Should your brand become a Walmart.com early adopter or would it be better to bide your time?

2020 may be the year that the battle of the two retail heavyweights, Amazon and Walmart, finally picks up steam.

For the longest time, Walmart has stayed within the safe confines of the brick and mortar world and let Amazon dominate ecommerce. But as Walmart.com starts to become more sophisticated, there’s change in the air.

We spoke with Jesse Chembars, Bobsled’s resident Walmart expert, about the nature of the Walmart marketplace and the opportunity that it presents for brands.

On the right: Jesse Chembars, Walmart Expert

Walmart, The Offline “Gorilla”, Goes Online

Jesse is adamant that Walmart is well placed to change the game for online marketplaces.

“Walmart is the ‘gorilla in the room’ when it comes to offline retail,” he says. “They will leverage their strengths to make an all-out assault on ecommerce.”

And although the Walmart.com marketplace is currently a lot smaller than Amazon, Jesse believes Walmart has already made some huge strides.

“During a recent webinar, Walmart execs claimed that Walmart.com is currently only 14% the size of Amazon in terms of total sales. However, this level of market share has been achieved with only approximately 1% of brands choosing to sell on Walmart.com vs Amazon. As Walmart ramps up their online capabilities, this gap will close.”

%20com.jpg?width=600&name=Walmart(.)%20com.jpg)

Jesse has personally observed some promising early results on the Walmart.com marketplace.

“From my experience managing both online marketplaces for Bobsled clients, if a brand is generating $100k per month of revenue on Amazon, they can generally expect to do $5k to 15k per month on Walmart.com,” he says. “Walmart is obviously still a developing marketplace, and I’m excited about the opportunity to scale the channel over time.”

Walmart Fulfillment Services (WFS) AKA “Walmart Prime”

After being rumoured for several years, Walmart announced the launch of Walmart Fulfillment Services (WFS) at the Retail West conference in early 2020. WFS is Walmart’s in-house fulfillment program where they facilitate 2-day shipping and manage returns/customer service on behalf of brands selling Walmart.com.

“We’ve been expecting Walmart to create their own version of Fulfilled By Amazon (FBA) for years now,” Jesse says. “Prime underpins Amazon’s unparalleled customer loyalty, so it’s a no brainer that Walmart would establish a similar program.”

Jesse believes that if you understand the mechanics of FBA, you’re well placed to grasp how WFS will work on Walmart.com.

“Amazon has changed consumer expectations in terms of fast shipping. It’s been possible to use 3PLs that integrate with Walmart and can offer 2-day shipping for a while. But now Walmart is dangling some serious carrots for brands to jump on board with WFS. Firstly, Walmart is explicitly stating that brands who use WFS will get boosted in search. And secondly, the WFS team will provide additional support for brands interested in creating A+ content for their listings.”

