Walmart.com, Instacart

.png)