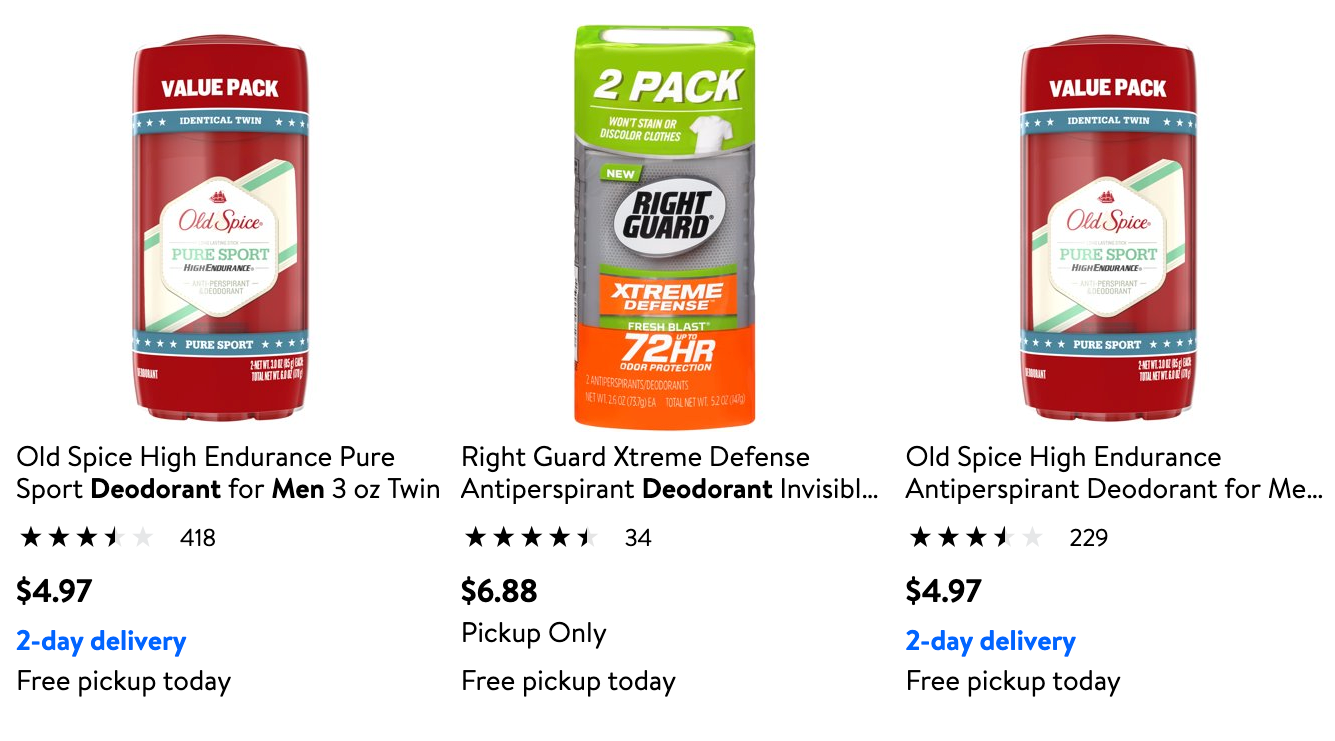

A recent change to the search results interface illustrates Walmart’s strong focus on 2-day shipping.

“Blue ‘2-day delivery’ tags have just started appearing on the search results page,” Jesse says. “Originally this tag was in plain text and was easy for shoppers to miss. Now it’s in blue it really jumps off the page. Brands without the blue tag are now at a serious disadvantage.”

Above: The two Old Spice products have the blue ‘2-day delivery’ tag however the Right Guard product does not.

According to Jesse if you see the benefit of FBA then WFS should make sense as well.

“The WFS fees are extremely similar to Amazon’s FBA fees,” he says. “So if you’re using FBA profitably on Amazon, there’s a very strong chance that you’ll be able to use WFS profitably on Walmart. Walmart execs are claiming that brands who have adopted WFS observed a 50% to 2000% conversion rate increase, and so if you can successfully preserve your profit margins I would definitely recommend applying for WFS.”

💡 To learn more about the impact of FBA, read this case study about a Bobsled client that transitioned from FBM to FBA.

Walmart (Like Amazon) Is A Fulfillment Powerhouse

Walmart will be doing their very best to align their in-store team and Walmart.com teams as the online marketplace ramps up.

“The growth of Walmart.com will inevitably result in online versus offline discrepancies,” Jesse says. “Inventory demands and pricing consistency are two potential issues that immediately spring to mind. Plus, Walmart will always try and compete with Amazon on price, so that’s another factor to consider. Therefore, considering their brick-and-mortar dominance, it’s in Walmart’s best interest to ensure these different parts of the business are effectively talking to one another.”

Jesse is confident that Walmart’s stores could be a massive advantage with their online play.

“90% of the US population lives within 15 minutes of a Walmart store,” he says. “So although Walmart has not revealed any details about their plans, it seems leaning heavily on this extensive network of stores would be the right move.”

💡 To learn more about Walmart PPC Advertising, read

this recent Bobsled blog post.

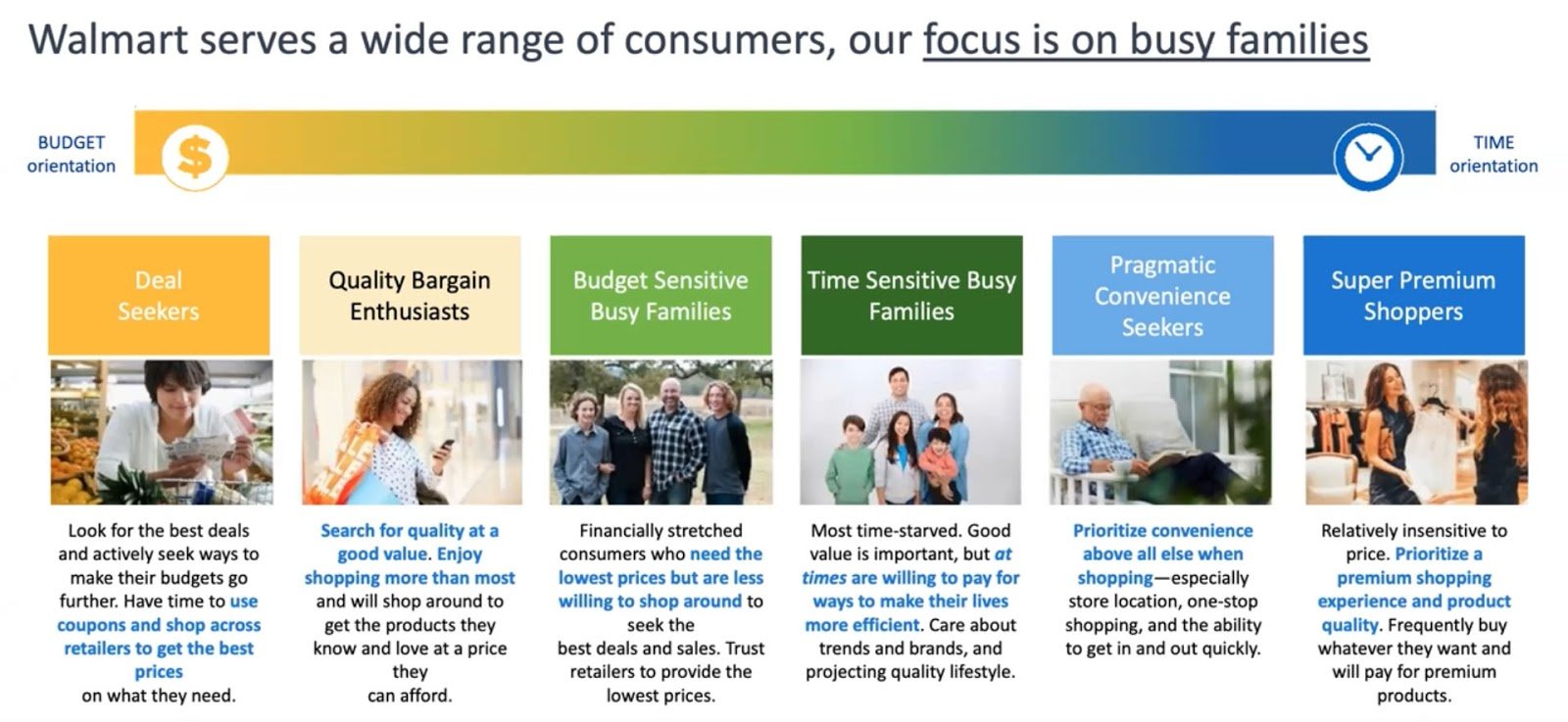

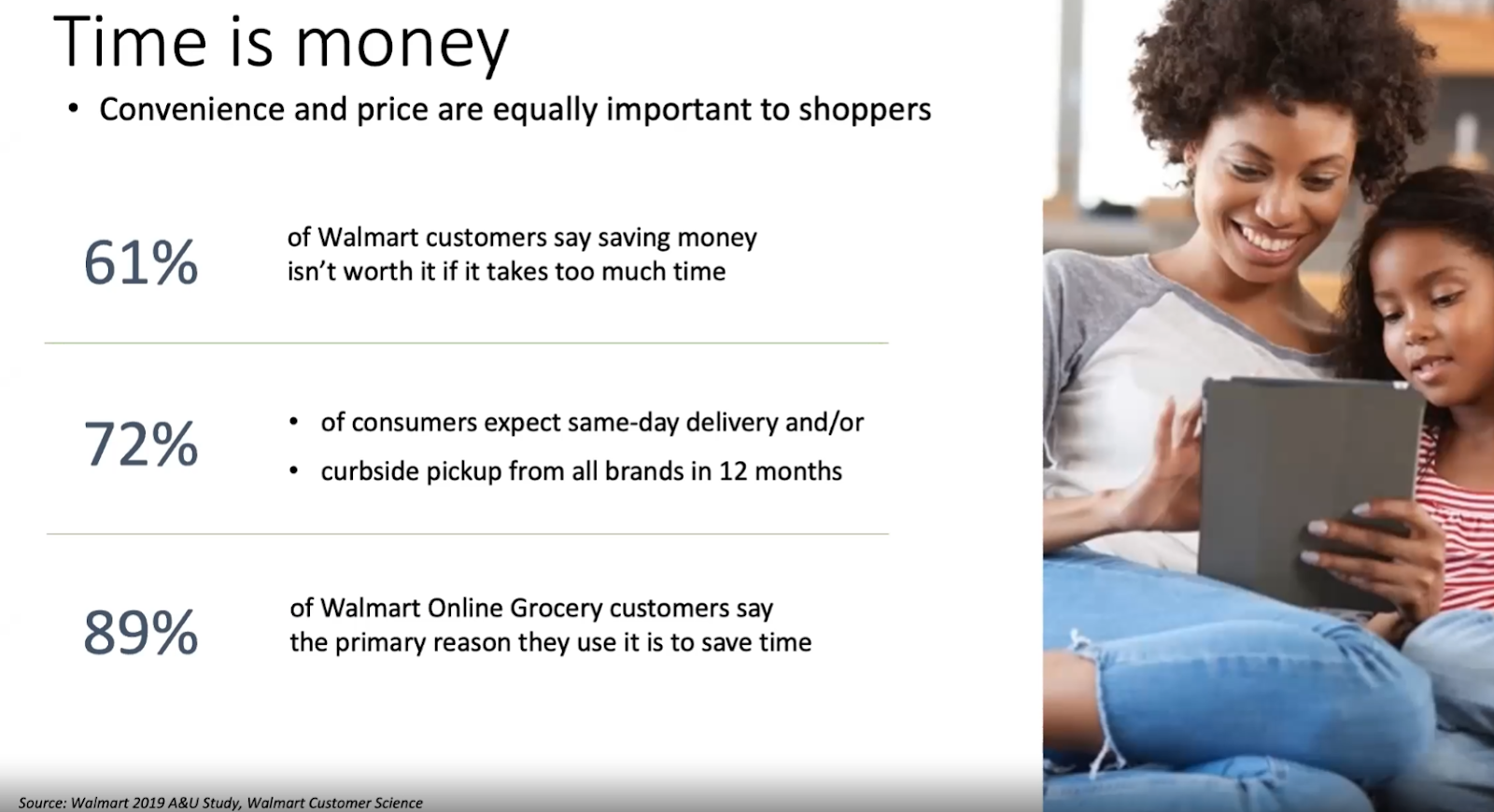

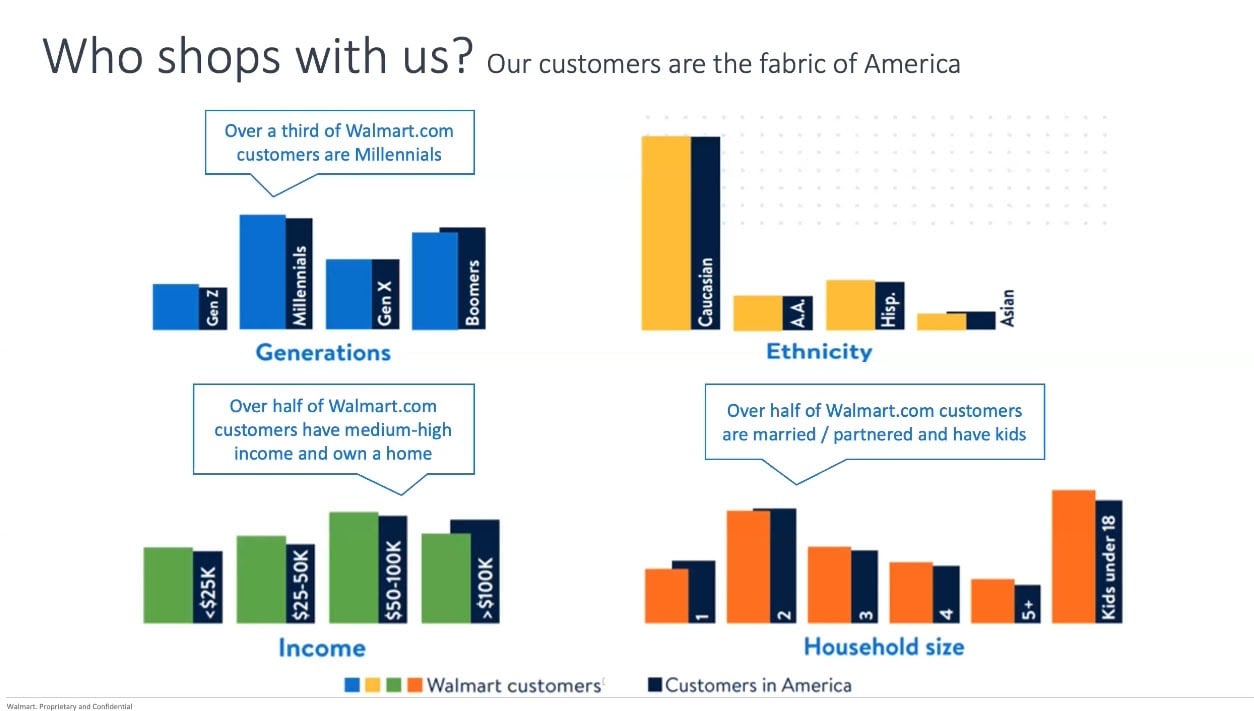

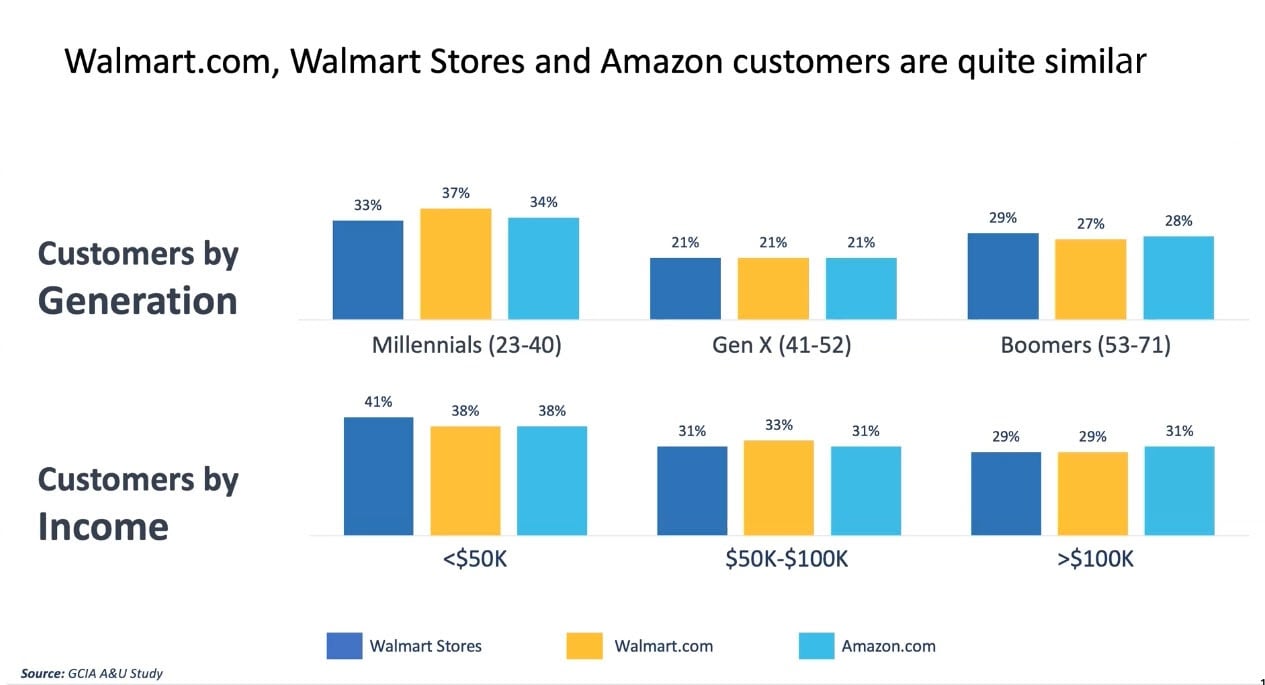

Walmart.com Shopper Demographics

Although the Walmart and Amazon target shopper demographics appear to be fairly similar, Jesse has yet to observe any channel conflict.

“With my accounts that are on both marketplaces I’ve yet to observe any noticeable cannibalization,” Jesse explains. “From my perspective, Walmart is trying to emulate their offline model with their online marketplace. There’s a strong focus on family, convenience and price. Walmart.com is still finding its feet as a platform, and as they niche down, I anticipate more direct competition with Amazon will emerge across certain categories. My hunch is that Walmart will do everything to leverage their network of brick-and-mortar stores, and therefore I think they’re well placed to try and lure more CPG and Grocery shoppers away from Amazon.”

Find some Walmart shopper demographic info below.

Walmart Is Pushing The Exclusivity Angle

Jesse believes that Walmart’s online marketplace will be more brand-focused compared to Amazon.

“In a recent webinar I heard an Walmart exec say ‘we only need 4 brands selling yellow tumblers, not 50’ and I interpreted this as a direct criticism of Amazon,” he says. “Certain low-barrier-to-entry categories on Amazon are awash with a sea of no-name products. It seems like Walmart will differentiate by being more exclusive, and therefore relying heavily on brands with more cache.”

And this should translate to a more hands-on approach from Walmart managing brands on their platform.

“Right now, whenever there’s an issue on Walmart.com you are directed to the Seller Center support team. As of right now they don’t have a Brand Registry process, so it will be interesting to see how they preserve brand integrity as the marketplace scales.”

💡 For more Walmart insight from Jesse and Bobsled CEO Kiri Masters, listen to Episode 132 of the Ecommerce Braintrust podcast.

Challenges Of Entering The Walmart Marketplace

Jesse has shared some hurdles brands could expect to face on Walmart.com at this time.

- Walmart.com is still very much a developing marketplace. There are limited tools for brands at this time e.g. basic PPC advertising options, and this makes scaling challenging.

- Right now you need to utilize API integrations to get the 2-day shipping badge.

- Walmart Seller Support Team is hit or miss. There have been instances of 48 hours with no response.

- In 2019 there were a lot of glitches with the Walmart.com product feeds - this creates obvious integrity issues for many brands.

Need help assessing the Walmart opportunity?

The Bobsled team would love to support your efforts!

Book a consultation today.

Tagged: Amazon Account Management, Walmart.com

.png)